The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. The first of a five-part look at these inputs, here’s how the stock market plays a role.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

India is an attractive market to penetrate due to its low operating costs and a diverse selection of companies in hot industries like technology - but with more than 1,000 public companies in the FRISK® "red zone," there's big-time risk in bringing business east.

CreditRiskMonitor offers up five quick and important facts that you need to know about Diebold Nixdorf Inc. to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.

Just like tariffs, supplier financial risk has become an important category to monitor by company procurement departments. If this isn't on your radar today, it should be.

Armed with CreditRiskMonitor’s SupplyChainMonitor product, procurement teams worldwide are restructuring by onshoring, nearshoring, and avoiding increasingly risky countries.

Keep your brains about you: if it looks like a zombie, acts like a zombie, and reports like a zombie, it is probably a zombie.

The FRISK® score cuts through the “Cloaking Effect” by identifying financially stressed companies with a differentiated and proprietary method that doesn't rely on payment history.

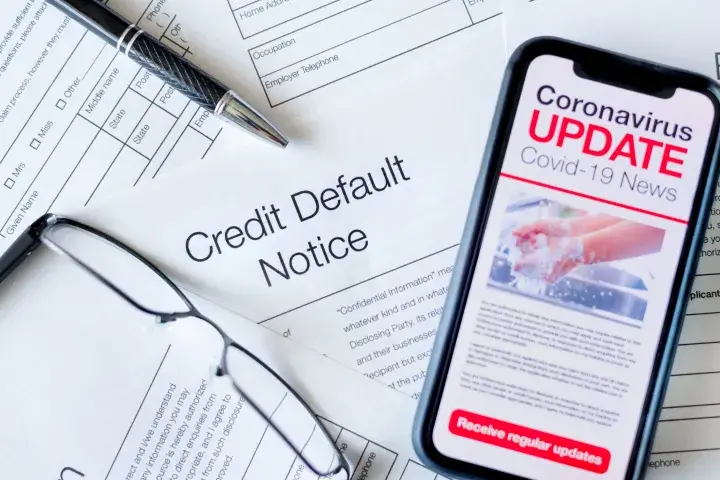

A dormant debt powder keg ignited in 2023; as bankruptcies continue to explode in 2024, risk professionals must set into motion a multi-faceted approach to financial risk evaluation.

A supplier network fraying at the edges can eventually break down into a full-blown disruptive crisis. With global debt soaring, daily bankruptcy risk evaluation is a must.