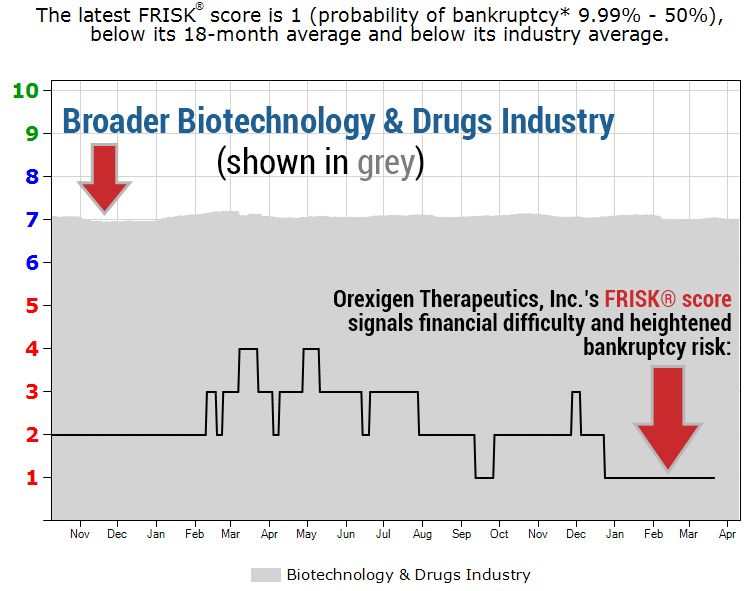

Orexigen Therapeutics, Inc., a biopharmaceutical operator, filed for Chapter 11 bankruptcy restructuring on Mar. 12, 2018. Its poor financial condition was highlighted by it's FRISK® score that landed firmly in the "red zone" for more than a year. Statistically, 96% of American public companies that go bankrupt pass through this high-risk category before filing.

This Bankruptcy Case Study will illustrate key factors that contributed to the collapse of the company. CreditRiskMonitor addresses concerns mentioned within the MD&A as well as relevant financial metrics. Fundamentally, its ability to generate sales was dependant on the commercial success of its only product, Contrave®. Simultaneously, it's unrestrained spending and high financial leverage ultimately led to debt covenant compliance risk.

If you are interested in protecting your portfolio against risk, we invite you to schedule a personalized demo with us to learn more about our offerings.

Ready to learn more?

Our FRISK® score model incorporates four powerful risk inputs:

- “Merton”-type model of stock market capitalization and volatility

- Financial ratios, including those used in the Altman Z”-Score Model

- Bond agency ratings from Fitch, Moody's, and DBRS Morningstar

- Website click pattern data from CreditRiskMonitor® subscribers, representing key credit decision-makers at more than 35% of current Fortune 1000 companies plus thousands of other large companies worldwide

Since the start of 2017, the FRISK® score’s rate of success in capturing public company bankruptcy is 96%. In any given year, you can count on one hand the times we miss – and in those outlier cases, the circumstances deal with unusual, unforeseen events such as natural disasters and CEO fraud.

Download the free report to learn more.

About Bankruptcy Case Studies

CreditRiskMonitor® Bankruptcy Case Studies provide post-filing analyses of public company bankruptcies. Our case studies educate subscribers about methods they can apply to assess bankruptcy risk using our proprietary FRISK® score, robust financial database, and timely news alerts.

In nearly every case, a low FRISK® score gave our subscribers early warning of financial distress within a one-year time horizon. Our proprietary FRISK® score predicts bankruptcy risk at public companies with 96% accuracy. The score is formulated by a number of indicators including stock market capitalization and volatility, financial ratios, bond agency ratings from Moody’s, Fitch and DBRS, and crowdsourced behavioral data from a subscriber group that includes 35% of the Fortune 1000 and thousands more worldwide.

Whether you are new to credit analysis or have decades of experience under your belt, CreditRiskMonitor® Bankruptcy Case Studies offer unique insights into the business and financial decline that precedes bankruptcy.