The decline and demise of oil services giant McDermott International, Inc. was missed by many due to an unwise reliance on trade payment data analysis. When it comes to public companies and bankruptcy prediction, payment data doesn't work.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Based on Neiman Marcus Group LTD LLC’s bottom-rung FRISK® score of “1,” trade creditors must perform deep financial analysis and take extra care when dealing with the company.

AutoCanada Inc.'s heavy leverage has put the company in potential danger. As interest rates rise in both Canada and the U.S., expected softer sales and higher costs will make it much harder for the company to remain solvent in 2019.

CreditRiskMonitor offers up five quick and important facts that you need to know about Bed Bath & Beyond Inc. to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.

Thomas Cook and Virgin Australia, two massive airliners, have filed bankruptcy. Could American Airlines be next?

CreditRiskMonitor’s FRISK® Stress Index is once again highlighting elevated financial risk for oil and gas drilling operators.

CreditRiskMonitor® offers up five quick and important facts that you need to know about Tupperware Brands Corporation to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.

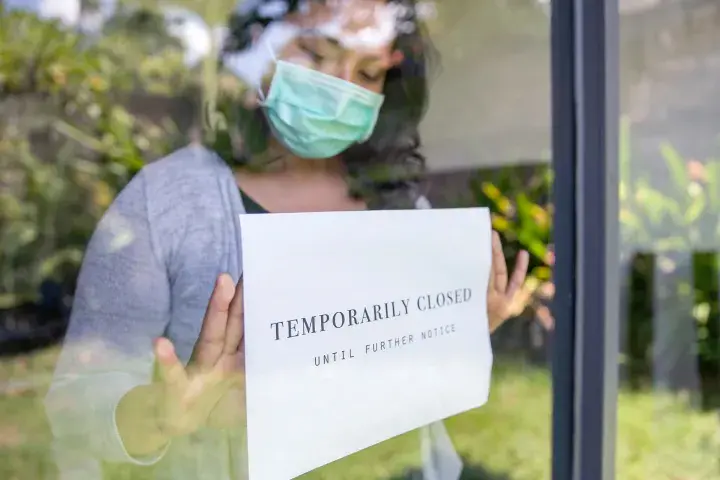

Retailers left and right exited stage left and into bankruptcy this summer. CreditRiskMonitor has the read on a few potential industry giants who might not survive to see 2021.

The median U.S. supplier has reduced capital expenditures into property, plant, and equipment and has increased their total debt-to-asset burden in the last two years. Such action creates pitfalls in supply chains, especially in the age of COVID-19.