Quickly Evaluate Vendors With Comprehensive Risk Management Solutions

Rapidly evaluate prospective vendors for financial stability and geopolitical risk.

Identifying, vetting, and onboarding suppliers is a major process for procurement teams. SupplyChainMonitor™ can ease that burden by providing third-party, unbiased data and analysis to ensure you’re not adding any weak links to your supply chain.

Reduce the noise in evaluating RFP responses

SupplyChainMonitor™ helps simplify and qualify the RFP form submission process by providing firmographic, financial stability, and compliance data about potential vendors, such as:

- Employee headcount

- Employee locations

- Industries they serve

- Financial accounts and ratios

- Sanctions

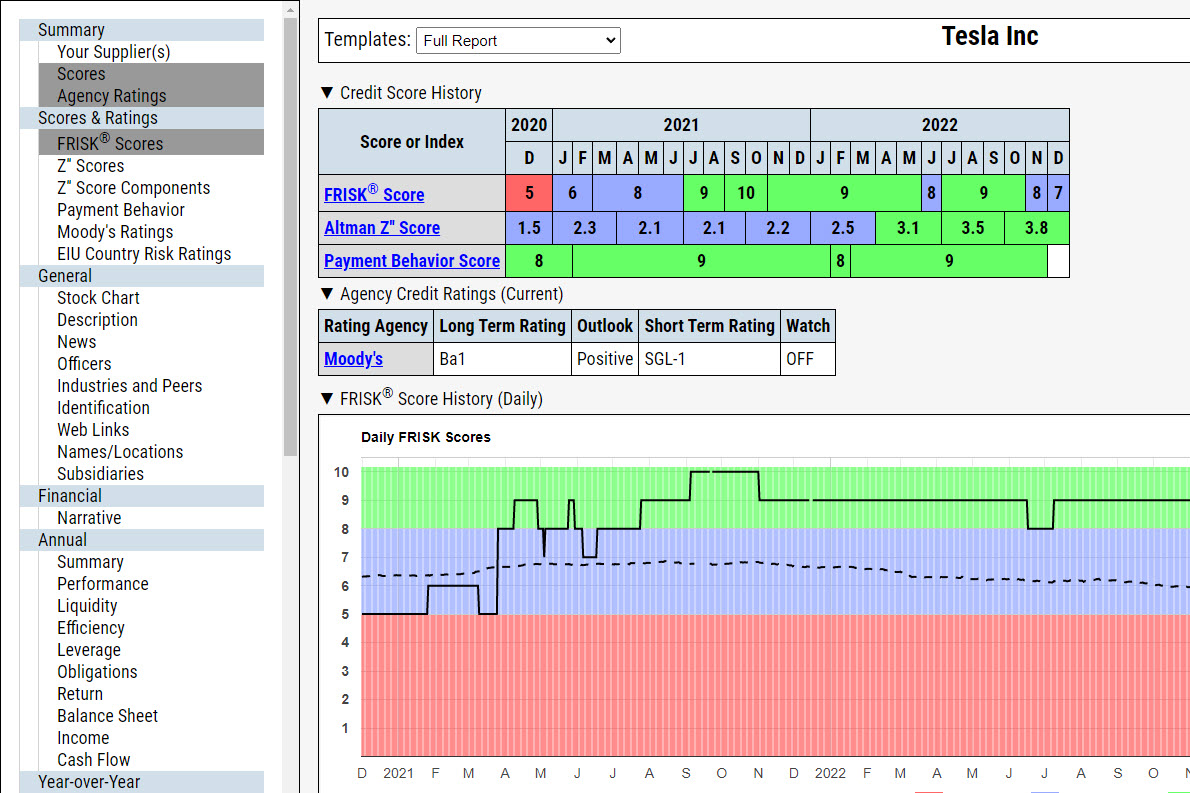

Our predictive financial risk scores like the FRISK® and PAYCE® can also be leveraged to:

Quickly and accurately differentiate low-risk vendors from high-risk ones

Our Risk Level uses our financial risk analytics, including FRISK® Score, PAYCE® Score, and FAST Rating, to provide a snapshot into a vendor’s financial stability.

Serve as a first-pass filter to protect your supply chain from future instability.

By helping you quickly filter out vendors who lack financial stability, you can accelerate your evaluation process while protecting your company’s operations, performance, and reputation.

Peer Analysis Benchmarking for supplier comparison

Easily evaluate potential vendors in comparison with one another or against other companies providing similar products and services.

Simplify bid reviews and bid leveling.

From firmographic data such as employee headcount, locations, and industries to detailed financial accounts and ratios, SupplyChainMonitor™ can simplify and qualify the RFP form submission process. Additionally, our Risk Level indicator uses our financial risk analytics like the FRISK® Score, PAYCE® Score, and FAST Rating to quickly differentiate low-risk vendors from high-risk ones, acting as a first-pass filter to protect your supply chain from future instability. Here too, the robust Peer Analysis tool allowing you to compare groups of suppliers based on scores and financial KPIs with trend analysis and visualizations. Simplify your bid reviews and bid leveling to partner with the best suppliers for your organization.