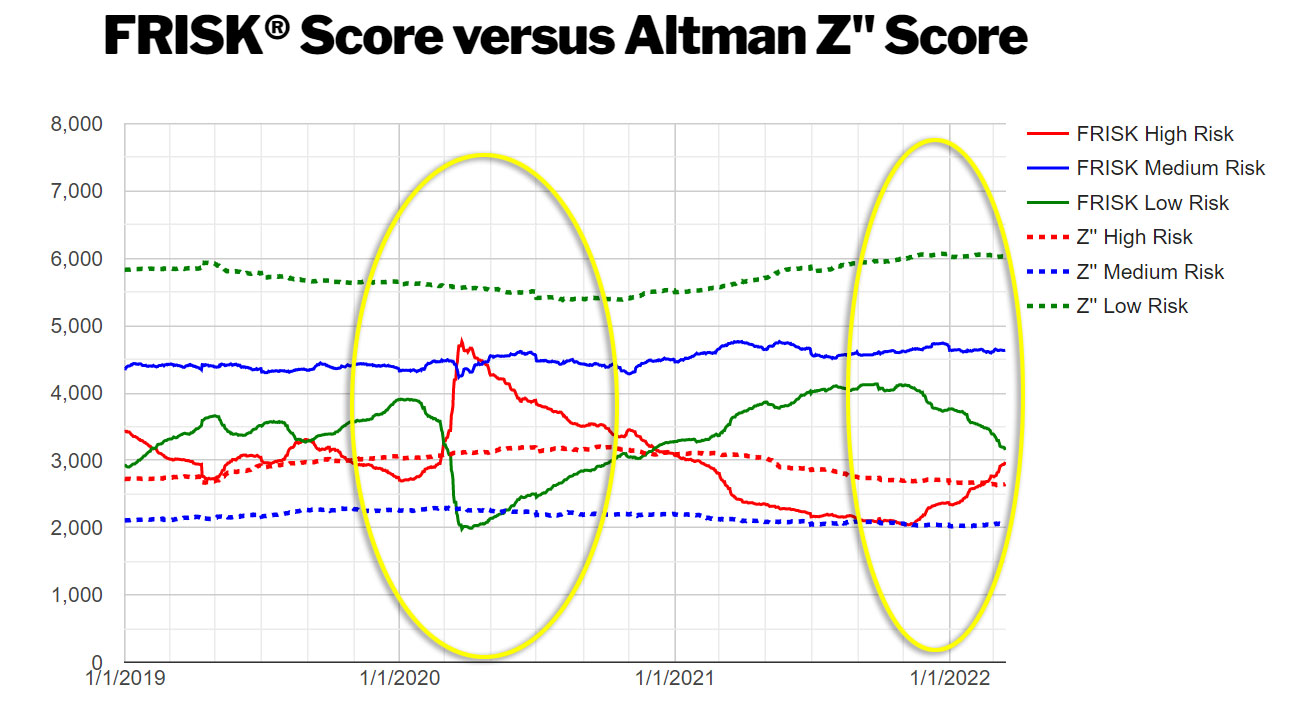

The Altman Z’’-Score, developed by acclaimed economist Edward Altman that’s based on financial statement information, took months to react to a surge in financial risk during 2020 when hundreds of companies filed bankruptcy. A popular model for financial risk evaluators, the Z’’-Score proved to not be built to handle rapid change. Exogenous shocks are more common than many people believe, with the current war in Ukraine so soon after 2020's coronavirus pandemic offering a prime example. During a system-wide shock, any delay will leave you in the dark about the true risks facing your company. CreditRiskMonitor’s clients leverage the daily-updating FRISK® score, keeping them abreast of changes in real-time and allowing more effective management of their risk exposure.

The Gold Standard

A public company's financial statements present a comprehensive, reliable lens when looking at financial risk – and that is why the FRISK® score includes financials as one of four key factors in its quantitative blend. Financials, however, are not perfect. They are only provided once, twice, or four times a year, depending on where a company trades. They also need to be compiled and audited before being officially released, resulting in a lag between when this key data is available relative to the period that it summarizes. A 35-day delay is the "best-case" scenario, but if financial decline starts at the beginning of a new quarter, it can take up to 4 months or more to appear in the financial statements. A lot can happen in a month or more and any score that relies solely on financial data will inherently reflect outdated financial conditions.

For financially strong companies, this is not a problem and financial declines normally take shape over multiple reporting periods. However, for financially *stressed* companies, a few months of delay could be the difference between a counterparty remaining stable and one that files bankruptcy. To address this timeliness problem, the FRISK® score also includes stock market information, bond agency ratings, and proprietary crowdsourced subscriber sentiment as data factors, in addition to financial ratios.

Stock markets are inherently forward-looking with prices changing by the second to reflect the wisdom of investors as they assess future risks and rewards. The FRISK® score leverages this factor in its distance-to-bankruptcy Merton model.

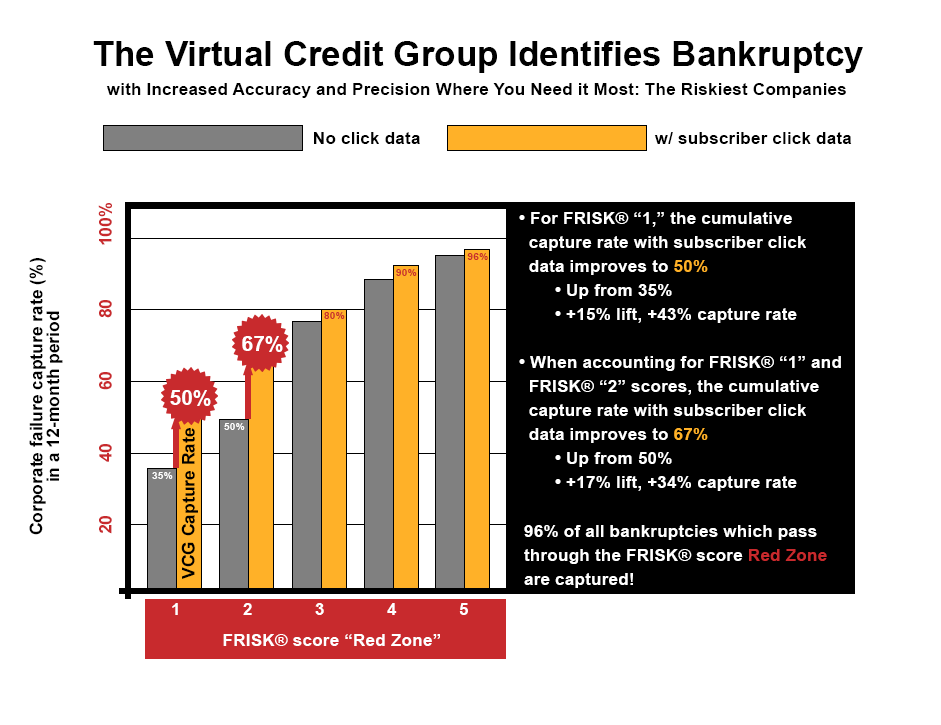

The crowdsourced subscriber sentiment input provides a daily-updating, independently predictive corporate bankruptcy risk model based on signals derived from the aggregate usage behavior of CreditRiskMonitor’s subscribers as they perform real-time risk research on companies. This influential group of risk professionals includes users from nearly 40% of the Fortune 1000 plus over a thousand other large businesses worldwide. The model identifies the shift in aggregate sentiment among these issuers of trade credit and therefore assists in the monitoring of the most critical situations when trade credit-based, working capital liquidity can dry up:

As mentioned, both quick-reacting factors are incorporated into the FRISK® score every day, ensuring that you receive real-time information. You will know, in as little as 24 hours, what companies you need to pay extra attention to now because of an industry-wide event or even global shock, like a pandemic or war.

Comparing the Pandemic and the War

The proof of how quickly the FRISK® score highlights increasing risk compared to the Z’’-Score was apparent during COVID in 2020 as well as during the Russia-Ukraine war in 2022.

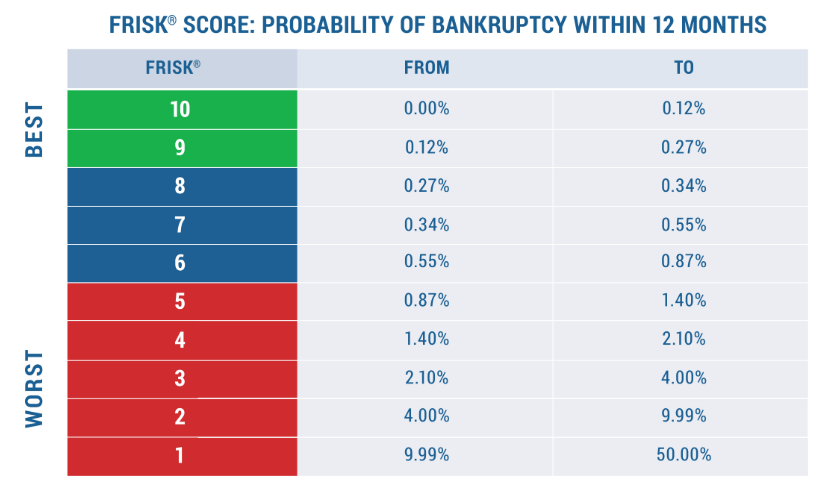

As the above chart shows, the companies falling into the high-risk "red zone" of the FRISK® score, those ranked "5" or lower on the "1" (highest risk)-to-"10" (lowest risk) scale, increased dramatically in early 2020, and we’re seeing that play out once again in 2022. The Z’’-Score didn’t react much in either of these cases. In 2020, it took until the second and third quarter financial statements were released before there was an apparent reaction in the Z’’-Score. It is likely there will be a similarly long delay in 2022 as the war rages in Ukraine.

Throughout 2020, hundreds of companies filed for bankruptcy and the FRISK® score gave subscribers several months to multiple quarters to adjust their risk exposure. In other words, those solely relying on financials (or worse, payment behavior) would have been too slow to react or completely left in the dark until it was too late.

Risk management teams cannot pay attention to everything at once and must prioritize dealing with their riskiest exposures. A company with a strong FRISK® score can receive a cursory review, whereas red zone companies should be addressed more promptly. A company that suddenly falls into the red zone requires immediate review and will likely be responsible for delinquency, receivable write-offs, and supply chain disruptions.

If a company's FRISK® score drops to a "1" or "2" category, decisive action is required as two-thirds of all corporate bankruptcies are rated in this group at least three months before filing. The Z"-Score can't help you make these calls in the face of sudden and dramatic changes. The FRISK® score is specifically designed to do just that. This troubling dichotomy between the Z’’-Score and FRISK® is already unfolding with the impact of the war and may intensify further.

Not having the FRISK® score at your disposal when industry and world events are happening quickly is like flying a plane without instruments through a hurricane. If you find yourself in these situations, you may underestimate your risk exposure or worse, not know where your risk exposure is the greatest. You need to prepare for these hard to predict situations now, and that can be achieved with the FRISK® score.

The Bottom Line

The FRISK® score is superior to the Z’’-Score and many other risk models because it incorporates additional data factors, including stock market information, bond agency ratings, and crowdsourced sentiment signals from CreditRiskMonitor subscribers. These high-quality, multi-frequency sources combine non-linearly to provide subscribers with the most accurate snapshot of the risk landscape. Don’t steer your risk decisions blindly, make the most informed risk decisions using the FRISK® score. Contact CreditRiskMonitor today for a free demonstration to see how you can stay ahead of the next exogenous shock.