International vacation and tourism operator Transat A.T. Inc. continues to struggle from pandemic headwinds and a cumbersome debt load. Without a major bump in travel demand sometime in 2021, bankruptcy proves more and more a possible endgame.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Caviar dreams, bankruptcy reality? Large-scale luxury automobile dealership, China Zhengtong, is dealing with acute refinancing risk challenges and looming debt maturities.

Extra, extra! Read all about it: The McClatchy Company, one of the nation's largest newspaper publishers, has filed for bankruptcy protection.

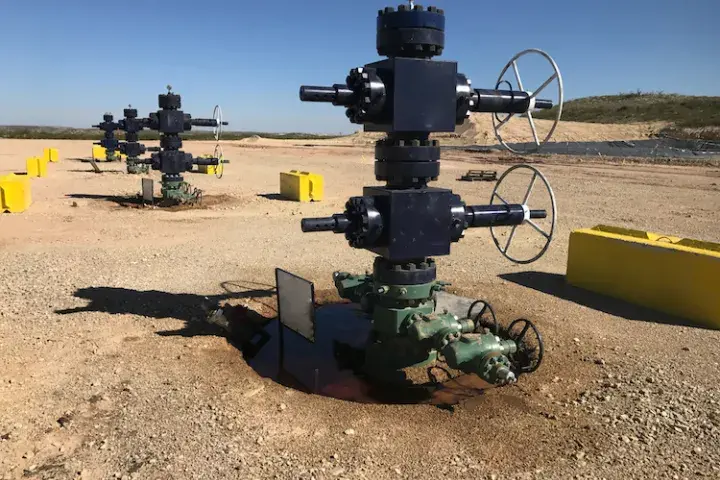

Ultra Petroleum Corporation has filed for Chapter 11 protection for the second time in four years, torpedoed in large part by persistently weak natural gas prices.

Sanchez Energy Corporation has struggled to generate meaningful returns on its assets, and with a total debt-to-assets ratio currently affording creditors little degree of protection from loss, it's time to look at this company with great scrutiny.

No Fly Zone? Triumph Group, Inc.'s fight to stave off bankruptcy will be a major item to watch for counterparties and shareholders alike in the coming months.

Louisiana-based Hornbeck Offshore Services, Inc., an operator of oil supply and support vessels, opted for bankruptcy after an acute collapse in energy prices.

China-based property developer Tahoe Group is providing evidence that the real estate bubble has resulted in ballooning inventories and distorted balance sheets, leaving less capitalized peers to struggle in an overly distended industry.

Mexican department store chain Grupo Famsa SAB de CV has met bankruptcy, hammered by a huge drop in sales due to COVID-19.