There has been a rising tumult in the water transportation industry since the Great Recession a decade ago. According to the FRISK® Stress Index, in 2018, the probability of failure for the industry compared to all others examined daily by CreditRiskMonitor remains 41% higher than all other industries.

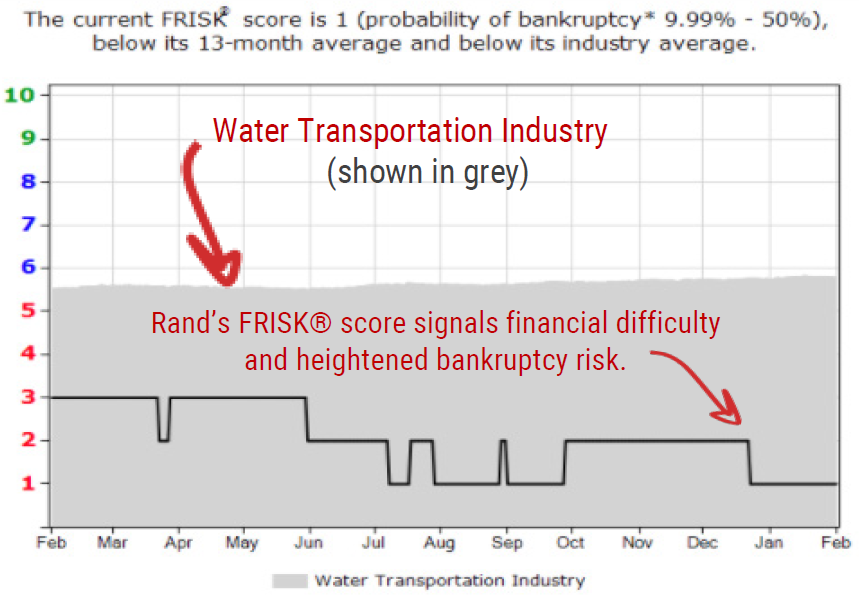

New Jersey-based Rand Logistics, Inc., has been heavily scrutinized by our subscribers for several years now. Our proprietary FRISK® score, which is 96% accurate in predicting U.S. public company bankruptcy risk within a 12-month window, showed that Rand plummeted to a "1" in July of 2017 and never rose back above a "2" in the months leading up to their bankruptcy. Note that even in a struggling industry such as shipping, the FRISK® score median hovers above the "red zone," or any score at "5" or below which would indicate a heightened probability of bankruptcy:

This Bankruptcy Case Study showcases the pain points Rand Logistics, Inc. stakeholders felt as they either abandoned or continued to work with the company. For instance, a subscriber with Rand Logistics in their portfolio would have found that the company's total debt in relation to equity increased significantly from 2016 to 2017, ballooning three times in size in 12 months' time. Still following the journey from 2016 to 2017, the company reported net losses in three of the last five fiscal quarters in what amounted to a 40% decline in year-over-year net income. As 2018 began, the company was delisted from NASDAQ and a few weeks later, Rand Logistics, Inc., and six affiliated debtors filed for Chapter 11 protection on Jan. 30.

Our FRISK® score model incorporates four powerful risk inputs:

- “Merton”-type model of stock market capitalization and volatility

- Financial ratios, including those used in the Altman Z”-Score Model

- Agency ratings

- Website click pattern data from CreditRiskMonitor® subscribers, representing key credit decision-makers at nearly 40% of current Fortune 1000 companies plus thousands of other large companies worldwide

Since the start of 2017, the FRISK® score’s rate of success in capturing public company bankruptcy is 96%. In any given year, you can count on one hand the times we miss – and in those outlier cases, the circumstances deal with unusual, unforeseen events such as natural disasters and CEO fraud.

Download the free report to learn more.

About Bankruptcy Case Studies

CreditRiskMonitor® Bankruptcy Case Studies provide post-filing analyses of public company bankruptcies. Our case studies educate subscribers about methods they can apply to assess bankruptcy risk using our proprietary FRISK® score, robust financial database, and timely news alerts.

In nearly every case, a low FRISK® score gave our subscribers early warning of financial distress within a one-year time horizon. Our proprietary FRISK® score predicts bankruptcy risk at public companies with 96% accuracy. The score is formulated by a number of indicators including stock market capitalization and volatility, financial ratios, agency ratings, and crowdsourced behavioral data from a subscriber group that includes nearly 40% of the Fortune 1000 and thousands more worldwide.

Whether you are new to credit analysis or have decades of experience under your belt, CreditRiskMonitor® Bankruptcy Case Studies offer unique insights into the business and financial decline that precedes bankruptcy.