Argentina is using extraordinary measures to keep its economy afloat. As the peso declines, businesses that are heavily reliant on debt financing could be in trouble if problems persist.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Risk of financial failure in South America is higher than it was during the Great Recession a decade ago. We scouted more than 1,500 public companies to find the riskiest public companies on the continent.

Companies have been ramping up efforts in nearshoring their purchased goods from Mexico and Canada while keeping other regions steady. This trend indicates supply chains are focused on dual sourcing and seeking alternative suppliers.

Public and private companies need to be proactively evaluated in distinct, different ways by risk management professionals - fortunately, with the FRISK® score and PAYCE® score, CreditRiskMonitor has world-class solutions for both subportfolios.

The offshore oil and gas market remains widely depressed. Troubled outfit Hornbeck Offshore Services, Inc. has fallen to a FRISK® score of “1,” which indicates severe financial distress.

A supplier network fraying at the edges can eventually break down into a full-blown disruptive crisis. With global debt soaring, daily bankruptcy risk evaluation is a must.

Deep cracks are surfacing in global corporate debt markets. The timing of corporate bankruptcies is always difficult to predict, yet FRISK® score trends show that the odds of a bankruptcy wave have measurably increased.

Optimal assessment of public company bankruptcy risk requires the balanced, holistic analysis provided by the FRISK® score.

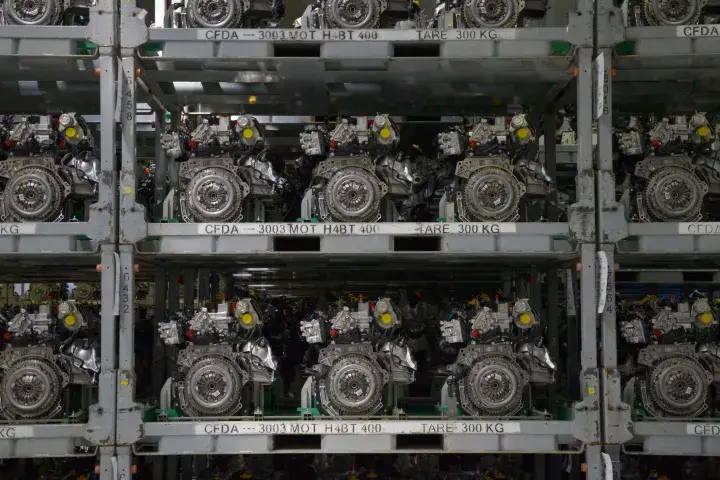

Many operators within the auto & truck parts industry continue to struggle from supply chain constraints and breakdowns brought on by the COVID-19 pandemic, adversely impacting profitability.