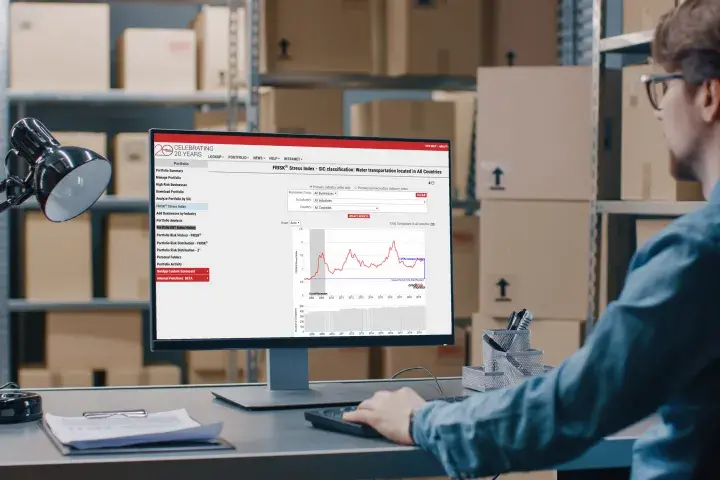

As the likelihood of an economic downturn continues to intensify, public companies across cyclical industries like trucking should be monitored closely.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Rite Aid Corporation's elevated risk of financial failure might be imperceptible if a credit and procurement managers put too much stock into whether or not the pharma retail mainstay continues to pay bills on time.

Frontier Communications’ deteriorating business fundamentals have been ongoing for years now, and CreditRiskMonitor’s subscriber crowdsourcing has provided an important high-risk signal in the last few quarters.

If you work in the volatile oil and gas industry, not a single day should go by where you do not have a read on corporate credit risk. It could save your company millions in the long run.

For Apple, providing capital support to its supply chain is an option, but for most companies bailing out critical suppliers is not financially feasible, let alone an option on the table. Is your supply chain secure?

Central banks worldwide are suppressing borrowing rates to accommodate credit markets, trying to alleviate financial pressures on corporations. This is creating a surge of "zombie companies," or firms that are staying alive in spite of their inability to service interest expenses.

Many operators within the auto & truck parts industry continue to struggle from supply chain constraints and breakdowns brought on by the COVID-19 pandemic, adversely impacting profitability.

CreditRiskMonitor recently published a High Risk Report on pharmacy retail chain Rite Aid Corporation. This detailed report will provide five quick and important facts that you need to know about this financially weak drug store operator.

Public company financial risk is higher than it has ever been, and the weakest links in your supply chain may lead to costly, time-consuming problems.