The path to corporate bankruptcy and the aftermath can occasionally be more complex than your garden variety scenario. Delinquency and past-due payment performance are among the common red flags that risk professionals use to warn of counterparty risk. Unfortunately, as CreditRiskMonitor® data shows for public companies, most trade payments only become past due and delinquent after a bankruptcy filing, so using such signals as leading indicators can leave unsecured creditors with a false sense of security and often low or nonexistent recovery rates after months or years of legal proceedings. The multi-factor FRISK® score provides risk professionals with an upfront warning to help mitigate their overall exposure even in the face of complex business failures.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

Leveraging Predictive Intelligence

Proprietary to CreditRiskMonitor, the FRISK® score indicates a company’s probability of going bankrupt within the next 12 months. Nearly 40% of the Fortune 1000 plus thousands of other large companies worldwide use the FRISK® score as a “first line of defense” to monitor their counterparties. The model incorporates four high-quality data components, including:

- Stock market performance, like the Merton model

- Crowdsourced sentiments of risk professionals based on their aggregated research patterns

- Financial statements, factoring in ratios similar to, but in excess of the Altman Z’’-Score

- Credit agency ratings from Moody’s, Fitch, and DBRS Morningstar

This hybrid model maximizes the predictive signals from each data source while simultaneously mitigating their shortcomings. For example, a company’s stock market performance provides a real-time risk indicator. As a company’s market capitalization falls below book value, equity raises cannot be used without diluting existing shareholders, which removes a major source of capital funding. Another real-time indicator is the crowdsourced sentiment of CreditRiskMonitor’s users, representing some of the most sophisticated risk professionals in the world, through their aggregated research patterns on the platform. When enough risk professionals are doing deep-dive research on specific businesses, they typically are doing so based on some material, non-public information that they have based on their dealings with those businesses and their exemption from Regulation Fair Discloser on SEC filing companies. Right or wrong, when a large enough group of risk professionals start to cut back on the issuance of trade credit to a counterparty, that counterparty is materially riskier given its need to find alternative sources of funding for its working capital, typically with interest rates above 0%. Financial statements capture numerous ratios and trends specific to the actual operating performance and financial health of the business. Lastly, credit agency ratings are integrated for their forward-looking through-the-cycle model features, which provides additional stability to the model. Ratings also inherently make use of non-publicly available information, which can include internal budget documents and confidential discussions with management.

The FRISK® score model correctly identifies 96% of all bankruptcies as high risk at least three months before filing and is updated every night with a fresh probability of bankruptcy in the next 12 months, providing subscribers with the best early warning system available for short-term counterparty financial risk. The 4% of bankruptcies that are missed by the FRISK® score are generally due to extraordinary circumstances including accounting fraud, strategic bankruptcies, and other extreme events that are usually undetectable until after the fact. Overall, however, the FRISK® score shows remarkable predictive performance in many bizarre situations – two examples from 2023 are outlined below.

Murky Foreign Proceedings

Creditor groups may attempt to force a foreign company into bankruptcy, or the equivalent proceeding, when a company fails to satisfy their obligations. Involuntary bankruptcy petitions can be filed with the local or foreign court system, but jurisdiction and court approval are legal requirements to start the bankruptcy process. The COVID pandemic negatively impacted TV Azteca SA de CV (“TV Azteca”), which later defaulted on its debt in February 2021. Its FRISK® score steadily declined into the red zone before trending to the worst possible level of “1.”

Although the company paid its bills on time for some period, that behavior changed as delinquent payments were reported in January 2022. In the following month, Fitch Ratings disclosed in its ESG framework that TV Azteca demonstrated a conflict of interest of making payments on Mexico-denominated notes but not its USD-denominated debt.

By March 2023, creditors of TV Azteca filed an involuntary bankruptcy petition. However, the company requested that creditors instead receive payment on Azteca’s own terms and dismissed the U.S. bankruptcy petition:

“Creditors cannot force it into bankruptcy because the company does not own or operate anything substantial in the United States.”

A Mexico court subsequently ordered TV Azteca not to disclose any attempt of U.S. bond credit collections. CreditRiskMonitor has observed that foreign companies and legal systems are murky territories that can result in protracted past due payments and monetary loss. The FRISK® score, however, enables risk professionals to stay ahead of company financial stress before such situations become problematic.

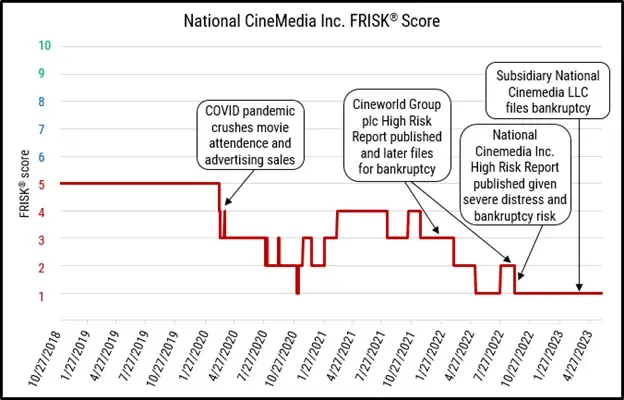

Complex Domestic Proceedings

The COVID pandemic also collapsed movie theater attendance and in-theater advertising. CreditRiskMonitor published a High Risk Report and Bankruptcy Case Study on the fallout of theater operator Cineworld Group plc. Other motion picture theaters and advertising agencies continued to broadly exhibit high-risk patterns, as well, which led to the publication of a High Risk Report on National CineMedia, Inc. in October 2022. By April 2023, the company’s subsidiary National CineMedia, LLC (“NCM LLC”) filed for bankruptcy. However, the parent company, National CineMedia, Inc., did not file for bankruptcy.

When risk scores/ratings are unavailable for the operating subsidiary, CreditRiskMonitor recommends using the parent company’s FRISK® score to detect financial stress and bankruptcy risk.

The reasoning for the subsidiary bankruptcy filing and not the parent remains unclear, which makes for a unique bankruptcy. Nonetheless, auditors of National CineMedia, Inc. still assigned a going concern warning, which was disclosed in its Q1 2023 SEC filing in the management discussion and analysis (MD&A) section following the bankruptcy event:

“We have concluded that our financial condition and projected operating results, the defaults under NCM LLC’s debt agreements subsequent to March 30, 2023, and the risks and uncertainties surrounding NCM LLC’s Chapter 11 Case raise substantial doubt as to the Company’s ability to continue as a going concern.”

National CineMedia, Inc. also indicated that its primary sources of liquidity derive from the subsidiary’s cash flows. Despite the parent company having never filed for bankruptcy, the financial distress of the subsidiary inherently has an effect on payment performance.

The subsidiary’s Restructuring Support Agreement outlined different recovery rates for creditor classes. In Docket No. 14, secured creditors are expected to obtain the following recoveries: “Pursuant to the Plan Term Sheet, holders of Prepetition Secured Debt and NCM, Inc. shall receive 86.2% and 13.8%, respectively, of the newly issued equity interests in Reorganized NCM.” Also subject to their recovery rate, the documentation states general unsecured claims will be paid in full unless a creditor committee is appointed. Unsecured trade creditors reported to CreditRiskMonitor that total past-due payments materially increased in April 2023. Despite the complexity of this situation, the FRISK® score still provided ample warning of the increased risk.

Bottom Line

Risk models cannot have 100% accuracy without meaningfully impairing their false positive rate “FPR” (i.e., the fraction of companies positively identified as likely to go bankrupt, for the same risk threshold, that do not file for bankruptcy), as described in the FRISK® score white paper. Overall, however, the FRISK® score demonstrates an exceptional ability to predict both ordinary and extraordinary bankruptcy events as defined by its 96% accuracy. Contact CreditRiskMonitor if you would like to learn more about our bankruptcy prediction models and how our approach is uniquely differentiated from the rest of the marketplace.