FRISK® Predicts: 2024’s Largest Bankruptcies

Our FRISK® Score predicted bankruptcy with 96% accuracy for 8 consecutive years

- Our FRISK® Score predicted bankruptcy with 96% accuracy for 8 consecutive years

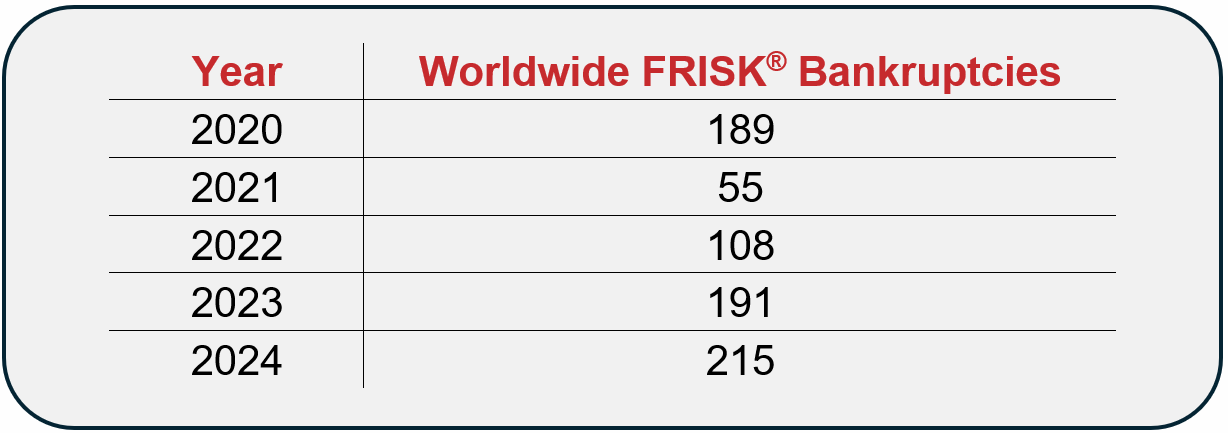

- 2024 bankruptcy filings surged above 2020 levels, signaling broad financial stress

- Mega-bankruptcies keep surfacing as debt servicing trends remain challenged

Commercial bankruptcy filings trended higher in 2024, with FRISK® Scored bankruptcies reaching 215 – an increase from 191 in 2023. For eight years, the FRISK® Score demonstrated 96% accuracy in predicting bankruptcy. This achievement reinforces why well over a thousand organizations globally, including nearly 40% of the Fortune 1000, use the FRISK® Score as a first-line-of-defense for mitigating financial risk. We reported on 755 FRISK® bankruptcies in the last five years – mitigating risk on even one bankruptcy saves time, money, and drives ROI.

Corporate Bankruptcies Exceed Historical Marks

2024 bankruptcies pushed above 2020 levels and are trending in line with the Great Recession. Corporate financial stress has extended beyond specific industries or regions, highlighting widespread financial strain. Small and medium sized enterprise bankruptcies are significant by volume, while “mega-bankruptcies” (liabilities over $1 billion) serve as a critical indicator given their significant impact on counterparties. High-risk companies are grappling with rising borrowing costs, inflation, and tight liquidity – the FRISK® Score warned on all these mega-bankruptcies:

In certain bankruptcies listed above, aggregate insider sentiment (crowdsourcing) updated the bankruptcy risk score to the worst classifications, i.e., FRISK® Scores of “1” and “2”. This enriched signal guided clients to prioritize and act before these companies filed for bankruptcy. Below are other significant foreign mega-bankruptcies successfully predicted by the FRISK® Score.

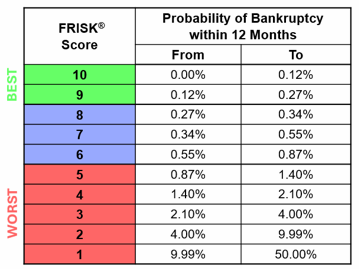

Risk professionals develop processes and procedures around the FRISK® Score and its bankruptcy scale shown below. As companies trend into the high-risk "red zone," clients monitor exposure, perform due diligence, and mitigate risk as needed.

Monitoring Untenable Debt

In conjunction with the FRISK® Score, financial KPIs, particularly interest coverage ratios, should be monitored as elevated interest rates reshape capital structures. Interest coverage ratios are calculated by comparing trailing 12-month EBITDA relative to net interest expenses. Companies that once relied on inexpensive debt face higher borrowing costs and limited refinancing options in more extreme cases. Many high-risk entities identified by the FRISK® Score are "zombie companies”, which have interest coverage ratios below one. In fact, every mega-bankruptcy listed reported a trailing twelve-month interest coverage ratio under one before filing.

Navigating 2025 with Confidence

The steady increase in commercial bankruptcy filings reinforces the need for continuous monitoring and proactive risk management. Clients rely on the FRISK® Score and our high-quality reporting to track their counterparties, detect risk early, and make informed decisions.

TLDR: Leading organizations worldwide, including nearly 40% of the Fortune 1000, use the FRISK® Score to stay ahead of bankruptcy and mitigate financial risk. To learn more about the model’s performance, read the FRISK® Score 8-Year Run with 96% Accuracy.