The airline industry continues to recover with passenger traffic returning to pre-pandemic levels. However, in 2022, many airlines fell into the lowest FRISK® score classifications of “1” and “2,” which indicates above-average bankruptcy risk and the need for proactive monitoring. The driving forces behind this increased risk level have been soaring fuel prices, wage inflation, higher interest rates flowing through fleet leases, and heavy debt burdens. With margin and cash flow headwinds, an approaching economic downturn could make this recovery short-lived.

Heed the FRISK® Score Warning

The FRISK® score incorporates financial statement ratios, stock market performance, bond agency ratings from Moody’s, Fitch, and DBRS Morningstar, and the crowdsourced aggregate risk sentiment of our subscriber base. This combination of inputs, combined in a non-linear model, allows the score to capture 96%+ of all publicly traded companies that eventually go bankrupt within its high-risk category at least three months before they file.

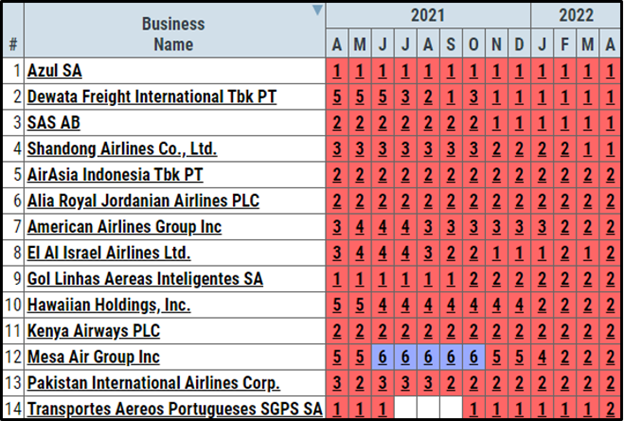

A score of "5" or below on the "1" (highest risk)-to-"10" (lowest risk) score, which we call the FRISK® score "red zone," makes up this high-risk group. The nonlinear, composite nature of the FRISK® score is the source of its superior accuracy relative to single-component models such as trade payment-based and financial ratio-based frameworks. In the portfolio below, CreditRiskMonitor selected airlines with FRISK® scores of “1” or “2” as two-thirds of all bankrupt companies fall to these levels before failure.

Uncovering Hidden Risk

Cost pressures are negatively affecting airlines in several different ways:

- Wages and salaries are the largest variable operating cost and the ongoing labor shortage has increased expenses

- Jet fuel prices have increased by nearly 80% compared to the pre-pandemic average of $56/bbl between 2015 and 2019. Certain airlines remain vulnerable to price fluctuations, as hedge books are smaller than pre-pandemic levels and, in some cases, nonexistent

- Massive debt issuance helped provide liquidity during the early days of the pandemic, but higher net debt combined with central banks raising interest rates has multiplied borrowing costs. The airline industry’s median short-term debt is 30.2%, whereas two operators from the list above are twice that level

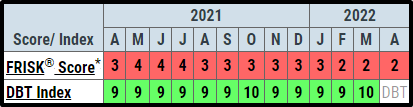

In February, American Airlines Group Inc.’s FRISK® score was downgraded from “3” to “2.” The company recently guided that its Q1 2022 revenue would only be down 16% instead of 17% versus 2019, but that cost per available seat would be up 12-13% versus the previous guidance of 11-13%. Total operating costs will be even higher when factoring in jet fuel costs. In FY21, its average price per gallon was $2.04 or $6.792 billion. Without any fuel hedges, a $100 per barrel cost for Brent crude would result in $2.88 per gallon, increasing fuel costs by $3.3 billion or 48.6%. Even with higher passenger yields, these added costs along with salaries and interest expenses will compress operating margins and hinder debt deleveraging.

Despite these blatant risks, the company's Days Beyond Terms (DBT) Index, a dollar-weighted calculation of payment trends, signals prompt payment behavior. Risk professionals should ignore misleading payment scores on public companies, such as Dun & Bradstreet’s PAYDEX® score.

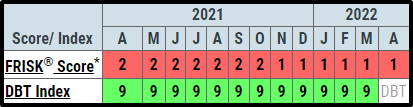

In November 2021, SAS AB’s FRISK® score was downgraded from “2” to “1” due to weakening stock market performance in tandem with ongoing distress shown in its financial statement ratios. In March 2022, Moody’s Investors Service downgraded SAS AB from Caa1 to Caa3 while maintaining a negative outlook. The rationale detailed SAS AB’s cost reduction plans, which included a debt for equity swap:

“...the proposal of a debt to equity swap for all hybrid and senior unsecured debt instruments issued by SAS AB and SAS Denmark-Norway-Sweden. The debt to equity swap proposal comes alongside a broader restructuring of SAS AB' balance sheet with leasing and aircraft financing contracts to be part of the negotiation and a capital increase to build a more significant liquidity buffer."

The company’s Days Beyond Terms (DBT) Index also shows payments are prompt, despite its longer-term financially distress:

For more historical information on SAS AB, please read our High Risk Report.

With sanctions imposed on many Russia-based companies, entities are essentially barred from any buy, sale, investment, or related transactions. Prior to these sanctions, Aeroflot-Rossiyskiye Avialinii PAO was already financially distressed with operating losses, negative tangible net worth, and a working capital deficit. In March, Fitch Ratings disclosed the following supply chain disruptions:

“For AFLT the key drivers include sanctions on provision of aircraft and spares that have severely disrupted its business, including cancellation of all international flights (except for destinations in Belarus) due to its all-leased fleet of mostly Boeing and Airbus aircraft."

Fitch downgraded the company to “CC” due to debt service restrictions and its mounting default risk on Mar. 11, 2022. The rating was subsequently withdrawn completely on Mar. 30 citing further business profile impairment due to sanctions. The company’s FRISK® score of “2” indicates 4-to-10x higher bankruptcy risk than the average public company. Also, after a previous announcement by the company denying the CEO’s intention to resign, Mikhail Poluboyarinov exited his position on Apr. 8. Executive departures combined with financial distress are a common occurrence in advance of corporate failure.

Finally, yet importantly, risk professionals continue to be worried about the increasing likelihood of another global economic downturn, which would severely affect airline demand. In our article “Spiraling Economic Warfare and the Risk of Another Global Recession,” we outlined several macro developments and the most vulnerable industries, a list that includes airlines.

Bottom Line

The latest major airline bankruptcy occurred in December 2021 with PT Garuda Indonesia (Persero) Tbk. While there has been a short reprieve in early 2022, the cost pressures outpacing the price increases outlined above coupled with the potential for a decline in demand due to a recession may be setting the stage for some serious trouble. This environment will likely limit debt deleveraging and could result in a secondary wave of bankruptcy filings. By using the daily-updated FRISK® score, risk professionals can stay ahead of their most vulnerable counterparties. Contact CreditRiskMonitor to learn how you can use the FRISK® score and other report features to keep your company ahead of the competition.