Three Key Things to Know at the Start:

- The FRISK® score marked Rite Aid Corporation as having a 10-to-50x greater risk of going bankrupt relative to the average publicly traded company.

- Weak financial performance, high leverage, and C-Suite exits were all visible warning signs of Rite Aid’s descent toward bankruptcy.

- Rite Aid’s rising bankruptcy risk was spotlighted in a High Risk Report in April of 2022, nearly 18 months before filing for Chapter 11 protection. CreditRiskMonitor subscribers were given an extraordinary advantage in lead time to adjust credit terms, or even an outright pivot to an industry peer, to eliminate unnecessary exposure and maximize cash flow.

CreditRiskMonitor® published a High Risk Report about Rite Aid Corporation ("Rite Aid") in April 2022. The pharmacy operator's financial profile gradually weakened, with negative trends in financial metrics and business developments indicating a worsening situation culminating in filing for bankruptcy on Oct. 15, 2023. Our Bankruptcy Case Study on Rite Aid examines the event details leading up to its final collapse.

This article will provide five quick and vital facts about Rite Aid highlighting how CreditRiskMonitor® subscribers and prospective clients can identify troubling situations within their portfolios before bankruptcy strikes.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

1. FRISK® Score Screamed Triage While Payments Missed the Mark

Rite Aid's bankruptcy shouldn't be a surprise to attentive CreditRiskMonitor subscribers its FRISK® score had warned of extreme risk for well more than a year. For most of that time, Rite Aid's FRISK® score was mired at the lowest possible level of "1" on the "1" (highest risk)-to-"10" (lowest risk) bankruptcy risk scale. A "1,” in FRISK® score parlance, indicates 10x-to-50x the bankruptcy risk of the average public company.

Even more compelling was that the Days Beyond Terms (DBT) Index, similar to Dun & Bradstreet's PAYDEX® score, completely missed signaling the rising risk at Rite Aid. The payment-based DBT Index indicated strength reflecting Rite Aid’s prompt payments to suppliers right up to the day it declared bankruptcy. To the chagrin of many financial risk professionals, the high risk FRISK® score and prompt payment DBT Index discordance is all too common. Publicly traded companies, like Rite Aid, do whatever they can to make supplier payments on time – in spite of ever-increasing bankruptcy risk – in order to retain access to inventory and services necessary to keep generating revenue. The FRISK® score sees through this payment-based "Cloaking Effect."

FRISK® Score | Probability of Bankruptcy Within 12 Months | |

| From | To | |

| 10 | 0.00% | 0.12% |

| 9 | 0.12% | 0.27% |

| 8 | 0.27% | 0.34% |

| 7 | 0.34% | 0.55% |

| 6 | 0.55% | 0.87% |

| 5 | 0.87% | 1.40% |

| 4 | 1.40% | 2.10% |

| 3 | 2.10% | 4.00% |

| 2 | 4.00% | 9.99% |

| 1 | 9.99% | 50.00% |

The FRISK® score correctly identifies 96% of public companies that file for bankruptcy at least three months beforehand by combining four high-quality data components:

- Crowdsourcing, or the aggregated risk sentiment of CreditRiskMonitor® subscribers indicated by their group research actions on the platform

- Stock market performance, including volatility and market capitalization trends

- Credit agency ratings from Moody’s, Fitch, and DBRS Morningstar

- Financial statements, factoring in ratios similar to but in excess of the Altman Z’’-Score and using non-linear weights

The proprietary combination of these four metrics within the FRISK® score consistently outperforms any individual metric and payment data in the prediction of bankruptcy.

2. Band-Aids Aren't Enough to Cover These Wounds

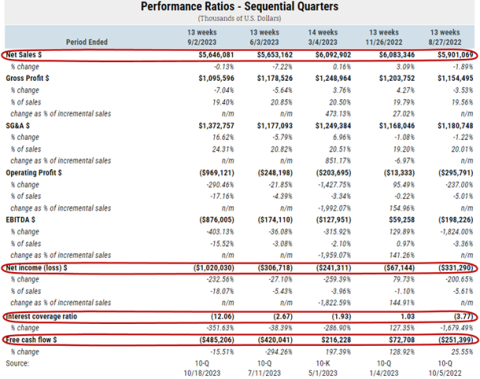

Rite Aid’s financial statements and ratios were bleak and easily accessed in the CreditRiskMonitor service. For example, sales have been roughly flat for the last three fiscal years, net income was negative in each of the last five fiscal years, and free cash flow was negative in three years with the cumulative free cash flow in deep negative territory over all five years. These disconcerting trends were apparent over the last five quarters, as well.

Debt-servicing was also problematic with weak interest coverage ratios. Situations like this can only persist for so long without material changes in performance. In Rite Aid’s case, its interest coverage was negative in three of the past five years and four of the past five quarters:

3. Rite Aid Leaned Too Hard on the Leverage Crutch

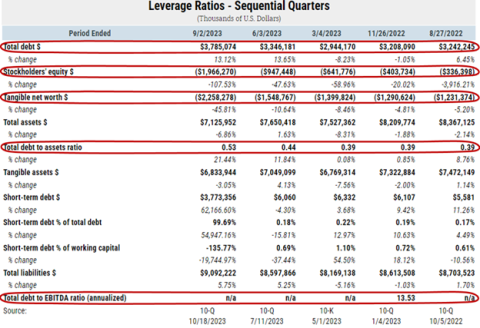

Although Rite Aid’s total debt trended down for several years, it ticked up in fiscal 2023. As of its second quarter financials, posted days after declaring bankruptcy, the debt load on an absolute basis was higher than it was five years ago. Meanwhile, ongoing losses pushed stockholder’s equity and tangible net worth deep into negative territory. Such developments suggest that there was little additional room for borrowing as the company's troubles worsened.

Additionally, debt-to-earnings before interest, taxes, depreciation, and amortization (EBITDA) was worryingly high, reaching double digits when EBITDA was positive. When EBITDA turns negative (as shown in the performance ratios page), which occurred in four of the last five quarters, CreditRiskMonitor shows n/a. A negative debt-to-EBITDA ratio is even worse than a high one, as it generally indicates extreme financial distress. High leverage will make a business unstable (think of an upside-down pyramid) and reduce flexibility to deal with adversity.

4. Management Provided a Bad Prognosis

Rite Aid's management was also clearly signaling the increasing risk in the management discussion and analysis (“MD&A”) portion of its quarterly SEC filings, specifically in the Liquidity and Capital Resources section that CreditRiskMonitor emphasizes are part of its standard business reports. In this section, a company’s management must provide a transparent account of a company's liquidity and capital resource risks or face criminal penalties. In turn, risk professionals must make it a habit of reading this section of the MD&A for high-risk companies when assessing short-term danger.

In the case of Rite Aid, the Liquidity and Capital Resource section of the MD&A from its first quarter SEC filing posted on July 11, 2023, stated that credit amendments it was forced to make were leading to rising interest costs and that its excessive leverage would require a significant amount of the company's cash flow just to cover its interest expenses:

"Our high level of indebtedness could: (i) limit our ability to obtain additional financing; (ii) limit our flexibility in planning for, or reacting to, changes in our business and the industry; (iii) place us at a competitive disadvantage relative to our competitors with less debt; (iv) render us more vulnerable to general adverse economic and industry conditions, including those resulting from COVID-19; a decline in the overall economy, and the current rising interest rate environment, and (v) require us to dedicate a substantial portion of our cash flow to service our debt."

5. CreditRiskMonitor's News Service Flagged the Brain Drain

The CreditRiskMonitor news service delivers email alerts about important news updates to subscribers on a daily basis. For a subscriber, these are invaluable alerts, as they highlight excessive turnover in the executive suite for struggling companies, in addition to other material changes.

For example, CreditRiskMonitor subscribers were updated when Rite Aid's CEO, Heyward Donigan, exited in January 2023. They were warned when Paul Gilbert, the Executive Vice President, Chief Legal Officer, and Secretary, departed in March 2023. And finally, when Justin Mennen, EVP and Chief Digital and Technology Officer, left in July 2023.

Employees step down all the time, but when a struggling company sees so much change in its leadership team, it suggests that the board is looking to change directions or, perhaps, that key leaders are trying to get out before they are tarnished by a bankruptcy filing. Both are challenging situations.

Bottom Line

When a company falls on hard times creditors must tread a fine line between remaining supportive and protecting their own best interests. The most important step in that process is identifying bankruptcy risk before it happens by using the FRISK® score as a first line of defense. Rite Aid, among many other examples, proves that CreditRiskMonitor provides its subscribers with more-than-sufficient lead time to make the adjustments needed to mitigate write-downs and maximize cash flow.

Contact us today to see how we can help you get ahead of risk and protect your company from future bankruptcies.