Three Key Things to Know at the Start:

- The FRISK® score highlighted WeWork Inc. as having a 10-to-50x greater risk of going bankrupt relative to the average publicly traded company.

- Weak financial performance, executive turnover, and a going concern warning were visible signs of WeWork Inc.'s ongoing business troubles.

- WeWork Inc.'s extreme bankruptcy risk was spotlighted in a High Risk Report in November of 2022, about 12 months ahead of its Chapter 11 filing; reports like this afforded CreditRiskMonitor® subscribers even more advanced notice before the company had to seek out court protections.

WeWork Inc. ("WeWork"), the popular flexible workspace provider, saw its financial condition deteriorate significantly in the last year. With a moribund FRISK® score and a debilitating cash burn rate, WeWork eventually filed for bankruptcy protection on Nov. 6, 2023. Our Bankruptcy Case Study on WeWork provides a fully detailed breakdown of the company's collapse in Chapter 11.

This article will provide five quick and vital facts about WeWork highlighting how CreditRiskMonitor subscribers and prospective clients can identify troubling situations within their portfolios before bankruptcy strikes.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

1. WeWork Stayed in the FRISK® Score Basement

WeWork's FRISK® score has been mired at "1" for more than a year’s time – meaning it possessed the worst-possible score on the "1" (highest risk)-to-"10" (lowest risk) scale, indicating extreme financial duress and bankruptcy risk. Any time a company has a FRISK® score in the lower half of the scale, counterparties must take action to mitigate risk exposure.

The FRISK® score correctly identifies 96% of public companies that file for bankruptcy at least three months beforehand by combining four high-quality data components:

- Crowdsourcing, or the aggregated risk sentiment of CreditRiskMonitor® subscribers indicated by their group research actions on the platform

- Stock market performance, including volatility and market capitalization trends

- Credit agency ratings from Moody’s, Fitch, and DBRS Morningstar

- Financial statements, factoring in ratios similar to, but in excess of, the Altman Z’’-Score and using non-linear weights

The proprietary combination of these four metrics within the FRISK® score consistently outperforms any individual metric and payment data in the prediction of bankruptcy.

FRISK® Score |

Probability of Bankruptcy Within 12 Months | |

| From | To | |

| 10 | 0.00% | 0.12% |

| 9 | 0.12% | 0.27% |

| 8 | 0.27% | 0.34% |

| 7 | 0.34% | 0.55% |

| 6 | 0.55% | 0.87% |

| 5 | 0.87% | 1.40% |

| 4 | 1.40% | 2.10% |

| 3 | 2.10% | 4.00% |

| 2 | 4.00% | 9.99% |

| 1 | 9.99% | 50.00% |

Often companies facing high financial stress attempt to maintain prompt invoice payments, which can hide the underlying bankruptcy risk. However, in the case of WeWork, slow payments were shown by the Days Beyond Terms (DBT) index (a metric similar to Dun & Bradstreet's PAYDEX® score), and served as a secondary warning of its increasing financial distress. In effect, the bottom-rung FRISK® score, as well as the slow payment trends, indicated that a five-alarm fire occurred before the eventual bankruptcy.

2. Red Ink Up to the Rafters

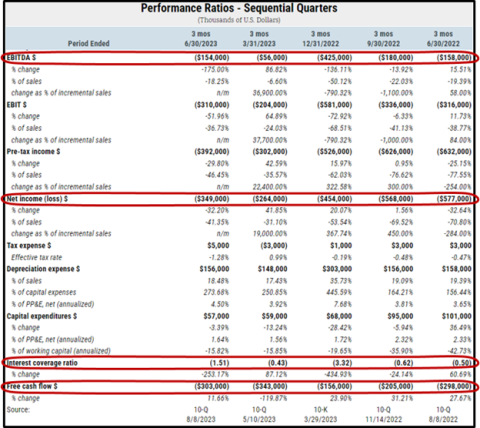

Although there were numerous signs of financial weakness to note, one of the most important was the company's inability to turn a profit. WeWork posted negative EBITDA, net losses, and negative free cash flow in each of the last five fiscal quarters:

WeWork's depreciation was insignificant relative to revenue because it doesn't own property in actuality. Instead, it takes out long-term leases at properties others own and then subleases that space to small tenants for relatively short periods of time. Therefore, the company's weak EBITDA, net income, and negative free cash flow are more troubling than you would expect if you were analyzing a more conventional property-owning landlord. In effect, WeWork was attempting to make the spread between its rental costs and the sublease rents it collected, yet never secured attractive rent spreads.

3. WeWork's Foundation Continued to Crumble

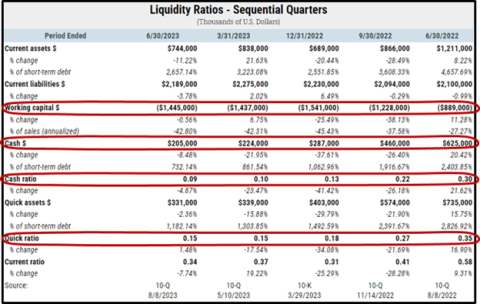

Given the poor revenue and profitability trends, WeWork couldn’t cover its interest expenses. Its debt obligations and other accrued expenses led its total liabilities to be hundreds of times larger than its market cap as it neared bankruptcy. This was largely related to the long-term leases the company signed for the space it was subleasing to others, i.e. the leases became an overhang, and the business model was cracking.

In addition, WeWork's cash balance was heading steadily lower, falling from $625 million in the second quarter of 2022 to $205 million in the same stanza of 2023. That shrinking cash balance further indicated that WeWork's lease costs were eating away its remaining liquidity.

4. The C-Suite Shuffle Strikes Hard

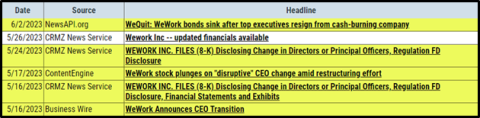

When we published the High Risk Report on WeWork roughly a year ahead of its bankruptcy, executive turnover was highlighted as a key warning sign of the company's increasing bankruptcy risk. Three CFOs in two years and the company founder stepping down after a failed IPO attempt in 2019 were cited as examples.

Turnover in the executive suite is a key red flag when it occurs at financially troubled companies. The resignation of WeWork's CEO and CFO in May was simply a continuation of that worrying trend. However, as is the case with so many bankruptcies, a growing list of executives rushing out should magnify your concern about the timeline to bankruptcy. The news alerts listed below about executive departures are immediately delivered to subscribers via email.

5. The Call to Evacuate Came Before the End

WeWork itself disclosed the possibility of failure in its own corporate filings. Within the company's Form 10-Q filed in August 2023, it was explained, "As a result of our losses and our projected cash needs, which have been impacted by the recent increases in member churn, combined with our current liquidity level, substantial doubt exists about the Company’s ability to continue as a going concern." You should always read the management discussion and analysis (MD&A) section of a financially weak company's quarterly SEC filings, specifically looking for warnings like this. Within CreditRiskMonitor, the Liquidity (MD&A) feature brings users directly to the "Liquidity and Capital Resources" section of the SEC filing, so subscribers can immediately access and review the most important information about the company’s financial health.

Bottom Line

WeWork’s business model left it with long-term lease obligations that it was attempting to cover with short-term lease revenues. It never managed to make those two ends meet, with the FRISK® score indicating to CreditRiskMonitor subscribers that bankruptcy risk was significant in the last 12 months.

Contact CreditRiskMonitor today to see how we can help you avoid high-risk companies like WeWork that may be lingering in your portfolio right now.