The high-profile implosion of China’s largest property developer, China Evergrande Group, with 2.4 trillion RMB in total assets has snapped to the attention of financial risk evaluators worldwide. CreditRiskMonitor's 96%-accurate FRISK® score has been indicating heightened bankruptcy risk in China Evergrande for well more than a year, lapping competitors like Dun & Bradstreet and their risk analytics before they can indicate distress.

We Caught It, They Didn't

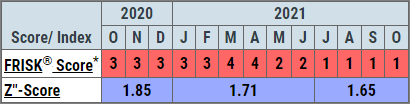

If you ever needed a reminder that the FRISK® score is best in class at bankruptcy risk prediction, look no further than how it compares to the most storied – and effective – historical models. The famed Z’’-Score developed by Dr. Edward Altman, one of the more notable bankruptcy prediction tools leveraged by academics and actuaries since the late 1960s, failed to quickly identify China Evergrande’s financial stress:

China Evergrande is a prime example of the quality gap presented when comparing the Z’’-Score to the FRISK® score, given that its Z’’-Score was trending neutral for four consecutive semi-annual periods. This neutral risk assessment was underpinned by China Evergrande’s large net working capital position, positive TTM EBIT, rising retained earnings relative to total assets, and relatively unchanged leverage. When viewed alone, the Z"-Score continues to give heavily indebted China Evergrande a clean bill of health.

Perhaps more concerning, the company's third-party auditor also signed off on its 2020 annual report without providing a going concern notice. Granted, this omission was likely a genuine oversight, but it suggests that they, too, couldn't see the imminent solvency risk. A going concern warning is a major red flag that should never be ignored, but it's only useful if the company's management and/or accountants raise the issue.

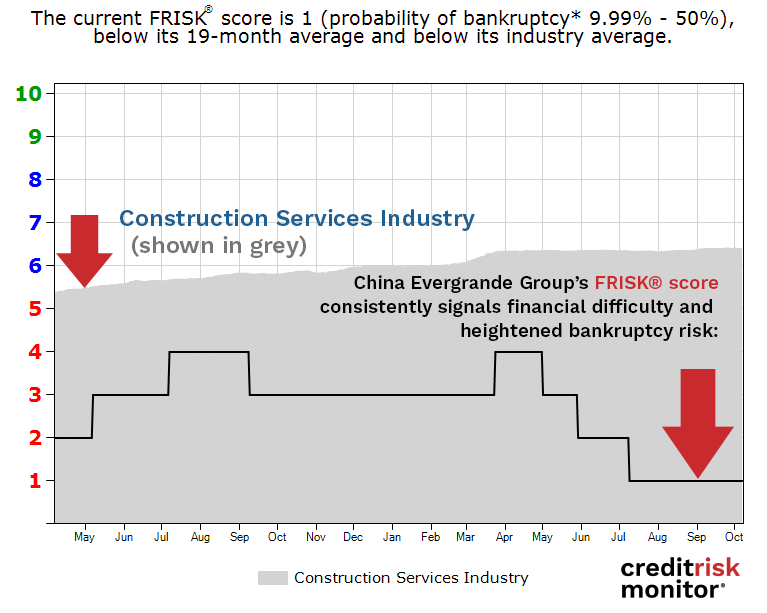

Even for an industrial firm as prominent as China Evergrande, it’s easy to envision a credit manager being blindsided by the debt meltdown that has taken place – if they don’t have the right solution to catch it all, that is. China Evergrande Group has been paying suppliers with discounted properties and it has missed two debt payments as of Oct. 1, 2021. As of the fiscal period ended June 30, 2021, quick assets only totaled 130 billion RMB against current liabilities of 1.6 trillion RMB. There is a debate about whether the Chinese government will step in to save the company, other Chinese developers will purchase inventories and investment properties to smooth its cash crunch, or if the company will file bankruptcy. Many factors are up in the air, but with 123 billion RMB of notes due in the next two years and impaired access to external funding, time is against the company.

The FRISK® score, however, pinpointed the risk by trending deep within the high-risk "red zone", the lower half of the "1" (highest risk)-to-"10" (lowest risk) range, for more than a year. For context, this trend of financial distress ran well beneath the construction services industry’s average FRISK® score of “6.” All the while the Z’’-Score, relying solely on China Evergrande Group's financial statements, indicated that there was no reason to worry.

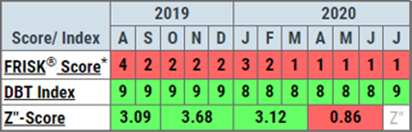

This isn't the first notable occurrence of this kind, either. In North America, the Z’’-Score conspicuously failed to provide a timely warning for the bankruptcy risk of gasoline engine manufacturer Briggs & Stratton before their bankruptcy filing in July 2020 – while the FRISK® score captured the real risk quotient:

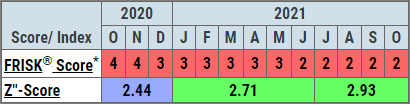

Heading back to China and their construction industry, a copycat of sorts can be found in Fantasia Holdings Group Co., Limited. The oddity here is that while the FRISK® score is steadily decreasing over time, the company’s Z’’-Score has inversely increased in the last 12 months. Currently, for Fantasia Holdings, total liabilities are 31 times larger than market capitalization, which also has declined by 64 percent since Q4 2020.

One last note about China and public companies covered by the FRISK® score: CreditRiskMonitor features more than 6,000 Chinese public companies in our database – as it relates to a republic that’s notoriously mysterious to read for corporate financial risk professionals, having the unshakable FRISK® score as your North Star is invaluable to anyone’s international portfolio.

What Sets the FRISK® Score Apart

Financial ratios, including those used in the Altman Z”-Score Model, are a core data component of the FRISK® score because they provide a deep look into a public company's fiscal wellbeing. However, the FRISK® score also includes stock market performance, bond agency ratings, and subscriber crowdsourcing patterns (a proprietary factor exclusively developed by CreditRiskMonitor). Essentially, this bankruptcy analytic pulls together multiple high-quality data sources to form an aggregated, daily updated, and more accurate financial risk assessment.

The beauty of the FRISK® score is that it does all the work for subscribers, so they don't have to examine and try to combine these four factors on their own. There's a fully baked score to check each morning (if you so choose) and, immediately, you'll know if you need to worry about counterparty bankruptcy risk. This simple-to-use, 96% accurate tool then allows you to allot your valuable time to high-risk companies where it will be most useful. That's important given that the Z’’-Score, and by extension, other financially based models, may not be an adequate shortcut.

Bottom Line

Using a public company’s financial statements to examine bankruptcy risk will often put you on the right path. Yet China Evergrande Group is another example of why financial models that rely on this information exclusively can, just as often, be insufficient to your process. The FRISK® score is a more dynamic, comprehensive, and accurate solution that saves time and effort in identifying your largest financial risks. Contact CreditRiskMonitor today to see a true picture of your counterparty risks before your portfolio is impacted by bankruptcy.