Payment history isn't a sufficient indicator of public company bankruptcy risk, a fact highlighted by the all-too-frequent pattern of prompt payment history all the way up to the day of filing. Hexion Inc., which declared bankruptcy on Apr. 1, 2019, is a prime example of the failure of payment data. This activity is known as the "cloaking effect," a term our competitor Dun & Bradstreet coined following the Great Recession in their white paper, “Bankruptcy: Why the Surprise?”

Within the findings, D&B states: “...inquiries from the credit community [were] questioning why [D&B] had not predicted a filing or closing.” CreditRiskMonitor's proprietary FRISK® score, however, identified the risk at Hexion. It shows why this multifaceted score is more successful than relying on trade data or any credit rating that uses this misleading information.

CreditRiskMonitor is a leading web-based financial risk analysis and news service designed for credit, supply chain and financial professionals. Subscribers include thousands of risk professionals globally, including those employed by nearly 40% of the Fortune 1000. A few of CreditRiskMonitor's most important features are:

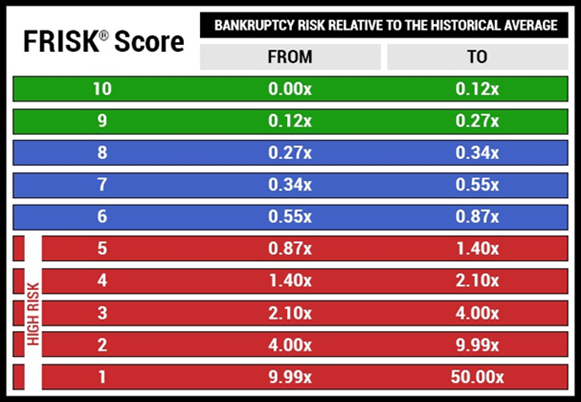

- The aforementioned FRISK® score, which is 96%-accurate in predicting public company financial stress and bankruptcy risk

- Our strength in coverage spans 56,000 global public companies, totaling approximately $63.8 trillion in corporate revenue

- Timely news alerts, spread financial statements, credit agency ratings and analysis, the Altman Z”-Score, among many other resources

Trade Data Missed It Again

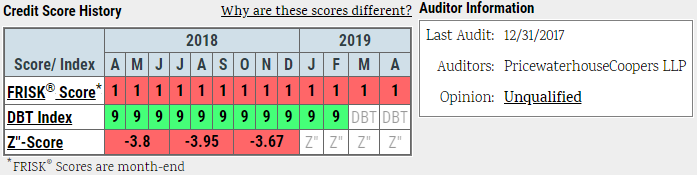

The FRISK® score, which spans a range from "1" (highest risk of bankruptcy) to "10" (lowest risk), had pegged Hexion as a financially troubled counterparty for more than a year leading up to its bankruptcy filing. However, the company's payment history was prompt, as denoted by its highly positive DBT Index marks. The DBT Index is a historical look at a company's payment history, meant to mimic similar payment-based tools on the market, including the PAYDEX® score from D&B. The DBT Index is a backward-looking dollar-weighted measurement of past payment performance, converted into a simple range labeled, not-so-coincidentally, from "1" (worst) to "10" (best). As the table below shows, the FRISK® score picked up the risk that the payment history failed to reflect in Hexion:

In fact, after D&B answered subscriber complaints about missed bankruptcies, it admitted that trade data isn't "singularly or collectively sufficient to perform the credit analysis needed." In other words, payment history doesn't work.

When you step back and reflect on the phenomenon, it isn't overly difficult to understand. In the words of D&B, "any scores heavily weighted by historical payment data would have reflected the timeliness of those payments," but "the payment patterns or performance of the troubled company mask their true financial condition."

CreditRiskMonitor's FRISK® score isn't fooled by trade data since this information is not used within the model.

A More Powerful Tool

The FRISK® score incorporates a number of unique risk indicators including:

- Adjusted stock market capitalization and volatility

- Financial ratios, including those used in the Altman Z”-Score

- Bond agency ratings from Fitch, Moody's, Morningstar Credit Ratings and DBRS

- The crowdsourced research patterns of our own subscribers

These indicators work in conjunction to provide a highly accurate measurement of bankruptcy risk. When a company's FRISK® score falls into the lower half of the "1" to "10" range, the area we call the FRISK® score "red zone," subscribers need to start doing additional due diligence. If the score continues to descend, it's time to have an urgent conversation with management and consider reducing exposure. The FRISK® score provides the early warning you need to protect yourself and your company, something that payment data will not help with. See the FRISK® score bankruptcy probabilities in the table below:

The Details

Of course, no company falls into bankruptcy overnight (though you wouldn't be able to tell that from payment history data). It's a process akin to watching a train wreck, but in slow motion. In the case of Hexion, the company's troubles were building on its balance sheet and income statement well in advance of its bankruptcy.

For context, Hexion's total debt-to-assets ratio was already high at about 130% in 2013. It continued to move higher, hitting 180% in Sept. 2018, the last time it reported earnings before it declared bankruptcy. Meanwhile, the company reported persistent net losses for several years and free cash flow was consistently weak as well. Tangible net worth was deeply negative and steadily deteriorated over the last year. We dig into all of these numbers and more in the Hexion Bankruptcy Case Study.

Taken together, this data provides some background as to why the highly accurate FRISK® score was warning financial counterparties about the risk at Hexion. Simply put, CreditRiskMonitor subscribers just need to regularly check a company’s FRISK® score - knowing that a score in the red zone means it's time to pay immediate and close attention.

Bottom Line

Although the story can be significantly different for every single public company that finds itself faced with bankruptcy, there's one familiar trend: payment data repeatedly misses the risk. You didn’t need CreditRiskMonitor to remind you of this trend, either – D&B shed light on the problem themselves seven years ago and their findings still prove useful (and point to a continued blind spot in their coverage which persists in present day). A significant 96% of all bankruptcies are captured in the high-risk red zone of FRISK® scores. If you'd like to learn more about how CreditRiskMonitor can help you see the financial risks that payment data misses time and time again, please contact us for a free demonstration.