Pier 1 Imports, Inc.’s management stated in a recent press release that the company has sufficient liquidity to implement its 2020 turnaround plan, opposing concerns offered in an S&P Global Ratings Report. CreditRiskMonitor’s FRISK® score on Pier 1 Imports remains firmly in the high-risk “red zone” and all business counterparties should pay close attention to this turnaround situation.

CreditRiskMonitor is a leading web-based financial risk analysis and news service designed for credit, finance, and procurement professionals. Subscribers include thousands of risk professionals all over the globe, including key decision makers from nearly 40% of the Fortune 1000. Three features of the CreditRiskMonitor service include:

- Commercial credit report coverage spanning more than 56,000 global public companies, totaling $63.8 trillion in corporate revenue, as well as numerous private companies.

- The FRISK® score, which identifies financial stress and bankruptcy risk with 96% accuracy.

- Proprietary subscriber crowdsourcing, which uses aggregated research of risk professionals

Divergent Scoring

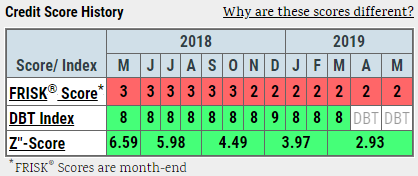

Sometimes credit professionals rely on tools that primarily evaluate the payment behavior of a subject company (such as Dun & Bradstreet’s PAYDEX® score or our similar Days Beyond Terms (DBT) Index). Pier 1 Imports has shown excellent payment performance as indicated by its DBT Index throughout 2018 as well as in the early months of 2019. Our research has found that prompt payment of invoices doesn’t provide any adequate representation of public company financial health.

Yet, as depicted in the graph above, the FRISK® score has been signaling heightened financial risk for Pier 1 Imports over the past year. While the business seemingly shows good metrics on payments, the FRISK® score offers a more accurate assessment. Pier 1 Imports’ FRISK® score of “2” is on the lower end of the “1” (highest risk)-to-“10” (lowest risk) scale. Typically when a company’s FRISK® score falls into the red zone, it’s necessary to carefully monitor its financial condition.

At the same time, Pier 1 Imports has been showing a consistently strong Z”-Score. This is a longstanding financial statement-driven metric developed by Dr. Edward Altman more than 50 years ago, still commonly used to assess bankruptcy risk. When a Z”-Score is equal to or greater than 2.6, it indicates sound financial health. With payment history and the Z”-Score offering good signals, the divergence with Pier 1's FRISK® score, which indicates financial weakness, becomes even more important. The key is to understand the difference between these stand-alone metrics and the FRISK® score.

The FRISK® score is more accurate than any other metric because it uses multiple high quality data sources including financial statement ratios, stock market metrics, subscriber crowdsourcing and credit agency ratings when available. All data components are dynamically weighted and each help to offset the shortcomings of another, ultimately driving the excellent timing and 96% accuracy of the credit model.

Subscriber crowdsourcing is certainly the most unique configuration within the model. Depending on the research patterns of other subscribers, their click activity on the CreditRiskMonitor service can signal increased risk to the FRISK® score. Essentially, if enough subscribers (a diverse group of risk professionals) are researching a company in a particular fashion, it can represent heightened “concern.” For Pier 1 Imports, many subscribers have been examining the company with increased scrutiny, particularly in April of 2019.

Turnaround Attempt

For fiscal year 2019, Pier 1 Imports recorded a same-store sales decline of 11%, much worse than the previous year’s comp of negative 2%. Additionally, merchandise margins collapsed from 37% to 29%, which was driven by a combination of clearance sales and higher promotional activity. A dramatic deterioration in sales trends in combination with heavy discounting is a red flag.

The company's interim CEO, Charyl Bachelder, disclosed in its Q4 2019 conference call that recent weak performance was due to poor execution: “our wounds were predominantly self-inflicted…costs were not managed to match performance. We also lost focus of our core customer” (emphasis added). This is a worrying admission, with customers likely switching to alternative stores. Pier 1 currently faces a laundry list of competitors including Amazon, Walmart, Wayfair, Target, Home Depot, Lowes, Bed Bath & Beyond, Williams Sonoma, Kirkland’s and many other smaller and more localized chains. Recapturing lost sales will be difficult.

Fiscal 2019 was challenging, given Pier 1 Imports’ EBITDA was negative $129 million and its free cash flow deficit was $135 million. Management has laid out a plan to substantially cut costs by $100-$110 million. Yet some of these cost savings will be channeled into reinvestment to benefit longer term performance, so near-term cash outlays will likely remain significant.

The Q4 MD&A stated that the company expects to have sufficient liquidity over the next 12 months. However, the company’s cash on hand was $55 million (small compared its recent cash burn) and its quick ratio was only 0.33x (after excluding deferred revenue from current obligations). Therefore, the business may be required to draw on external cash sources in the coming quarters. Substantially all of its stores and distribution centers are leased, so it doesn’t have alternative cash sources. Furthermore, only a small fraction of its leases are coming up for renewal in the coming year, so improving same-store sales is necessary to offset the fixed costs of rent and wages.

Adding to the list of headwinds, leverage ratios have become a problem for Pier 1 Imports as well. Total debt-to-tangible net worth hit a new high of 2.8 times after the company had to borrow $50 million on its revolving credit facility. Although this bought the company time, it increases its future interest burden. Pier 1 Imports' options appear limited as it looks to prove the credit rating agencies wrong.

Bottom Line

Pier 1 Imports, Inc.'s management is hyper-focused on turning around the business, but don’t let other scoring methods (including the PAYDEX® score and the Altman Z”-Score) mislead you. Its current FRISK® score of “2” indicates heightened financial stress and we think counterparties should closely monitor its performance and liquidity going forward. With pressures from competition, creditors and landlords, the company is walking a tightrope.

The retail industry continues to be haunted by persistent bankruptcy filings. Pier 1 Imports is simply one of many examples of financially weak companies in the space today. If you want to safeguard your trade receivables, contact us today for a free risk assessment.