CreditRiskMonitor warned of the increasing bankruptcy risk at newspaper owner McClatchy Company for more than a year before their Chapter 11 filing in February 2020. Yet McClatchy Company is not an isolated case and risk professionals should be monitoring other news provider outlets closely.

A leading web-based financial risk analysis and news service designed for credit, supply chain and other risk professionals, CreditRiskMonitor has been serving thousands of clients – including nearly 40% of the Fortune 1000 - for more than 20 years.. Important features of our service include:

- The FRISK® score, which is 96%-accurate in predicting public company bankruptcy

- Public company coverage of more than 56,000 across the globe

- In depth financial ratio and trend analysis and access to vital MD&A disclosures

The FRISK® Score's Warning

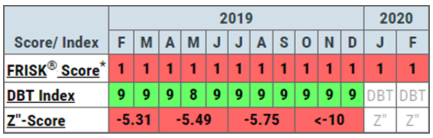

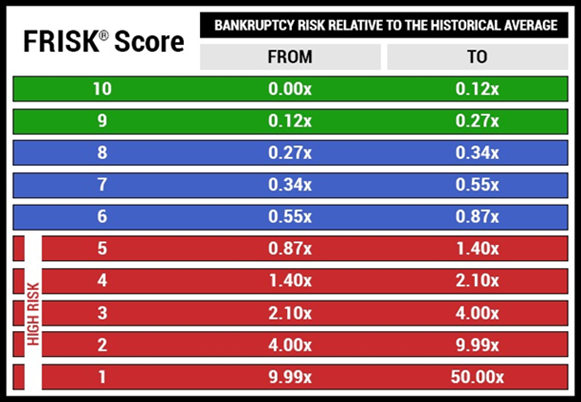

McClatchy Company's FRISK® score was mired at a worst-possible "1" on the "1" (highest risk)-to-"10" (lowest risk) scale throughout 2019. The FRISK ® score incorporates financial ratios, bond ratings, stock market performance, and the crowdsourced research activities of CreditRiskMonitor subscribers.

Subscriber crowdsourcing is a powerful predictor of bankruptcy risk because it leverages multiple years of research behavior on the CreditRiskMonitor service. As aforementioned, we serve nearly 40% of the Fortune 1000 – meaning our users include credit professionals whose actions have significant influence on the dollar flows of trade credit, one of the largest sources of corporate working capital. When multiple subscribers exhibit certain patterns of research, it has been shown to be predictive of bankruptcy risk. That aggregated data is anonymously shared with other subscribers via the FRISK® score.

In the months leading up to the McClatchy Company’s Chapter 11 filing, our subscribers were clued in to the elevated concern through the company's bottom-rung FRISK® score of "1," which indicated bankruptcy risk was 10-to-50x greater than the average public company:

The financial risk that CreditRiskMonitor accurately identified, however, was notably missed by payment-based scores. Commonly known as the "cloaking effect," McClatchy Company paid its bills in a timely manner until its bankruptcy, as seen by the high DBT Index score (a measure similar to Dun & Bradstreet’s PAYDEX® score). Credit professionals relying on payment scores, like D&B's PAYDEX®, put their company at risk of being blindsided and subject to write downs. Instead, we strongly advise the use of real-time credit models such as the 96% accurate FRISK® score, which look forward instead of backward in assessing bankruptcy risk potential.

This FRISK® score is an early warning tool that highlights the need for a deep dive. Ideally, subscribers will have used CreditRiskMonitor's extensive analysis tools well before McClatchy Company fell to a "1." In fact, CreditRiskMonitor provides alerts whenever a company's FRISK® score falls to "5" (and subsequently drops lower), so you can take action when a counterparty is in the high-risk "red zone."

McClatchy Company posted negative net income for four consecutive quarters prior to its bankruptcy. It had negative free cash flow in two of those periods. It was unable to cover its interest expenses over that 12-month span. What’s more, the company's debt was worryingly high while liquidity was simultaneously weak. Add in a declining top line, and all factors ultimately played a role in McClatchy Company’s filing.

Additionally, the company had been warning in its MD&A for at least a year that its ability to borrow was limited: "we were not permitted to incur additional pari passu obligations under the limitation on indebtedness incurrence test as defined in the 2026 Notes Indenture." Proceeds from asset sales, as the MD&A further explained, would largely be earmarked for debt reduction and, thus, unavailable for day to day cash needs. And by June 2019, it was seeking waivers related to its required pension plan contributions. The above warning signs are highlighted in CreditRiskMonitor's McClatchy Company Bankruptcy Case Study. With the broader industry facing headwinds today, it pays to take the lessons from McClatchy Company and apply them to other public companies.

Troubled Peers

Lee Enterprises, Incorporated's FRISK® score has fallen from a "3" to a "1" over the past 12 months. Its financials are weak, its bonds are classified as "junk," and its total liabilities are 10x greater than its market capitalization. Lee Enterprises has a 10-to-50x greater prospect of bankruptcy than the average company. The December 2019 MD&A highlights in detail the risks Lee Enterprises faces if it doesn't remain in compliance with a loan it received from Berkshire Hathaway. Although obtaining that loan may have bought the company time, it didn't change the trajectory of the business. Any risk evaluator would be wise to monitor Lee closely and would benefit from scouring vital information put forth in subsequent MD&As.

Company | FRISK® score | DBT Index |

Lee Enterprises, Inc. | 2 | 8 |

The E.W. Scripps Company | 2 | 9 |

Gannett Co., Inc. | 3 | 8 |

The FRISK® score for The E. W. Scripps Company has sunk from a "6" to a "2" over the last year. Scripps has a 4-to-10x greater risk of bankruptcy than the average company. Weak financials, junk-rated debt, and total liabilities that are 4x greater than the company's market capitalization are all troubling signs to examine here. Although E.W. Scripps isn't currently warning about liquidity issues in its MD&A, it is highlighting a material increase in borrowing costs. That was driven by a more than doubling of its debt load due to an acquisition. Keep careful watch over this media company.

Gannet Co., Inc., best known in the industry as publisher of the famed USA Today, has seen its FRISK® score fall from a neutral "6" in April 2019 to a "3" today. Over that time, New Media Investment Group acquired old Gannett and renamed the combined company Gannett Co., Inc. Although management is looking to cut costs and rationalize the business, bankruptcy risk has increased due to the company's leverage. Its market capitalization has declined more than 60% over the past year, with total liabilities sitting at 12x market capitalization. Financial ratios, meanwhile, are indicating financial stress. Highlighting the situation was management's MD&A note that "Our leverage may adversely affect our business and financial performance and restricts our operating flexibility."

A commonality to point out: Lee Enterprises, E.W. Scripps, and Gannett Co., Inc. today are all paying their bills in a timely fashion similar to McClatchy Company up until it filed for bankruptcy. Payment-based scores (i.e. PAYDEX®) are consistently missing the risks that the FRISK® score uncovers on a regular basis.

Bottom Line

CreditRiskMonitor subscribers were warned well ahead of time of the rising bankruptcy risk at McClatchy Company. Lee Enterprises and E.W. Scripps in particular are facing similar headwinds, with the FRISK® score warning that now is the time to review before it’s too late. Call us today and we'll help you understand the risks like these you face throughout your portfolio.