When one hears “everything is bigger in Texas,” bankruptcy risk isn’t generally the first thing that comes to mind – yet the adage is apt for Houston-based Stage Stores Inc.

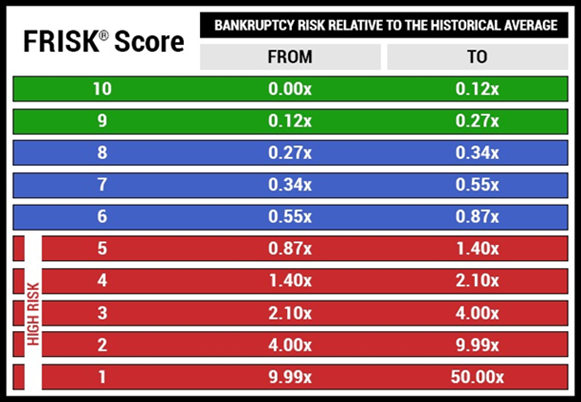

The popular department store operator is signaling severe financial distress in 2019, where we are currently forecasting that Stage Stores is nearly 10 times more likely to face bankruptcy by this time next summer than the typical public company. This, while the company’s strategic revenue-boosting gambit of converting department stores to off-price retail locations continues to progress.

A huge part of what makes CreditRiskMonitor unique in uncovering bankruptcy risk is our subscriber crowdsourcing factor, which provides data that has improved our FRISK® score. Our subscriber base includes thousands of credit and risk professionals the world over, including nearly 40% of the Fortune 1000. We track their aggregated click patterns on the web service and found that it is predictive of bankruptcy. Since crowdsourcing was introduced into the FRISK® score’s computation, the FRISK® score’s accuracy rate has improved to 96% for U.S. public companies.

Utility of the FRISK® Score

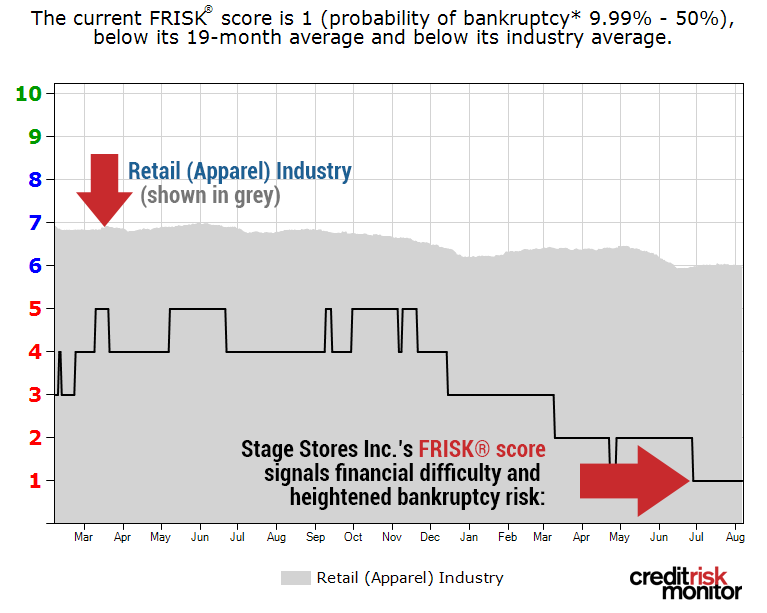

Stage Stores’ FRISK® score has been trending in the “red zone,” the lower half of the FRISK® scale, for more than a years’ time. In addition to the aforementioned subscriber crowdsourcing, the model leverages three additional data factors to deliver a final metric: stock market capitalization, financial ratios like the Altman Z”-Score and bond agency ratings from Moody’s, Fitch, DBRS and Morningstar Credit Ratings when available. Our research over the past two decades has determined that when these factors are blended together, the accuracy in assessing a public company’s risk of bankruptcy increases exponentially.

Crowdsourcing activity specifically signaled higher risk over the last two quarters, when Stage Stores’ FRISK® score correspondingly sunk to a “1.” This downtrend indicates a large increase in bankruptcy risk:

CreditRiskMonitor recommends that subscribers carefully watch companies trending in this high-risk category. This warning signal, combined with its 12-month timing element, allows counterparties to identify and reduce risk exposure in advance of bankruptcy. Stage Stores' FRISK® score of “1” signals short-term bankruptcy risk up to 50%, as shown in the chart below:

Limited Flexibility

Stage Stores reported comparable store sales declines of 2-3% in each of the last three fiscal quarters. Further, the first quarter of 2019 demonstrated the steepest underperformance year-over-year, as net sales declined by 5% and gross margins deteriorated by 310 basis points. Executive management has responded with an acceleration of store closings; 41 stores closed in 2018 and 2019 guidance revealed plans for about 50 more store closures.

Stage Stores’ performance does not leave much more room for deterioration. The company’s trailing 12-month EBITDAR-to-rent expense ratio is low at approximately 1.35 times. In the latest conference call, management provided a longer-term update to its off-price conversion plans:

“At the end of 2019, we expect to have more than 150 off-price stores representing approximately 25% of total company sales. Our 2020 plans include converting…with off-price sales representing approximately 50% of total company sales.”

Off-price retailers have performed much better than department stores due to changing consumer spending habits. A widespread transformation is certainly necessary, but these goals involve execution risk and significant capital outlays.

In the fiscal first quarter of 2019, Stage Stores’ total cash on hand was just $23 million versus current obligations of $202 million, excluding operating leases that are up for renewal. Additionally, the MD&A states that the Credit Facility agreement carries a covenant that requires excess availability of $35 million or more. As of the period ending May 2019, Stage Stores maintained an excess of $55 million, which only leaves $20 million in borrowing capacity. With these investment constraints, management will be challenged in carrying out its business transformation.

Bottom Line

Many retailers, particularly department stores, have been under pressure from changing consumer spending habits. Unfortunately, Stage Stores is running out of time and capital to be competitive in the retail sector. The company’s FRISK® score of “1” indicates severe financial stress and subscriber crowdsourcing is currently indicating aggregate concern. These warning signals often forebode weakening vendor relationships and even bankruptcy filings, so be sure to stay alert.