The Russia-Ukraine war has brought commodity supply shocks, particularly in oil and gas, and has slowed global economic growth since its start in March last year. The U.S. and several European Union members have sanctioned Russian companies that dramatically reduced their international trade activity.

Beyond companies addressing their supply chain exposure to individually sanctioned entities, they must also manage geographic risk exposure and intensifying macroeconomic pressures in the future. Sophisticated supply chain decision makers are adopting nearshoring strategies – many who use CreditRiskMonitor’s new SupplyChainMonitor™ product – in response to the dual forces of recent pandemic lockdowns and this Russia-Ukraine conflict. These pivots require a keen sense of where in the world valuable commodities can alternatively be sought.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

Here are some of the issues that have arisen in wartime and what should be considered in 2023.

Commodity Challenges

One of the first reactions to Ukraine’s invasion by Russia was the severe dislocation in commodity markets. Ukraine, for example, is a major exporter of seed oil, corn, and grain. With attacks taking place and the country's ports blocked, global prices rose swiftly, pressuring food manufacturers and industrial companies reliant on ethanol and other biofuels. While a compromise has been reached that reopened Ukrainian ports, the war will likely have a lingering impact on the country's ability to produce commodities at pre-war levels. As such, temporary supply sources may need to be leaned on for longer, or permanently, from more reliable locations. SupplyChainMonitor’s global coverage of 30+ million businesses and peer analysis tools are exceptionally effective in assisting procurement risk evaluators in sourcing such new/alternative suppliers.

Russia, meanwhile, is a significant energy exporter. Oil and natural gas prices spiked, especially in Europe, following the invasion and have remained volatile since. This pricing impacts not just utilities and transportation industries, but also chemicals, refining, and manufacturing. Costs have risen dramatically for fuel, resins, and other vital product inputs. Entering 2023, there has been no resolution on this front, though there has been a near-seismic shift in where energy is going. For example, China and India have become even larger buyers of Russian oil while the United States and Middle Eastern countries are increasingly looking to supply Europe's needs.

These are just two of the largest areas of concern. The conflict also touches things as far and wide as nickel, aluminum, palladium, and fertilizers. When searching for alternative suppliers, SupplyChainMonitor subscribers can screen by geography, industry type, size, risk level, and other criteria. Financial risk can be addressed with the FRISK® score and PAYCE® score to monitor and limit financial stress in your supply chain.

Sanction Complications

One of the major global efforts to resolve the conflict is the use of sanctions. Nations globally have severely restricted Russian trade, including its all-important energy industry. Presently, Russia is one of the most sanctioned countries worldwide, according to SupplyChainMonitor data.

SupplyChainMonitor integrates sanctions data from U.S. Treasury, the United Nations, the European Union, and the United Kingdom into its service to help subscribers stay informed of sanctions with parent-subsidiary linkages. Failure to comply with sanctions can lead to significant civil and criminal penalties.

| Company | Annual Revenue ($, Billions) |

| Gazprom PAO | $143.38 |

| NK Lukoil PAO | $132.09 |

| NK Rosneft PAO | $122.65 |

Sanctioned Russian integrated oil and gas companies.

Sanctions are likely to remain in place in 2023, and perhaps expanded, making reviews of these lists critical.

Planning Ahead

The ongoing nature of this conflict necessitates constant monitoring and a deep understanding of counterparties, whether they are new or long-standing partners. When maintaining a supply chain, risk professionals should consider the following questions:

- How much financial stress and/or bankruptcy risk exists in my supply chain?

- What is the geographic risk profile of my supplier base?

- Are any counterparties subject to sanctions or at risk of future sanctions?

- Which are the best alternatives for my critical, direct, and strategic relationships?

- How much of my procurement dollars are vulnerable to disruption?

SupplyChainMonitor provides quick and easy solutions to address these questions. The FRISK® score is ideally suited to update supply chain professionals as financial stress and bankruptcy risk changes in real time. This hybrid score makes use of both slow-moving metrics, like company financial statements and bond agency ratings, but also fast-moving inputs that are updated daily, including stock price changes and subscriber crowdsourcing. This methodology allows the FRISK® score to be timelier and more accurate than other financial risk models.

Within SupplyChainMonitor, subscribers gain access to numerous suppliers worldwide for sourcing and monitoring. When identifying alternative commodity suppliers outside of Russia and Ukraine, for example, subscribers will be able to identify hundreds of thousands of companies in the agricultural and mining industry classifications. Since Russia recently cut LNG gas shipments to Europe and sanctions are now in place, EU importers have been securing supply from alternative sources.

Replacing A Sanctioned Entity

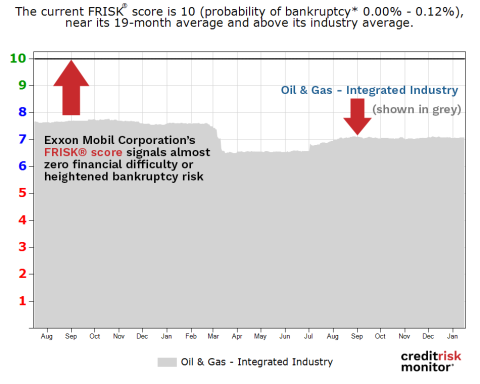

Gas supplier Gazprom, being a sanctioned entity, is no longer a viable relationship for European customers. EU importers have secured alternative supply from companies such as Exxon Mobil Corp. (“Exxon Mobil”), which is now working with Slovakia's national gas importer SPP. Exxon has a FRISK® score of "10," the best possible rating on the "1" (highest risk)-to-"10" (lowest risk) scale. Its FRISK® score is well above the average for the Oil & Gas - Integrated Industry, further evidence of its relative financial strength compared to peers:

For companies looking to switch from a sanctioned supplier to a new one, Exxon Mobil seems to be an ideal choice with its supply capacity, integrated operations, and financial strength. The daily updated FRISK® score provides counterparties with confidence regarding Exxon Mobil’s overall financial strength. By contrast, the FRISK® score can inform subscribers when a particular entity is financially distressed, e.g., Petroleos Mexicanos (“PEMEX”). This Mexican state-owned energy company has seen its FRISK® score deteriorate over the past year, falling deeper into the high-risk "red zone." This reflects increasing financial stress and heightened bankruptcy risk. When comparing these two energy suppliers, the FRISK® score would support choosing Exxon Mobil over PEMEX.

Bottom Line

When Russia invaded Ukraine the world environment quickly changed. Trade patterns have been altered, commodity prices continue to wildly fluctuate, and macroeconomic risks are increasing. SupplyChainMonitor has been helping subscribers see the full spectrum of risks worldwide, with subscribers using the FRISK® score to stay ahead of counterparty financial stress and bankruptcy. The Russia-Ukraine war could also prove to turn temporary changes in trade to ones that are more permanent.

Companies should implement sound sourcing strategies that account for sanctions, country, and financial risk to mitigate future disruptions. Contact us today to see how we can help make your supply chain more resilient.