Suppliers have been carefully monitoring retailer financial risk due to rampant bankruptcy filings. Since early 2017, some major bankruptcies have included Gordmans Stores, Inc. (Mar. 13, 2017), The Gymboree Corporation (June 11, 2017), Toys “R” Us, Inc. (Sept. 18, 2017), The Bon-Ton Stores, Inc. (Feb. 4, 2018), and Claire’s Stores, Inc. (Mar. 19, 2018). The industry's troubles aren't over, either, with Sears Holdings Corporation, Neiman Marcus Group Ltd LLC, and J. Crew Group, Inc. showing ongoing signs of financial distress. The research patterns of our subscribers, meanwhile, have recently highlighted increasing risk at J. C. Penney Company, Inc. and show that this troubled retailer should be given additional attention today.

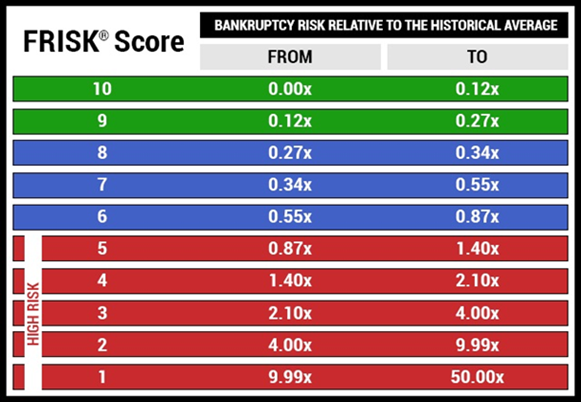

We published a High Risk Report on J. C. Penney in late 2017; since publication, the company’s financial situation has continued to deteriorate. J. C. Penney’s FRISK® score has been trending in the “red zone,” the bottom half of CreditRiskMonitor's proprietary bankruptcy risk scale, which signals material distress. The FRISK® score is 96% effective in measuring financial stress and bankruptcy risk within a 12-month period.

J. C. Penney’s FRISK® score is now a lowest-possible “1,”indicating a 10-to-50% probability of bankruptcy. In part, this high-risk signal is due to CreditRiskMonitor’s proprietary subscriber crowdsourcing data. Crowdsourcing is unique data derived from thousands of risk experts globally, including employees from nearly 40% of the Fortune 1000.

Crowdsourcing Risk Professionals

Subscriber crowdsourcing is powered by risk professionals, most of which are credit managers. Based on our research, we have found that certain click patterns by subscribers within our commercial credit reports can demonstrate concern about company financial health. Credit managers in aggregate play a critical role in a corporation’s working capital structure since trade credit dollars represent a necessary and inexpensive form of financing.

If a company appears to be approaching bankruptcy, trade creditors will reduce their risk by buying insurance or adjusting terms. Prior to such actions, however, risk professionals usually perform extensive and careful research into the company. In effect, crowdsourcing data picks up on that research, highlighting financially risky scenarios and anonymously informing all subscribers that are doing business with that company. In the case of J. C. Penney, the amount of vendor-supplied financing hasn’t materially changed, but subscribers are certainly taking notice of the company’s deteriorating financial position. Those concerns, meanwhile, are incorporated into the FRISK® score on a daily basis, helping to push its score lower.

Over the past several months, subscriber crowdsourcing has been sending a negative signal to the FRISK® score. Concurrently, J. C. Penney CEO, Marvin Ellison, left the company to pursue an opportunity at Lowe’s Corporation. It's not uncommon to see executive departures when business turnarounds like the one at J. C. Penney are not transpiring well. In fact, shortly after that executive departure, the company reported disappointing second quarter results. Thinking back to crowdsourcing, CreditRiskMonitor subscribers showed particular concern about this earnings release.

Since risk has discernibly increased, we will assess what has been transpiring at the company. We think it’s also important to note that J. C. Penney’s FRISK® score is well below the retail industry average FRISK® score of “6.” Users can compare the drastic difference in bankruptcy risk between a FRISK® score of “1” and “6” using the FRISK® probability of bankruptcy chart shown below:

Checking the Results

In the second quarter, J. C. Penney reported a year-over-year decline in net sales and gross profit of approximately 4%. Total store locations dropped from 1,011 to 865, representing a 14% year-over-year decline. While the company doesn’t break out online sales in its reporting due to its omnichannel approach, the decline in sales was most likely due to a smaller store footprint.

J. C. Penney’s operating costs deleveraged on a year-over-year basis in the second quarter, where selling, general, and administrative expenses relative to sales rose from 28% last year to 31% this year. These cost increases partially fueled the retailer’s adjusted EBITDA dropping by 50% year-over-year. This period also represented the second consecutive quarter of net losses for fiscal 2018.

Simultaneously, management cut its annual earnings guidance and now forecasts a midpoint net loss of about $300 million for the full year, down from its prior expectation of breakeven profit. Part of this reduction is due to weak inventory management. In the second quarter conference call, J. C. Penney CFO Jeffrey Davis stated: “we are taking the necessary steps to markdown and clear excessive inventory positions across many of our categories, which encompasses more than just seasonal product for fashion misses.” This will pressure gross margins in the coming quarters and may eventually require a write-down. In other words, it looks like there could be more bad news to come in the quarters ahead.

The company’s net debt position has been effectively unchanged for several years now, but with materially lowered EBITDA, leverage is becoming a more significant problem. In a recent note by Moody’s, the analyst team downgraded the firm’s long term credit rating from B2 to B3 (or one notch from B to B-). This level effectively represents highly speculative credit risk. Within the rating’s rationale, the Moody’s team stated: “Debt/EBITDA is estimated to approach 6.8 times at fiscal year-end 2018. The need to reduce inventory levels and connect more effectively with its core customer suggests that leverage levels will remain elevated as the company works with new leadership to define and execute its strategy to return to stabilizing its market position and improving profitability.”

One key issue for J. C. Penney is that the retail market is increasingly competitive, and off-price discounters and niche stores have been taking incremental share. This issue is compounded as J. C. Penney has been unable to hold down a seasoned CEO to help maneuver and execute important strategic decisions. Unless significant changes can be implemented, particularly rightsizing its store portfolio and inventory levels, financial stress will continue to mount. Furthermore, if J. C. Penney’s annualized EBITDA falls relative to recently adjusted expectations, it could trigger credit agencies to lower their ratings again. The retailer's turnaround efforts do not appear to be making much headway at this point.

Bottom Line

Subscriber crowdsourcing data has highlighted J. C. Penney’s bleak financial position, and users can affirm this through its low FRISK® score. On the positive side, free cash flow is expected to remain modestly positive and inventory financed by vendors is still relatively healthy. However, the fact that J. C. Penney’s CEO jumped shipped and that guidance implies a steep net loss, its credit health is clearly coming into question. FRISK® scores between “1” and “3” are the riskiest, and the company will likely remain within this range for the foreseeable future. In our view, credit managers should keep J. C. Penney on their radar heading into 2019, particularly watching out for further weakness in the retailer's leverage metrics.