During the last U.S. recession, corporate bankruptcies blindsided financial counterparties who relied upon payment history to identify financial risk. That issue, known as the “Cloaking Effect,” hasn't gone away. Yet you don't have to rely on blind feel because CreditRiskMonitor's proprietary FRISK® score sees through the Cloaking Effect to identify bankruptcy risk with 96% accuracy. Nearly 40% of the Fortune 1000 and thousands of additional subscribers each year rely upon the FRISK® score in their financial risk analysis.

CreditRiskMonitor is a leading web-based financial risk analysis and news service designed for credit, procurement and financial professionals. It provides commercial credit report coverage spanning more than 56,000 global public companies, totaling approximately $63.8 trillion in corporate revenue.

Bad Practice

During the deep 2007-to-2009 U.S. recession, Dun & Bradstreet was fielding complaints about its PAYDEX® score which, like our own Days Beyond Terms (DBT) Index, is based on historical payment performance. While looking into the issue, D&B coined the term "Cloaking Effect" to describe the fact that public companies often pay on time right up to the point when they declare bankruptcy. Put simply, any score based on payment data will miss financial risk at public companies. The recent bankruptcy of Hexion Inc. is a great real-life example of this.

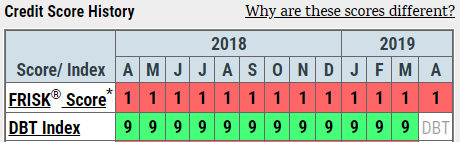

Notice within the chart below Hexion Inc.’s consistent DBT Index of "9" over the past year, suggesting prompt payment (highlighted in green). Now compare that to the FRISK® score of "1" over the same time period (highlighted in red). That's the lowest possible score on the "1" (highest risk)-to-"10" (lowest risk) scale, suggesting a bankruptcy risk over the coming 12 months of as much as 50%. That's the Cloaking Effect in full view, as Hexion Inc. sought out bankruptcy court protections in April. Responding to worried customers during the recession, D&B summed up the still ongoing issue very well, explaining that payment data isn't, "singularly or collectively sufficient to perform the credit analysis needed."

The chart also shows that the FRISK® score wasn't fooled by Hexion Inc.'s strong payment history and correctly identified the heightened bankruptcy risk well in advance. That's because the score doesn't look at payment history. Instead, the FRISK® score incorporates stock market metrics, financial statement ratios, bond agency ratings and the crowdsourced sentiment of CreditRiskMonitor subscribers.

These four components are dynamically weighted and specifically selected because the weaknesses and strengths of each work in a complementary fashion. For example, bond ratings tend to change slowly, while stock market data changes very quickly – together providing more information than either would if taken alone. This is why nearly 40% of the Fortune 1000 trusts the FRISK® score to help them identify risk early; providing ample time to prepare in advance, instead of being surprised and left to react to bad news.

Other Recent Examples

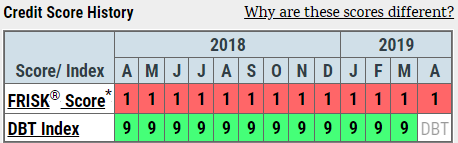

While Hexion Inc. is a great case in point, it's not an example that will help financial counterparties that weren't already using the FRISK® score. Unfortunately, the Cloaking Effect – and the risk it poses – is widespread. For example, consider Hovnanian Enterprises, Inc.’s FRISK® score that is warning of heightened financial risk. The DBT Index, again based on payment history, misses the brewing trouble because public companies tend to pay in a timely fashion until they declare bankruptcy. If you do business with Hovnanian Enterprises, Inc. today, it must be on your watch list.

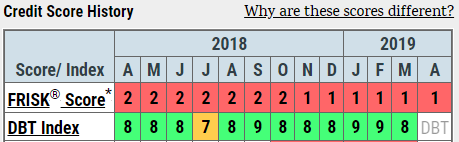

Oil and gas driller Legacy Reserves Inc. is another example where financial counterparties need to be paying extra close attention today. Notice the drop in the FRISK® score from "2" to "1" in late 2018 despite the payment history indicating continued prompt payment. The Cloaking Effect is obscuring the increase in financial risk.

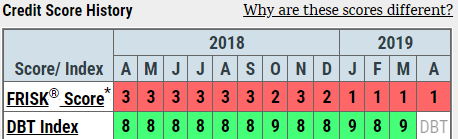

The decline in Quorum Health Corporation, which operates acute health facilities in the U.S. market, is even more pronounced. Despite continued prompt payment, the FRISK® score's multivariate approach has been highlighting a trend toward increasing financial risk over the past six months, with the score falling from a “3" in late 2018 to a "1" today. Subscribers would have been alerted via email each time the score changed for the worse.

Next Steps

Being provided with ample warning is vital in allowing you the time you need to prepare. The first step should always be digging deeper into the details, which the CreditRiskMonitor service facilitates via spread financial data, peer comparisons on key financial metrics, agency credit ratings and easy access to the most vital sections of a company's public filings. You can get a feel for the tools by looking at our Hexion Inc. Bankruptcy Case Study or any other report within CreditRiskMonitor’s Resources section.

With these tools at your fingertips you can quickly get a better idea of what is going on at the company and determine if you need to get on the phone with management. Or, perhaps, just start looking for other customers or suppliers. Information, by the way, that can be gleaned from our peer comparison tool which offers access to a comprehensive list of companies.

Bottom Line

Beating the Cloaking Effect with a powerful, multivariate tool like the FRISK® score is your first line of defense, but it isn't the final step in the process. Hexion Inc. is a good example of what can happen when you rely on the wrong information, but it won't be the last time the Cloaking Effect hides the true risks that financial counterparties are facing. Please feel free to contact us today if you would like a demonstration of the powerful tools available within the CreditRiskMonitor service.