On Sept. 23, 2018, ESL Investments, Inc. offered a proposal to Sears’ Board of Directors, pushing for a major financial restructuring. ESL, a hedge fund controlled by Sears CEO Eddie Lampert which owns more than 50% of the company’s outstanding common stock, stated that the retail giant must act immediately or it may be forced to file for bankruptcy. CreditRiskMonitor has previously warned of Sears’ steep financial risk, relaying that suppliers are reducing exposure significantly and that credit insurance has been expensive or even unavailable. ESL's proposal confirms just how bad things have become.

CreditRiskMonitor is a leading web-based financial risk analysis and news service designed for credit, supply chain, and financial professionals. Subscribers include thousands of risk professionals from around the world, including employees from nearly 40% of the Fortune 1000. Three of the service's most important features are:

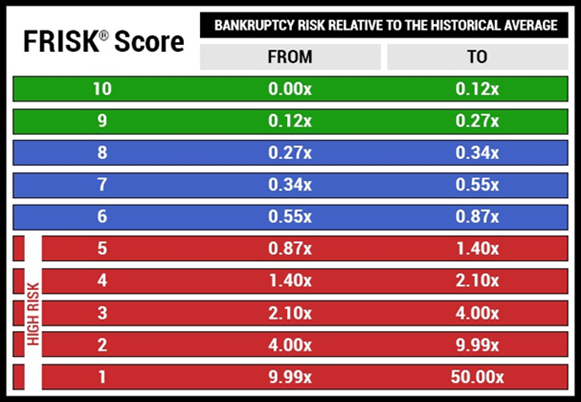

- The FRISK® score, which is 96% accurate* in predicting public company financial stress and bankruptcy risk

- The Trade Contributor Program, which tracks ~$3 trillion annually and identifies high risk exposure

- Proprietary subscriber crowdsourcing, a powerful scoring model that derives data from thousands of financial professionals globally

These three solutions help risk professionals stay ahead of counterparty financial stress and bankruptcy risk in both an accurate and timely manner. For Sears specifically, its FRISK® score remains at a “1,” the worst financial risk category that represents the highest probability of bankruptcy.

Liquidity Drying Up

Working capital has been negative for five consecutive quarters. During this time, however, Sears has been able to sustain operations by selling the Craftsman brand and real estate, while also issuing debt. In the second quarter of 2018, Sears also received help from its credit card amendment with Citibank, whereby Sears was paid $425 million. But cash is now a problem given a debt interest payment of $134 million due in October and a debt maturity of $668 million due in less than 12 months. This is why ESL is pushing for a restructuring.

In light of this liquidity risk, it’s not surprising to see vendors continuously reducing their exposure. According to CreditRiskMonitor’s trade payment data, payables have fallen by almost 27% on a year-over-year basis, similar to what was reported in its second quarter filing. More importantly, the trend in vendor financed inventory has shown a deteriorating trend. On a second quarter trailing 12-month basis, the figure has declined from 27.6% to 22.3% to 17.7% between fiscal 2016, 2017 and 2018, respectively. This behavior has contributed to the company’s working capital troubles.

Trade credit is an important form of financing to most companies as the cost of credit is practically nothing, and it is especially critical for junk debt issuers. As of the second quarter of 2018, Sears' net debt stood at $4.95 billion, including capital lease obligations. According to disclosures, secured borrowing came in at an expensive 6.9% rate while commercial paper and lines of credit are well into the double-digit range at 12.8% and 11.4%, respectively, for the 13 weeks ended Aug. 4, 2018. Interest expenses in each of these categories are up significantly relative to 2017.

Revolving Risks

While Sears has closed underperforming stores and cut costs, performance has been lackluster. Second quarter revenue declined by nearly 26% year-over-year, in part driven by a 4% decline in same-store sales. Equally important, gross margins have been persistently weak in the low 20% range, which is firmly below the department and discount store industry median of 31%. This level structurally limits the business from turning an operating profit. Selling, general and administrative costs relative to sales revenue have creeped higher as well, where operating margins are in the negative mid-to-high single-digit range.

The ESL proposal appears to be the only option to keep the business operating. It would provide a significant reduction of cash-related rent and interest expenses, as well as maturity extensions. Even if the proposal is implemented, though, its viability is questionable at best. There would be significant execution risks, including obtaining full commitment from creditors, the timing of asset sales and the realization of the estimated cash proceeds, among others.

On the asset side specifically, ESL disclosed that Sears could free up approximately $1.75 billion in cash through the sale of Sears Home Services and Kenmore, among others pieces, to reduce debt. One of Sears’ goals is to preserve the value of its remaining brands, particularly for the purpose of making reasonable sale transactions.

Risks remain prevalent. For example, in the second quarter, Sears showed approximately $69 million in impairment charges attached to Kenmore, indicating that lower future cash flows would be realized. Additionally, ESL made an independent offer of $400 million for the brand, but revealed that this purchase price would be below stated book value. Simply put, finding attractive bids for such brands and vast amounts of real estate in a short period could prove difficult.

Fitch Ratings provided a fairly negative assessment surrounding the proposal as well, stating: “even if the restructuring as proposed – which Fitch views as challenging to execute – goes through, the company will continue to require significant liquidity injection given operating headwinds.” Accordingly, the firm rated their long-term issuer default rating at “CC” and unsecured notes at “C.” These categories represent extremely speculative credit risk and borderline imminent default.

Bottom Line

CreditRiskMonitor subscribers have been alerted to these risks through Sears’ FRISK® score of “1,” indicating an elevated probability of bankruptcy. Based on recent cash challenges, ESL has offered a proposal to stave off such an outcome. However, it’s difficult to determine whether such a transaction will be agreed to and successfully executed or simply fall through. Sears still controls valuable assets but its financial position appears dire whether or not it receives a lifeline.