Corporate supply chains have shifted dramatically amid the Russia-Ukraine war and ongoing geopolitical conflicts with China. Armed with CreditRiskMonitor’s SupplyChainMonitor™ product, procurement teams worldwide are restructuring by onshoring, nearshoring, and avoiding increasingly risky countries.

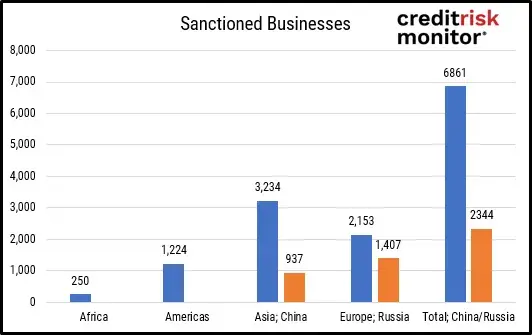

Regulatory bodies have imposed more than 2,000 sanctions on companies based in Russia and China. Moreover, country ratings provided by the Economist Intelligence Unit (EIU) reveal increasing risks with Russia and China. In response, U.S. trade activity has deteriorated with those nations, while significantly growing with Canada, Mexico, and Asia ex-China.

CreditRiskMonitor is a B2B financial risk analysis platform designed for credit, supply chain, and other risk managers. Our service empowers clients with industry-leading, proprietary bankruptcy models including our 96%-accurate FRISK® Score for public companies and 80+%-accurate PAYCE® Score for private companies, and the underlying data required for efficient, effective financial risk decision-making. Thousands of corporations worldwide – including nearly 40% of the Fortune 1000 – rely on our expertise to help them stay ahead of financial risk quickly, accurately, and cost-effectively.

Escalating Country Risks

SupplyChainMonitor™ provides actionable data, such as global sanctions and country risk ratings, to help procurement professionals formulate strategic plans on an ongoing basis – which often include significant changes to business operations and investment. Sanctions data is sourced from regulatory bodies based in the U.S., U.K., U.N., E.U., Canada, Australia, and Japan. Supply chains must address such compliance risks as sanctions can unexpectedly and forcefully terminate business relationships. For example, Russia became the most sanctioned country worldwide essentially overnight, which affected more than 1,400 Russian businesses. The U.S. treasury department reported that more than 1,000 foreign companies have already shifted investment and operations away from Russia, which resulted in billions of losses for businesses:

EIU country risk data currently shows that Russia ranks in the worst decile of countries to do business within Europe. EIU also reported that Russia suffered the largest global fall in the Democracy Index in 2022 – with Russia and China representing the largest authoritarian regimes. Russia responded to global sanctions by sourcing more supplies from China, according to The Wall Street Journal, while many countries have had no choice but to sever business relationships.

U.S. international trade activity with Russia and China specifically has shown stark deterioration in 2022. Total exports to Russia decreased by 71% and imports fell by more than 50%, or a 62% decrease in aggregate trade. Many Russian industries, including energy, technology, manufacturing, and transportation, have been adversely affected.

China remains the largest exporter to the U.S., though its leading position narrowed significantly relative to other countries. In 2022, U.S. imports and exports with China only increased by 6% and 2%, respectively. In terms of total share, Russia and China were the only two major countries that reported import and export declines year-over-year. Effectively, most of U.S. incremental trade growth shifted to Canada, Mexico, and the rest of Asia outside of China, reflecting the trend toward “nearshoring” and “friendshoring” by western companies.

Shifting Trade Activity

The United States-Mexico-Canada Agreement keeps progressing its intended goal with U.S. trade steadily growing with Canada and Mexico. Total U.S. trade activity increased by $726 billion in 2022, with more than one-third tied to Canada and Mexico. Turning to U.S. imports specifically, Canada and Mexico grew by 22.3% and 18.3%, respectively, and by more than $150 billion in total.

When comparing Mexico and China, Mexico offers U.S. supply chains closer proximity, tariff-free imports, and cheaper labor, which often results in shorter lead times and lower input costs. Both Mexico’s labor market and infrastructure have improved in the last 18 months, according to EIU data. Mexico has also drawn direct investment from manufacturers, including capital goods supplier ATEK Companies, Inc. and toymaker Mattel Inc., according to The Wall Street Journal.

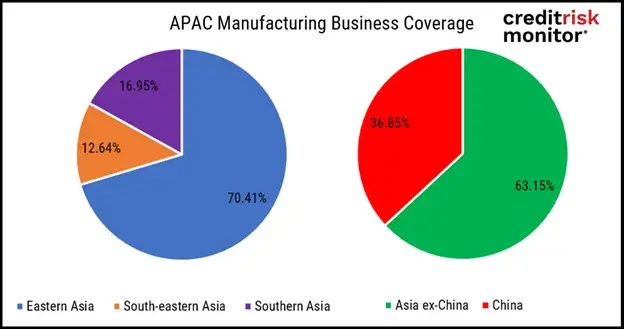

Within SupplyChainMonitor’s business coverage of 30+ million businesses is Asia-Pacific’s vast manufacturing base. Although no single Asian country provides China’s manufacturing capability, the group certainly does when considered together. Key members of the “Asia ex-China” group, include:

- High-skilled labor countries of Japan, South Korea, and Taiwan

- Low-cost labor countries of Vietnam, India, Indonesia, and Philippines

- Other low-risk nations of Thailand, Malaysia, and Singapore

U.S. imports from Asia ex-China increased from 20.4% to 23.7% of total trade, or grew by $109 billion year-over-year. By comparison, that’s higher than China’s total share of 16.5%, and more than triple China’s growth of $31.8 billion. According to SupplyChainMonitor™ data, nearly two-thirds of all manufacturing companies operate outside of China, offering procurement professionals numerous supplier alternatives.

Source Financially Healthy Alternatives

Beyond addressing country and sanction risks, procurement professionals can also leverage the SupplyChainMonitor™ platform to address financial risk. Supply chain disruptions are highly correlated with financial distress due to deficient financial resources and poor operational reinvestment.

SupplyChainMonitor enables subscribers to monitor their entire supply chain with industry-leading analytics, including the FRISK® and PAYCE® scores. With our 12-month forward-looking bankruptcy models, procurement professionals can identify and prioritize their riskiest counterparties. Based on our research, zombie vendors in particular have been known to cause severe and recurring supplier problems. In short, supply disruptions can quickly impact your company’s revenue, profits, and reputation.

Subscribers can filter out distressed vendors when sourcing alternatives by using the FRISK® score for public companies and PAYCE® score for private companies. For public companies specifically, subscribers also have the ability to directly compare suppliers with our peer analysis tool.

For example, subscribers may find two suitable suppliers for a particular input product. Companies with FRISK® scores between “6” and “10” should receive priority over those in the “red zone,” or between “1” and “5,” which have significantly higher bankruptcy risk.

However, companies with similar financial risk scores should be evaluated further, including operating performance, leverage, liquidity, and investment patterns, data which is all available to subscribers. With our bankruptcy scores, peer analysis, and financial analytics, supply chain professionals can quickly distinguish financially healthy and distressed companies.

Bottom Line

Global sanctions and intensifying country risks are only two unique categories impacting supply chains. Economic turbulence and rising interest rates are additional concerns and present a severe challenge for zombie companies worldwide, which we think will ultimately result in a new cascade of bankruptcies. We strongly encourage procurement professionals to perform supplier financial reviews and identify safer alternatives. To learn more about category risks impacting supply chains, see how SupplyChainMonitor™ will provide you with actionable guidance.