Windstream Holdings, Inc. declared bankruptcy on Feb. 25, 2019. The Arkansas-based telecom giant continued to pay its bills in a timely manner right up to the day it filed, meaning that any credit tool relying on payment history was essentially blind to the bankruptcy risk Windstream presented. CreditRiskMonitor's proprietary FRISK® score flagged that risk, when subscriber crowdsourcing research patterns helped to highlight the company's increasingly troubled state. Windstream's downfall is proof positive as to why the blended data which comprises the FRISK® score is superior to relying on payment history.

CreditRiskMonitor is a leading web-based financial risk analysis and news service designed for credit, supply chain and financial professionals. Subscribers include thousands of risk professionals all over the globe, including employees from more than 35% of the Fortune 1000. Three features of the CreditRiskMonitor service include:

- The FRISK® score, which is 96%-accurate in predicting U.S. public company financial stress and bankruptcy risk

- Proprietary subscriber crowdsourcing, a powerful scoring model that derives research patterns from thousands of risk professionals globally

- Our strength in coverage spans 56,000 global public companies, totaling approximately $63.8 trillion in corporate revenue.

Identifying the Problem

Trade data has severe limitations when it comes to tracking financial risk for publicly traded companies. Our research shows that public companies tend to pay on time all the way up to the point of bankruptcy. This is so common, in fact, it has a name: The "cloaking effect."

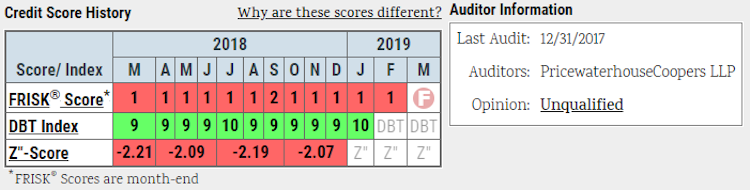

Windstream is a prime example of the cloaking effect. Note in the image below the difference between the telecom provider's FRISK® score and the Days Beyond Terms (DBT) Index, which is based on historical payment history and meant to emulate other common credit monitoring systems (e.g. the PAYDEX® score) on the market. The DBT Index continually indicated healthy payment behavior. Yet, the FRISK® score, which uses a “1” (highest risk) to “10” (lowest risk) scale, was signaling elevated risk of bankruptcy. The FRISK® score correctly identified the risk well in advance, providing ample time for professionals to adjust their exposure:

We didn't invent the “cloaking effect” moniker: one of our chief competitors, Dun & Bradstreet, did when it began to investigate why payment-based systems were missing so many public company bankruptcies. D&B's eight-page whitepaper entitled “Bankruptcy: Why the Surprise?” itself offers a mea culpa: “Even with sophisticated tools at their disposal, our customers want to know why they are being blindsided… Our research shows that regardless of the number or combination of elements used, credit professionals are applying too much emphasis on payment related data.” Payment history's poor record of success in identifying risk is why we specifically chose to exclude this data from our 96%-accurate FRISK® score. For public companies, the FRISK® score is the most accurate credit risk score available because it is built with truly useful data.

The FRISK® score brings together four components: stock market metrics, financial statement ratios, agency credit ratings and, most recently, proprietary subscriber crowdsourcing. Each is integrated into the model using non-linear, dynamic weightings. Equally important, the four factors mitigate each other’s shortcomings and ultimately provide a more accurate result than any one component alone. As Windstream shows, the FRISK® score provides warning whereas payment history does not.

The Virtual Credit Group Expressed Concern

Windstream was noteworthy with our proprietary crowdsourcing data, known as our “virtual credit group,” which anonymously tracks risk professionals using our web-based service. Certain research patterns indicate heightened concern and, thus, help to pinpoint bankruptcy risk. When enough subscribers exhibit the same worrying research patterns, they are incorporated into the score. Our subscribers started to show their concern with Windstream in late 2017, and this concern was a contributing factor to the company’s weak FRISK® score right up until their bankruptcy filing.

But it wasn't the only reason. We've been discussing Windstream’s weak financial state for some time, publishing both a feature article and a High Risk Report in 2018 to highlight the company's troubling financial condition. The cause of Windstream's bankruptcy was the loss of a court case tied to its 2015 spinoff of telecommunications assets into a real estate investment trust (REIT), which pushed it into technical default. However, as our previous reports explain, the bigger picture was steep financial leverage that left it in a precarious state.

The company's third quarter 2018 financials (the last available prior to the bankruptcy filing) paint a scary picture but are the culmination of soft business. While management was able to improve operating margins in the quarter, the company's debt-to-asset ratio was extremely high at 97%. Its current ratio was also quite poor, so it’s little surprise that Windstream was pushed over the edge. In fact, its cash and equivalents were only $37 million in the last quarter, but the court case required a payout exceeding $300 million.

The CreditRiskMonitor Difference

We've taken a deeper dive into Windstream's situation with a Bankruptcy Case Study. But it's important to further highlight this case because of the discrepancy between the company's payment history and FRISK® score. The cloaking effect – which Dun & Bradstreet admits in their own published whitepaper as being a blind spot within their offerings to risk professionals who deal with public companies – hid the risk here, making payment history all but meaningless. The virtual credit group, or the crowdsourcing component of the FRISK® score, flagged the risk well in advance of Windstream's ultimate bankruptcy. Coupled with weak financial data and other FRISK® components, CreditRiskMonitor's suite of tools gave subscribers ample warning and time to adjust their risk exposure.