CreditRiskMonitor Announces 2023 Results

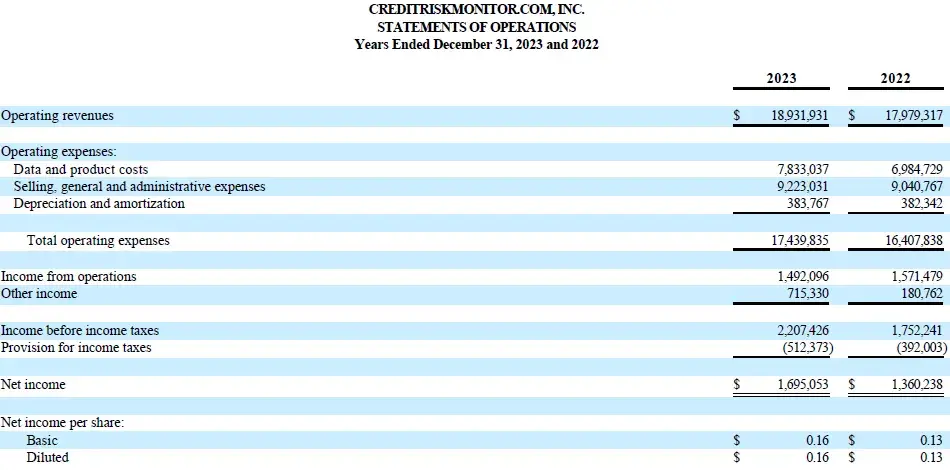

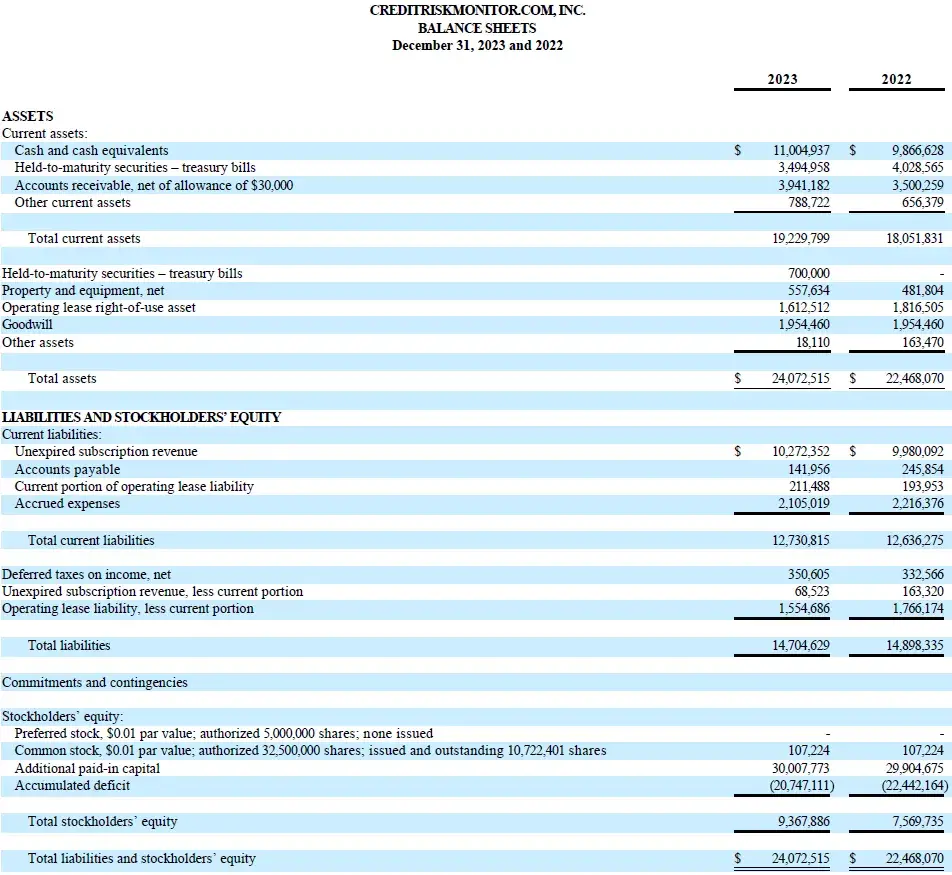

VALLEY COTTAGE, N.Y. - March 21, 2024 - CreditRiskMonitor (OTCQX: CRMZ) reported revenues of $18.9 million, an increase of approximately $953 thousand or 5%, for the year ended December 31, 2023, as compared to 2022. The Company reported operating income of approximately $1.49 million, a decrease of approximately $79 thousand for 2023 as compared to 2022. The decrease in operating margin was primarily due to increased data and product costs related to the SupplyChainMonitor™ product that preceded corresponding revenue gains. The Company reported net income of approximately $1.70 million, an increase of approximately $335 thousand for 2023 as compared to 2022.

Mike Flum, CEO, said, "In the second half of 2023, CreditRiskMonitor experienced renewed interest in our namesake CreditRiskMonitor® product, due to a rebound in bankruptcy rates to more typical levels after the historical lows of 2021 and 2022. We're also starting to see more sales engagement with our new SupplyChainMonitor™ product as we've continued to refine our sales process while expanding our outreach. The high renewal rate for our initial SupplyChainMonitor™ subscribers validates its utility for early adopters while the expanded interest from prospects confirms its market fit. We are encouraged to see the results of all our revenue team's hard work in building a robust sales pipeline.

Looking ahead to 2024, we are optimistic. The ongoing macroeconomic and geopolitical challenges underscore the need for B2B financial risk analysis, fueling demand for our products. We are particularly enthusiastic about launching our new Confidential Financial Statements ("CFS") Solution, a revolutionary product designed to streamline the way subscribers assess the financial risk of private companies by removing data entry requirements. A subscriber or its invited counterparty can securely upload financial statements, answer a few basic questions, and receive a detailed business report within 1 business day. These reports feature all the content our clients love like clean, standardized statements, financial spreads & ratios, peer benchmarking, and bankruptcy risk scores including our proprietary CFS score. This innovative product not only saves time but also enhances decision-making while offering clients a way to get coverage on all their critical counterparties. Finally, its consumption-based credit model only charges clients when they receive a risk score and they can buy more credits at any time during their annual term. No big investments to get started and no bad experiences paying for effort without results.

Moreover, we are deepening our investment in AI to improve our operational efficiency and products. Our use of AI, both predictive machine learning and generative techniques, continues to become more sophisticated. Specifically regarding generative AI, we are proceeding with caution given the potential for responses containing erroneous information and corresponding damage to the integrity of our subscriber relationships. We have installed human review steps and labeling for generated content to ensure quality and transparency. We use a variety of tools for these processes including our own fine-tuned, open-source models. While initially focusing on internal applications, we are exploring chat interfaces that will serve as the prototypes for a new, client-facing engagement channel in the future, once we can ensure utility, reliability, and trust.

Our commitments to introducing new products and expanding through innovative new channels will incur additional operational costs. However, we are confident these investments will fuel our growth strategy and enhance operational efficiency, ultimately leading to higher sustained profitability. We remain committed to delivering subscription services to our clients whose value exceeds their cost."

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. The products help corporate credit and procurement professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively.

The Company’s newest platform, SupplyChainMonitor™, leverages its financial risk analytics expertise to create a risk management solution built specifically for procurement, supply chain, sourcing, and finance personnel involved in the supplier lifecycle, risk assessment, and ongoing risk monitoring. Users can assess counterparty risks at the aggregate and granular levels under a variety of categories including geography and industry, as well as customized, customer-specific configurations. The platform features mapping capabilities with real-time weather/natural disaster event overlays as well as customizable news notifications, reports, and charts.

Our subscribers, including nearly 40% of the Fortune 1000 and well over a thousand other large corporations worldwide, use the Company's timely news alerts, research, and reports on public and private companies to make important risk decisions. The Company's comprehensive commercial credit reports covering both public and private companies worldwide are published through its web-based platform and feature detailed analyses of financial statements, including ratio analysis and trend reports, peer analysis, corporate issuer ratings from key Nationally Recognized Statistical Rating Organizations ("NRSROs"), as well as the Company's proprietary bankruptcy analytics: the FRISK® and PAYCE® Scores. One of the FRISK® scoring model's exclusive input features is the aggregate risk sentiment of our subscribers based on their crowdsourced usage behaviors resulting in the improved classification of bankruptcy risk for the riskiest corporations and boosting overall accuracy.

The Company, through its Trade Contributor Program, receives confidential accounts receivables data from hundreds of subscribers and non-subscribers every month. This trade receivable data is parsed, processed, aggregated, and finally reported to summarize the invoice payment behavior of B2B counterparties, without disclosing the specific contributors of this information. The Trade Contributor Program's current trade credit file processes approximately $3 trillion of transaction data annually.

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words “anticipates”, “estimates”, “believes”, “expects” or words of similar meaning, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, those risks, uncertainties, and factors referenced from time to time as “risk factors” or otherwise in the Company’s Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, CEO & President

845.230.3037

ir@creditriskmonitor.com