Knowledge of how and when to react to a business defaulting is essential; cutting ties with a customer or supplier too soon could lead to a missed sales opportunity, while being too late can result in financial loss.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Heavily indebted public companies - including perhaps theaters near you - are reeling as countries around the world shut their economies to slow the progress of COVID-19.

Public company bankruptcies soared in 2020, and filings continue to roll in as fallout from COVID-19. Here are five of the most notable Chapter 11 cases we've seen so far in 2021, and another five companies we feel are in big-time danger.

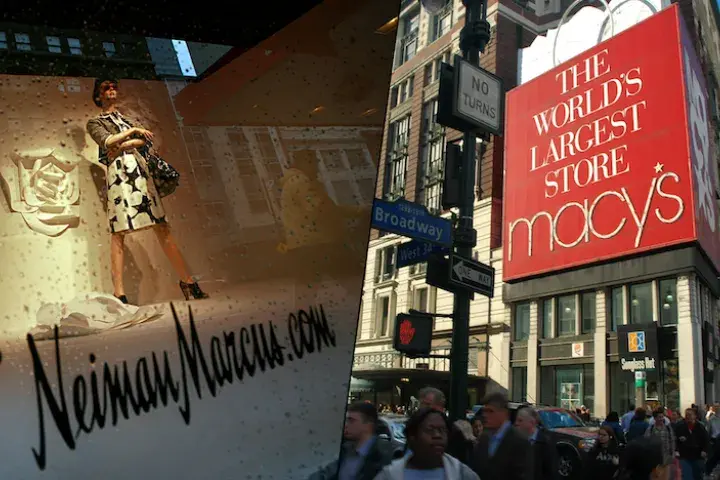

Big-name retailers Macy’s, Inc. and Neiman Marcus Group LTD LLC are on opposite ends of the bankruptcy risk spectrum - and for Neiman Marcus, time may be running out to turn their fiscal fortunes around.

In a highly interconnected world, large financially distressed companies like Spain's Obrascon Huarte Lain can pose far-reaching risks.

In a pandemic period when major public company bankruptcies are hitting hard daily, reliance on payment performance and/or financial statement analysis provides a whole new slew of dangers.

CreditRiskMonitor’s FRISK® Stress Index shows elevated financial risk within the global steel manufacturing industry, including big-time players in Schmolz + Bickenbach and ArcelorMittal.

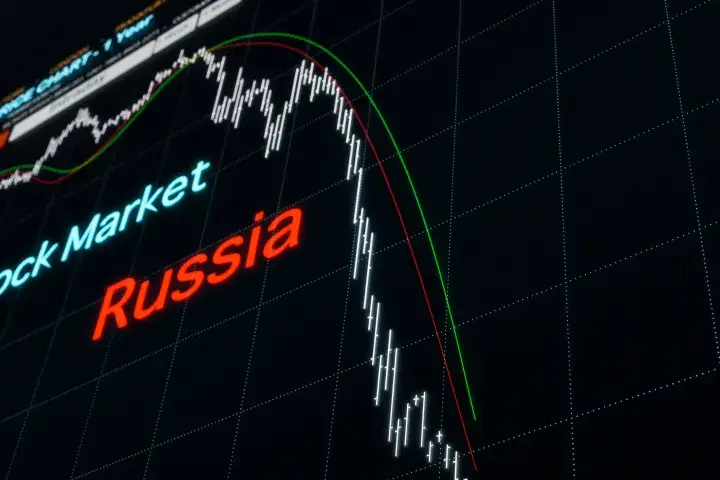

Sanctions have delivered significant financial stress to the Russian government and corporations alike. Overall, many Russian companies have dropped into – or have sunk further down into – the FRISK® score red zone, indicating heightened financial stress and corporate failure risk.

The global effort to slow the spread of COVID-19 continues to impact all economic regions and industries. Risk professionals must adapt quickly or risk being sideswiped by the rise in bankruptcies.