In preparation of future bankruptcies, credit professionals are using CreditRiskMonitor’s Credit Limit Ranges solution for automated monitoring on the size of credit lines.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

The FRISK® score cuts through the “Cloaking Effect” by identifying financially stressed companies with a differentiated and proprietary method that doesn't rely on payment history.

By tracking the behavior of credit managers and other professionals, crowdsourcing becomes the critical advantage that CreditRiskMonitor subscribers gain.

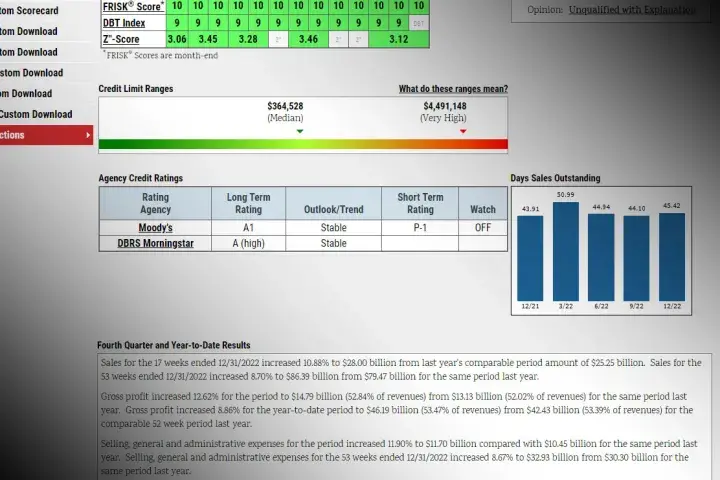

Major discount retailer, Big Lots, Inc. filed for bankruptcy on September 9, 2024. Importantly, both payment-based (DBT Index) and financial-only based models (Z’’-Score) failed to warn about this company’s bankruptcy risk. Conversely, the FRISK® Score provided warning for more than a year, enabling clients to mitigate their trade credit exposure.

CreditRiskMonitor recently interviewed Patrick Spargur, an experienced commercial debt collections executive, and former credit manager, on the economic downturn and relevant credit industry best practices to use in this challenging environment.

CreditRiskMonitor today announced a new licensing agreement with DBRS, an independent, privately-held, globally recognized credit agency.

The end credits have rolled for Cineworld Group plc, a global movie theater icon toppled by high leverage, debt, and a changing post-pandemic consumer environment.

Real Industry, Inc., suffered from costly debt financing, their risk further spotlighted by crowdsourced data harvested from credit managers.

Pump the brakes on credit extension? Sustained demand weakness and cumbersome debt load have us thinking twice about auto parts manufacturer Cooper-Standard Holdings Inc.