Dun & Bradstreet’s whitepaper “Bankruptcy: Why the Surprise?” stated that credit professionals were shocked by how many of their public company customers were going bankrupt during the Great Recession. Payment scores were not signaling any risk of bankruptcy; the danger was there all along, hidden by what Dun & Bradstreet coined the “Cloaking Effect.” Dissecting this issue, they explained: “Some companies pay their credit obligations in a discount or prompt manner right up to the actual filing/closing date.”

Payment history is not merely an inadequate gauge for financial risk in public companies, but rather it conceals their poor financial condition. By consequence of bankruptcy, creditors were unable to collect their accounts receivables and took huge write-downs. CreditRiskMonitor has continually warned its subscribers about the risks posed by the Cloaking Effect – an important issue for public companies.

CreditRiskMonitor subscribers use the FRISK® score because it cuts right through the “Cloaking Effect.” The bankruptcy model, which doesn't rely on payment history, predicts public company bankruptcy with 96% accuracy. The FRISK® score is optimized for credit professionals, updated on a daily basis and formulated to assess bankruptcy risk within a 12-month window. Furthermore, it will provide at least three months of warning prior to the filing date.

Don’t Rely On Payment Data

Dun & Bradstreet indicated the two top reasons as to why credit professionals will evaluate a company: “…credit departments are primarily reviewing only those existing customers that have past due balances or have exceeded their credit limits.” This may seem like standard operating procedure, but it is a fundamental error when performing routine checks. They then explained the problem in greater detail: “…payment data sources is neither singularly or collectively sufficient to perform the credit analysis needed.”

CreditRiskMonitor’s research over the course of 20 years of operation has overwhelmingly confirmed this problem: that payment scores fail to identify financial risk and it’s a problem for credit professionals. Public companies, specifically, have a variety of options to maneuver and hide financial stress in the time leading up to a bankruptcy filing. They can access special equity or debt financing, sell assets or quickly cut costs to prop up operating performance. These are often only short-term solutions, but they allow companies to keep paying their bills up until the bankruptcy filing. Therefore, CreditRiskMonitor advises that credit departments should not rely on payment scores at all.

Professionals in credit departments must accurately identify which businesses are high-risk in order to mitigate dollar exposure beforehand. By the end of the bankruptcy process, unsecured trade creditors will only receive a fraction of their original claim – sometimes as little as 10%. In other words, trade creditors are almost always left holding the bag; even one big miss on a large corporation can cripple this type of creditor due to the amount of dollars at risk in public companies. CreditRiskMonitor recommends using the FRISK® score as a first line of defense. Focusing on those companies experiencing a high degree of financial stress will significantly benefit your credit analysis process going forward.

Simply Check the FRISK® Score

The FRISK® score doesn’t use payment data in any way, shape or form. Rather, this sophisticated model integrates a variety of data components including financial statements ratios, stock market metrics, bond agency ratings and CreditRiskMonitor’s own proprietary subscriber crowdsourcing. These four components represent a comprehensive set of information and each factor is appropriately weighted.

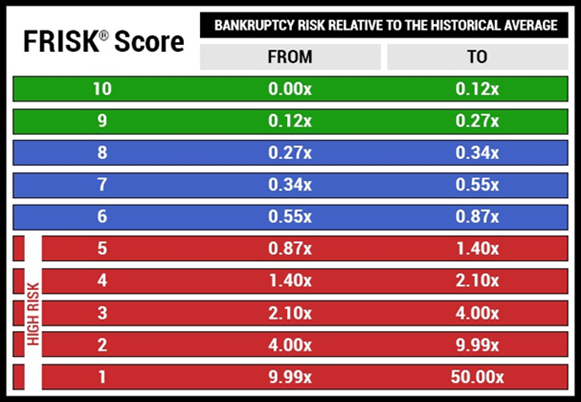

So how do credit professionals use this model? The FRISK® score is based on a “1” (worst)-to-“10” (best) scale with each score representing a different level of financial risk. When the score falls into the bottom half of the range (“1” to “5”), known as the FRISK® “red zone,” the company is financially stressed and has elevated risk of bankruptcy. See the FRISK® score chart below:

CreditRiskMonitor subscribers are proactively made aware when red zone companies are in their portfolio via alerts. These alerts include warnings when a company newly falls into this high-risk zone. Subscribers are advised to review, research and analyze these companies. The FRISK® score is also provided within the Risk Ratings section of our commercial credit reports.

Again, a payment model will not provide any meaningful indication of bankruptcy risk, whereas our FRISK® score will reveal this danger with precision. The FRISK® score provides a first warning sign so you can identify if a company is trending towards bankruptcy. From there you can then perform your step-by-step review process to see if that company has other red flags. If necessary, you can take the appropriate steps to mitigate risk exposure.

Comparison by Example

Our Bankruptcy Case Studies illustrate the Cloaking Effect problem through numerous company examples. Within each postmortem examination, a bankrupt company will show prompt payment of invoices, as indicated by a strong DBT Index. CreditRiskMonitor’s DBT Index shows if a business is paying its invoices on time, acting as a proxy for a traditional payment score, such as the PAYDEX® score. As these Bankruptcy Case Studies clearly show, however, the FRISK® score will have highlighted severe financial stress developing at these companies well in advance of their bankruptcy filings.

More than 60% of companies that file for bankruptcy trend in the riskiest FRISK® score categories of “1” or “2” prior to filing. The remainder of bankruptcies trend in the other high-risk buckets. Therefore, subscribers should be more vigilant on businesses that incrementally trend into the lower scores.

Regardless of the sector or industry, public companies that end up filing for bankruptcy show excellent payment performance and an extremely weak FRISK® score. See some examples below and their corresponding data at the time of filing:

Sector | Company | DBT Index | FRISK® score |

Technology | Tintri Incorporated | 8 | 1 |

Healthcare | Adeptus Health Incorporated | 8 | 1 |

Services | Sears Holdings Corporation | 9 | 1 |

Energy | Westmoreland Coal Company | 9 | 1 |

Transportation | Hanjin Shipping Co., Ltd. | 8 | 1 |

In each of these five cases, the DBT Index indicated prompt payment performance (“8” or higher is healthy), yet the FRISK® score indicated the highest risk of bankruptcy. Conversely, payment scores would have actually misled credit professionals; only after bankruptcy is declared do companies show poor payment behavior.

For long-form example reports, access CreditRiskMonitor’s Bankruptcy Case Study archive.

Bottom Line

Timely payment performance creates what is known as a “Cloaking Effect,” causing payment models to fail to warn of public company bankruptcy. Therefore, credit professionals should not rely on credit scoring models that use payment history as an input. The FRISK® score cuts through the “Cloaking Effect” by identifying financially stressed companies with a differentiated and proprietary method that doesn't rely on payment history. This is why thousands of risk professionals around the world use the FRISK® score, including those employed by nearly 40% of the Fortune 1000. How are you going to address this hidden risk?

If you would like to discuss the Cloaking Effect in greater depth, please contact our Vice President of Client Services, Chris Chach, by email at cchach@creditriskmonitor.com or by phone at 845-230-3022.