CreditRiskMonitor today announced that its Board of Directors has appointed Jennifer Gerold as Chief Financial Officer and David Reiner as Chief Accounting Officer, effective May 23, 2024.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

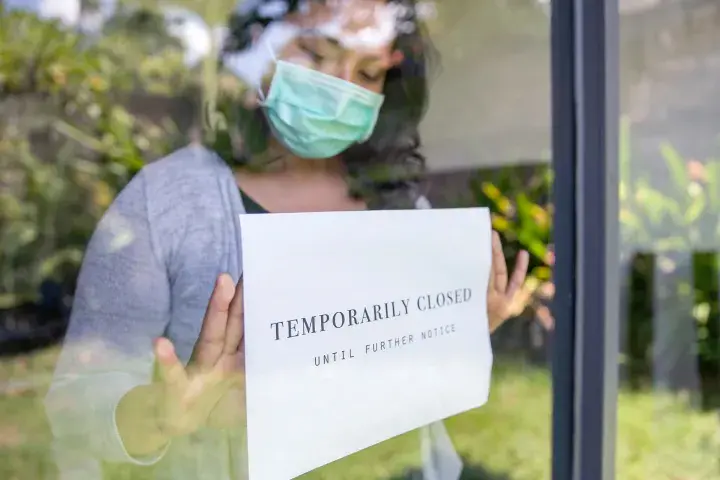

After surviving the COVID-19 pandemic, Rite Aid Corporation is still dealing with a heavy debt load and recurring net losses. Is bankruptcy nearing?

With an enduring COVID-19 pandemic both weakening crude oil prices globally and sinking their revenue, Basic Energy Services, Inc. has opted for bankruptcy protection for the second time in five years.

Oil and gas geosurveying company Ion Geophysical Corporation defaulted on its debt obligations earlier this year and announced forbearance and an amendment extension. The Houston-based company is the latest to fall during a post-COVID-19 energy crisis.

Retailers left and right exited stage left and into bankruptcy this summer. CreditRiskMonitor has the read on a few potential industry giants who might not survive to see 2021.

As the world grapples with a new surge of COVID-19 infections, it is worth revisiting Hertz Global Holdings’ bankruptcy and what their tribulation should teach you about other distressed travel names in your portfolio.

From the start of the coronavirus pandemic, CreditRiskMonitor subscribers have experienced an increase in public company FRISK® scored corporate failures* throughout North America.

Unless there is a rapid economic recovery, more retailers are going to go the way of J. C. Penney, Pier 1 Imports, Neiman Marcus and J.Crew. That is: bankruptcy.

The coronavirus has reduced air travel across key channels worldwide. Equity markets are souring on airliners, especially those that already carry excessive debt and are strapped for cash.