The U.S. Census Bureau reported that retail sales fell a devastating 16.4% in April. As if on cue, a slew of retailers, including several one-time industry icons, have fallen into bankruptcy. One of Warren Buffett's cheeky quotes is that “you don't find out who's swimming naked until the tide goes out.” It is now officially low tide in the retail sector. Thanks to the 96% accurate FRISK® score, however, CreditRiskMonitor subscribers have been wise for months – in some cases, years – to the Neiman Marcuses, J.Crews and J. C. Penneys of the world that have sought out court protection. Even before the COVID-19 pandemic, these risk evaluators were driving terms adjustments and even full pivots to healthier companies based on the danger levels exposed by the FRISK® score, avoiding multimillion-dollar write downs.

Here's a quick look at what's happened so far this year in retail, how CreditRiskMonitor provided that advanced warning, and nine additional dangerous retailers with strong negative FRISK® signals now.

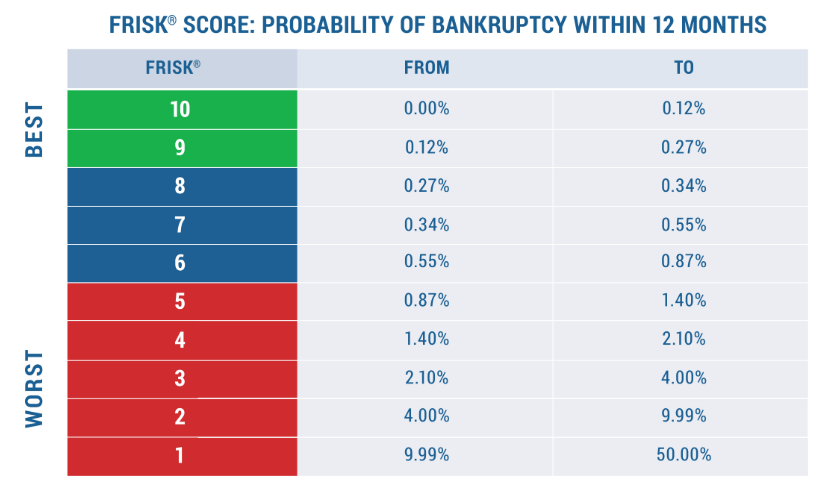

CreditRiskMonitor is a leading web-based financial risk analysis and news service designed for credit, supply chain, and other risk professionals. The core of the service is the FRISK® score, which accurately predicts public company bankruptcy using a "1" (highest risk)-to-"10" (lowest risk) scale. Ninety six percent of companies that eventually go bankrupt pass through the high-risk "red zone" of the FRISK® score, which is the lower half of the range. With coverage of more than 57,000 public companies globally and in-depth financial ratio and trend analysis, as well as access to vital news and regulatory filings, CreditRiskMonitor helps risk professionals navigate through even the most turbulent times.

Leveraged Retailers Crumble

The steep drop in retail sales highlighted by the U.S. Census Bureau's April report isn't surprising. The impact of COVID-19 has been global, with countries around the world shutting non-essential businesses and asking residents to stay home in an effort to slow the spread of the virus. Even financially strong companies have had a difficult time managing through this period of government mandated commercial freeze.

Public companies that entered the year with truly weak balance sheets and precarious businesses models have been crushed. The coronavirus has accelerated the trend toward e-commerce and provided a knockout punch for many large and small corporate retailers alike. CreditRiskMonitor tracked a total of 13 retail names that have declared bankruptcy so far in 2020, with six in the United States, one in Canada, and six in the Europe. All of these firms were in the high-risk red zone prior to filing for bankruptcy, meaning that CreditRiskMonitor subscribers were forewarned of the high financial risk.

Company | Country | Bankruptcy |

Tuesday Morning Corporation | U.S.A. | 5/27/2020 |

Canada | 5/19/2020 | |

U.S.A. | 5/15/2020 | |

U.S.A. | 5/10/2020 | |

U.S.A. | 5/7/2020 | |

U.S.A. | 5/4/2020 | |

MQ Holding AB | Sweden | 4/16/2020 |

U.K. | 4/9/2020 | |

Stockmann Oyj | Finland | 4/6/2020 |

Baltika AS | Estonia | 3/25/2020 |

Venue Retail Group AB | Sweden | 3/23/2020 |

Komputronik SA | Poland | 3/7/2020 |

U.S.A. | 2/17/2020 |

All examples shown in this table had the same toxic combination of excessive financial leverage and collapsing sales. For example, Pier 1 ended up in bankruptcy before the full impact of COVID-19 hit due to negative free cash flow, waning liquidity, and excessive debt. The troubles here predated the health scare, but the coronavirus has had a material impact just the same. With the sustained U.S. closure of non-essential retailers and creditors vying for liquidation, the company will not be reopening. Chapter 7 liquidations have been more common in this environment and this one in particular highlights the challenges of working with a financially strapped company that is out of options. Had the company filed for Chapter 11 in 2019, Pier 1 may have had a chance at fully restructuring its debt.

J.Crew's bankruptcy did not occur until after the U.S. started to shut non-essential businesses. Its leverage, with a total debt-to-assets ratio exceeding 100%, was higher than nearly all other apparel retailers. The company lost money in each of the past five years, with free cash flow dipping into the red in 2019. Entering 2020 on a weak note, the retailer's problems only worsened when market turbulence disrupted its planned spinoff of its best performing brand, Madewell. Out of options, J.Crew went to the bankruptcy courts to reduce debt and, hopefully, put itself back on track.

Which brings up retail heavyweights J. C. Penney and Neiman Marcus, two prominent department stores that have been forced into bankruptcy because of the impact of the coronavirus. Both have been dealing with weak sales on top of heavy debt loads. The real issue, however, has been the heavy investment needed to update their stores and improve their ecommerce platforms to better serve customers. With their physical outlets shut down, a slow makeover no longer worked and bankruptcy became the only option. They are both likely to use this process to shrink their retail footprints and debt to more manageable levels.

The High-Risk Watchlist

The FRISK® score provided an early warning in all of these bankruptcies, as CreditRiskMonitor's post-mortem Bankruptcy Case Study reviews highlight. These few are only some of the early casualties – the issues they faced are not unique, nor the outcomes. For reference, companies with FRISK® scores trending in the “1”-to-“5” categories have elevated bankruptcy risk, as shown within the chart below:

Here is a list of retailers from around the world that CreditRiskMonitor is presently watching closely:

Company | Country | FRISK® score |

Ascena Retail Group, Inc. | U.S.A. | 1 |

Stein Mart, Inc. | U.S.A. | 1 |

Grupo Famsa SAB de CV | Mexico | 1 |

Future Retail Ltd. | India | 1 |

TOM TAILOR Holding SE | Germany | 1 |

Restoque Comercio e Confecos de Roups SA | Brazil | 1 |

J.Jill, Inc. | U.S.A. | 1 |

Hudson Ltd. | U.S.A. | 3 |

Macy's, Inc. | U.S.A. | 4 |

As Macy’s works to reopen after COVID-19 store closures, it is likely to accelerate the pace of the permanent store closures it had planned before the coronavirus shutdown. While that should help the department store company boost its sales productivity, the company's debt load remains a major headwind. For example, the retailer just issued an additional $1.3 billion in bonds, backed by its real estate holdings, to help repay a credit facility, effectively turning temporary debt into permanent debt. Although not as bad as J. C. Penney or Neiman Marcus, Macy's total debt-to-tangible net worth ratio of over two times is a heavy burden, especially as the company deals with weak top line trends. Suppliers should closely track Macy's as it tries to work through what may be one of the biggest transition periods of its corporate lifetime. Notably, the crowdsourced research activity of CreditRiskMonitor's subscribers, a list that includes nearly 40% of the Fortune 1000, shows that risk professionals may already sense blood in the water. This component of the FRISK® score has put downward pressure on Macy's FRISK® score of "4."

Falling even further into the high-risk red zone is Stein Mart. This retailer operates off price stores in more rural locations. Its FRISK® score of "1" indicates it has a 10-to-50x greater risk of bankruptcy than the average public company. High leverage, disappointing earnings results, and negative sentiment from CreditRiskMonitor subscriber crowdsourcing are all key factors here. With total liabilities at more than 50 times the company's market capitalization, financial counterparties should consider how best to protect themselves from another potential bankruptcy.

Bottom Line

Retailers around the world, but particularly in the United States, have been muddling through major shifts in the retail landscape. Although most have struggled, those with heavy debt loads always have a harder time. Before COVID-19, it looked like companies could work through the e-commerce transition; however, with shuttered stores dragging down sales, time is running out. Unless there is a rapid economic recovery, more retailers are going to go the way of J. C. Penney, Pier 1, Neiman Marcus and J.Crew. CreditRiskMonitor is here to help if you would like assistance navigating this crisis. Contact us today for a demonstration of the predictive risk management tools we provide.