CreditRiskMonitor subscribers were the first to see the danger in now-bankrupt propane giant Ferrellgas Partners. The keys to successful risk evaluation were regularly keeping a keen eye upon the FRISK® score and not being swayed by payment data.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

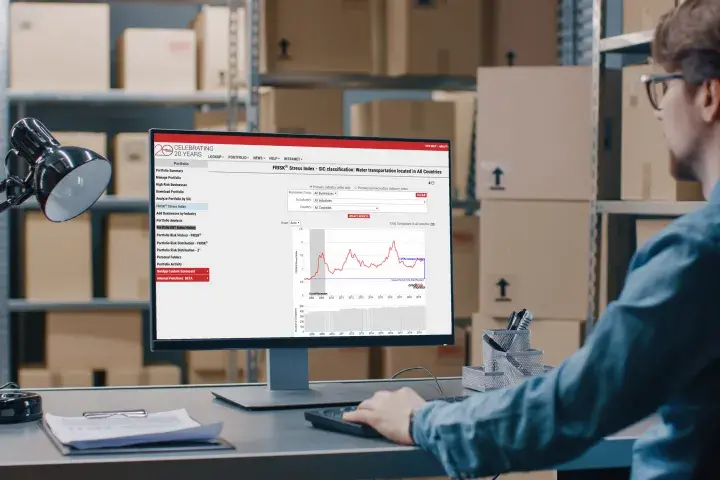

As the likelihood of an economic downturn continues to intensify, public companies across cyclical industries like trucking should be monitored closely.

If you work in the volatile oil and gas industry, not a single day should go by where you do not have a read on corporate credit risk. It could save your company millions in the long run.

Central banks worldwide are suppressing borrowing rates to accommodate credit markets, trying to alleviate financial pressures on corporations. This is creating a surge of "zombie companies," or firms that are staying alive in spite of their inability to service interest expenses.

Many operators within the auto & truck parts industry continue to struggle from supply chain constraints and breakdowns brought on by the COVID-19 pandemic, adversely impacting profitability.

CreditRiskMonitor recently published a High Risk Report on pharmacy retail chain Rite Aid Corporation. This detailed report will provide five quick and important facts that you need to know about this financially weak drug store operator.

Sanctions have delivered significant financial stress to the Russian government and corporations alike. Overall, many Russian companies have dropped into – or have sunk further down into – the FRISK® score red zone, indicating heightened financial stress and corporate failure risk.

Public company financial risk is higher than it has ever been, and the weakest links in your supply chain may lead to costly, time-consuming problems.

Stage Stores Inc. is nearly 10 times more likely to face bankruptcy by this time next summer than the typical public company.