CreditRiskMonitor reported operating revenues of $4.6 million, an increase of approximately $253 thousand or 6%, for the three months ended March 31, 2023, as compared to the first quarter of fiscal 2022.

Resources

Stay Ahead With In-Depth Analytics on Public And Private Companies

CreditRiskMonitor CEO Jerry Flum and Senior VP Peter Roma recently spoke with PYMNTS.com on why public company debt should scare creditors as it relates to bankruptcy risk.

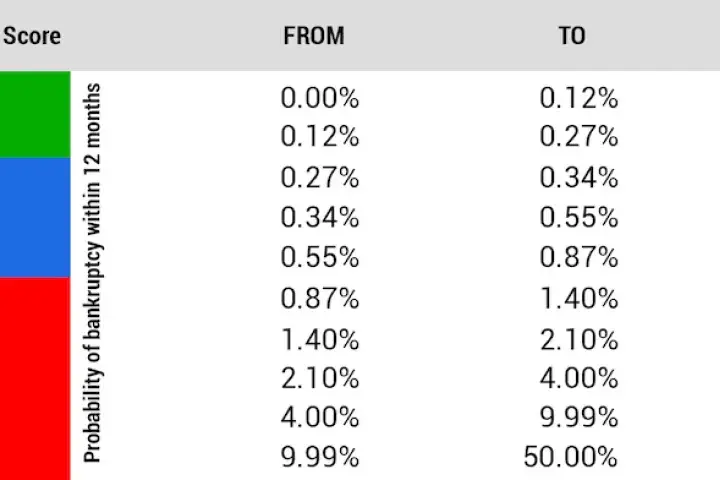

Read this in-depth white paper to learn more about CreditRiskMonitor's proprietary FRISK® score, how it works and why it's so accurate.

How can we be so sure of the accuracy? We measure it. Download this scorecard to see how the score performed in 2015 & 2016. In short – we predicted 98.6% of U.S. public company bankruptcies at least 90 days in advance.

Independent oil and natural gas exploration leader California Resources Corporation has seen its FRISK® score bottom out. The time has come for trade creditors to pay close attention.

A popular technology solutions provider to the energy sector, Houston-based McDermott International, Inc. has met Chapter 11 bankruptcy - a fate which wouldn't have surprised vigilant CreditRiskMonitor subscribers.

Powered by crowdsourcing and deep neural network technology, CreditRiskMonitor® uses two proprietary scores – FRISK® and PAYCE® – to more accurately predict financial risk at public and private companies, respectively.

Read in-depth how crowdsourcing the wisdom of our uniquely positioned subscribers has enabled a significant enhancement of the CreditRiskMonitor FRISK® score, more accurately predicting corporate financial stress.

The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. Here’s how bond agency ratings play a role.