It’s just not working out: the coronavirus pandemic is forcing the hand of financially weak American fitness operations to pursue bankruptcy, with many involving permanent location closures.

Once hailed the “mecca of bodybuilding” in the 1970s by Arnold Schwarzenegger and featured in the famed documentary Pumping Iron, private company Gold’s Gym International, Inc. filed for bankruptcy restructuring on May 4, 2020. Town Sports International Holdings – a public parent company that operates more than 100 New York Sports Clubs locations – is also rumored to be considering Chapter 11. Stepping out of the gym and into related retail, health and wellness products retailer GNC Holdings Inc. could end up seeking bankruptcy protection if unable to preserve an agreement with its creditors.

With gyms shuttered for the last several months in the U.S., it is interesting to see that each of these companies continued to promptly payment of their invoices, traditionally used as an indicator of financial risk. Below, we explain why payment history is such an unreliable metric and why you should be considering forward-looking financial risk evaluation solutions.

CreditRiskMonitor is a leading web-based financial risk analysis and news service designed for credit, supply chain, and other risk professionals. The core of the service includes the 96%-accurate FRISK® score and 80+%-accurate PAYCE® score, which predict bankruptcy over a subsequent 12 month period for public and private companies, respectively. Professionals employed by nearly 40% of the Fortune 1000 as well as thousands of other large companies worldwide, leverage these models to enhance their risk management procedures and prioritize work flow.

Deceptive Payment Behavior

Public and private companies usually seek to maintain prompt payment of their bills. Credit reporting agencies, such as Dun & Bradstreet, typically incorporate commercial trade payment experiences within their credit ratings and scores. CFOs at companies far and wide are aware of this fact and how important maintaining good payment scores are to accessing trade credit from their supplies and maintaining their market capitalization. Therefore, public companies with access to capital markets will tap those facilities to continue making timely payments even if their finances are strained. In many cases, even a severely distressed company will demonstrate good payment patterns leading up to a bankruptcy filing. CreditRiskMonitor refers to this phenomenon as the “Cloaking Effect,” which misled risk departments during the Global Financial Crisis and is doing so again in the COVID-19 Credit Crisis.

CreditRiskMonitor’s FRISK® score and PAYCE® score, meanwhile, pierce through the Cloaking Effect thanks to their differentiated input factors and calculation methodologies.

- Concerning public companies: The FRISK® score incorporates unique data including subscriber crowdsourcing, stock market data, financial statement ratios, and bond agency ratings whenever available. These risk indicators together are much more reliable compared to trade experiences.

- Concerning private companies: The PAYCE® score uses payment history, federal tax lien data, and leverages artificial intelligence. Traditional models and human-pattern recognition cannot replicate the AI-based model, which aggregates a variety of metrics that effectively pinpoint underlying financial stress.

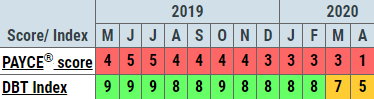

CreditRiskMonitor’s DBT Index, which is similar to PAYDEX® and other payment scores, shows that Gold’s Gym International, Inc. exhibited prompt payment behavior for nearly the entire span of the last year. For gym chains, recurring expenses often include new fitness equipment and machinery, maintenance, utilities, rent, sanitation, and facility construction. Their finance departments ensure at least on a dollar-weighted basis that retail trade suppliers, e.g. equipment suppliers, are paid within terms. However, the PAYCE® score for Gold's Gym indicated that the company had about 3x higher risk of bankruptcy versus the average private company. The company subsequently filed for Chapter 11 bankruptcy restructuring.

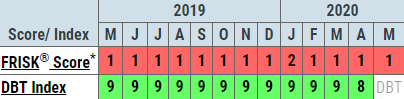

Town Sports International Holdings, Inc., operator of several branded chains including New York Sports Clubs, Boston Sports Clubs, and Philadelphia Sports Clubs, has been put under significant financial stress over the last year. The company’s FRISK® score of “1” reflects up to 50x higher risk of bankruptcy versus the average public company. Yet, the DBT Index indicates uninterrupted prompt payment behavior. In April, a going concern warning was issued and bankruptcy restructuring lawyers were hired from Kirkland & Ellis LLP and Olshan Frome Wolosky LLP. The question is no longer “if” a bankruptcy filing is forthcoming, but rather “when.” If you relied too heavily on payment trends, you would miss the substantial risk here.

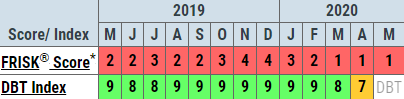

Shifting over to supplement retailer GNC Holdings Inc., the FRISK® score has steadily trended within the lower tiers of the FRISK® “red zone.” Since the onset of the coronavirus pandemic, the FRISK® score deteriorated to the bottom-rung of “1,” indicating the highest possible risk of bankruptcy. Despite the DBT Index continuing to report relatively healthy payment behavior, its financials have rapidly deteriorated. While the company managed to reach an agreement with lenders to extend the debt maturity dates on three of its outstanding loans, a bankruptcy restructuring still is not off the table.

Bottom Line

Traditional ratings and scores that only use trade experiences on a dollar-weighted basis as a central part of a credit determination provide misleading risk assessments in 80+% of bankruptcy cases. Companies hide their financial stress to maximize vendor financing so they can boost cash flow and achieve the lowest possible cost of capital. These scenarios are not unique to the fitness industry, though the area is a prime example of the problem today. Professionals need to rely upon bankruptcy scores that accurately identify financial risk and provide an adequate window to mitigate counterparty risk exposure. CreditRiskMonitor's FRISK® and PAYCE® scores are tailor-made to do just that. Contact us today to see how much risk the Cloaking Effect is hiding from you.