The coronavirus pandemic has slowed nearly every part of the global economy -- and with it, commodity demand has fallen precipitously. Now more than ever, companies are monitoring the financial health of their entire supply chains. Best practices involve not only monitoring and keeping open lines of communication with your immediate Tier 1 suppliers, but also reviewing the suppliers of your suppliers, which are your Tier 2 and Tier 3 suppliers.

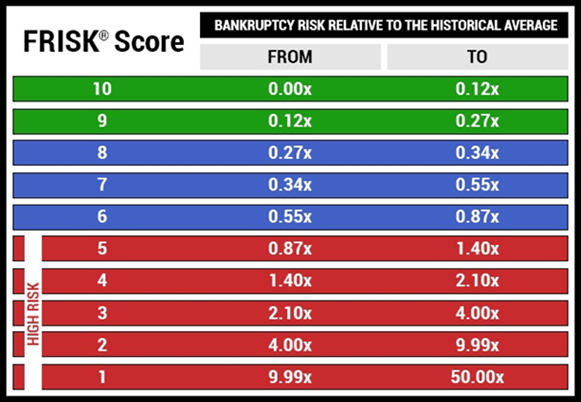

CreditRiskMonitor’s FRISK® score, 96%-accurate in predicting public company bankruptcy risk, serves as the first line of defense in identifying the weakest links along your supply chain. Tier 3 suppliers, such as metal producers, are presently falling on hard times and deserve a closer look as you prepare for and mitigate disruption. Professionals employed by nearly 40% of the Fortune 1000 plus thousands of other large companies worldwide rely upon the FRISK® score to help make crucial risk management decisions at the appropriate time.

The Economic Backdrop

Commodity | YTD Spot Price |

Aluminum | -18% |

Copper | -17% |

Steel | -13% |

Metal producers are one of the largest Tier 3 supplier groups worldwide. Since the beginning of 2020, the coronavirus has created an unprecedented demand rout, whereby key base metal categories, including aluminum, steel, and copper, have shown double-digit spot price declines. Notably, the largest importers of these commodities, the U.S. and China, are undergoing sharp economic contractions. That said, the pain is widespread with the Global Manufacturing PMI falling to 47.6 in April, the lowest level since the Global Financial Crisis.

The slowdown is particularly formidable in durable goods, such as industrial equipment, automotives, and aircraft carriers, as well as in construction activity, particularly for oil and gas rigs and pipelines and other commercial markets. According to the Institute for Supply Management (ISM), U.S. demand was abysmal heading into April: “Demand contracted heavily, with the (1) New Orders Index contracting at a very strong level, again pushed by new export order contraction, (2) Customers’ Inventories Index approaching a level that is considered a negative for future production, and (3) Backlog of Orders Index strongly contracting, in spite of a lack of production during the period.”

Moody’s Investors Service recently forecasted that global auto sales will decline by 20% in 2020, with European auto unit sales declining by 30% and U.S. units falling by 25%.

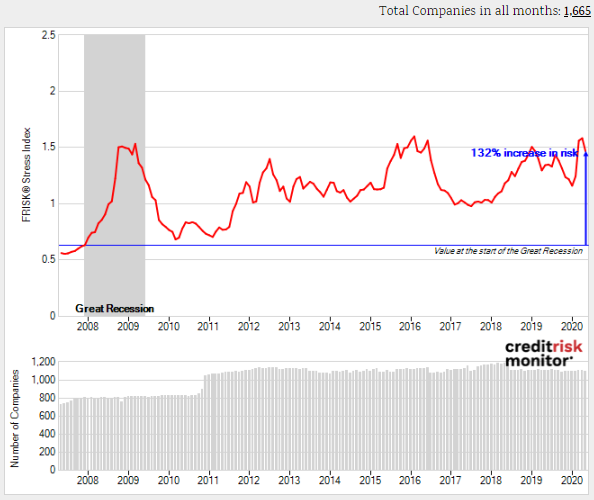

Accordingly, metal producers are being impacted by contracting volumes and pricing. In recent weeks, metal producing executives have provided negative outlooks, retracted forward guidance, and in some cases, are attempting to raise capital. For the primary metals industry (SIC 33), aggregated financial risk has increased by 132% since 2007, ranking comparable to the commodity busts of 2008 and 2015.

Distressed Tier 3 Suppliers

Distinct from the FRISK® Stress Index, the FRISK® score predicts an individual company’s probability of bankruptcy over the subsequent 12-month period. The model integrates high-quality risk signals including stock market performance, financial statement ratios, bond agency ratings, and subscriber crowdsourcing. The FRISK® score is based on a “1” (highest risk)-to-“10” (lowest risk) scale with anything in the “1”-to-“5” category falling into the high-risk “red zone.” Companies should use caution if sourcing from companies in the “red zone,” because financial distress is a harbinger of declines in quality and timeliness which are crucial in today’s just-in-time production environment.

The negative effects of the coronavirus on the mining industry have been severe, with 300+ companies worldwide falling from the moderate-risk category into high-risk. Consider some of the negative ramifications of an unforeseen bankruptcy in your supply chain:

- Would timely delivery of raw materials be upended?

- Would your production facilities be unable to manufacture goods altogether?

- Would your company need to provide capital support or arrange an acquisition?

Staying aware of supplier financial stress and bankruptcy is critical. In recent months, the FRISK® scores for eight notable producers have been trending in the high-risk category, with some being downgraded. Below are their respective FRISK® scores and largest production volume category:

Company | FRISK® Score | Commodity |

Century Aluminum Company | 1 | Aluminum |

Taseko Mines Limited | 1 | Copper |

United States Steel Corporation | 1 | Steel |

First Quantum Minerals Limited | 2 | Copper |

Cleveland-Cliffs Inc. | 2 | Steel |

ArcelorMittal South Africa Limited | 2 | Steel |

Schmolz+Bickenbach AG | 2 | Steel |

Alcoa Corporation | 4 | Aluminum |

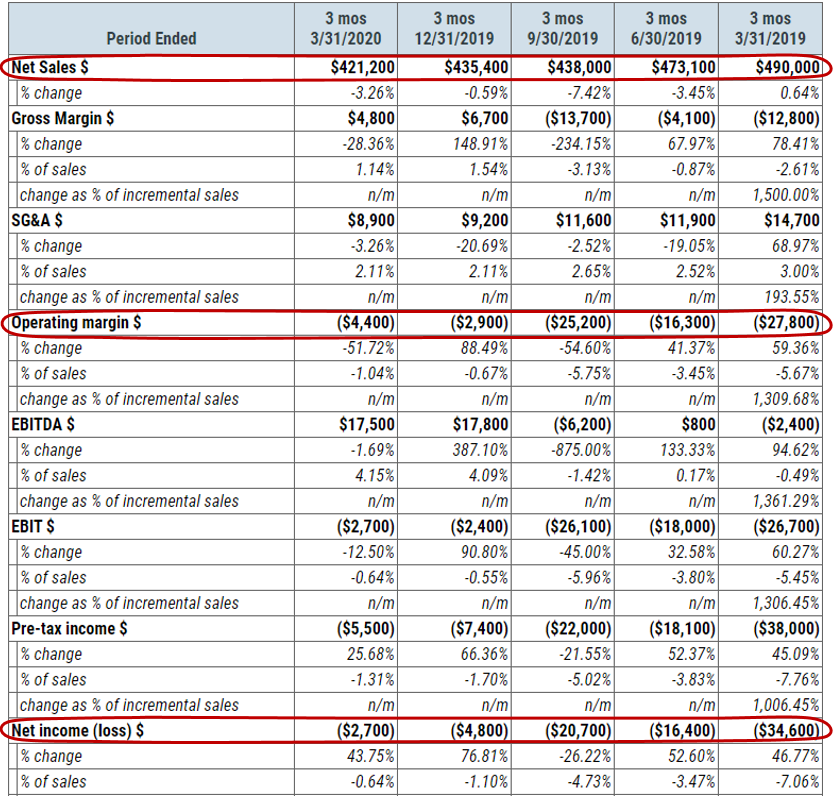

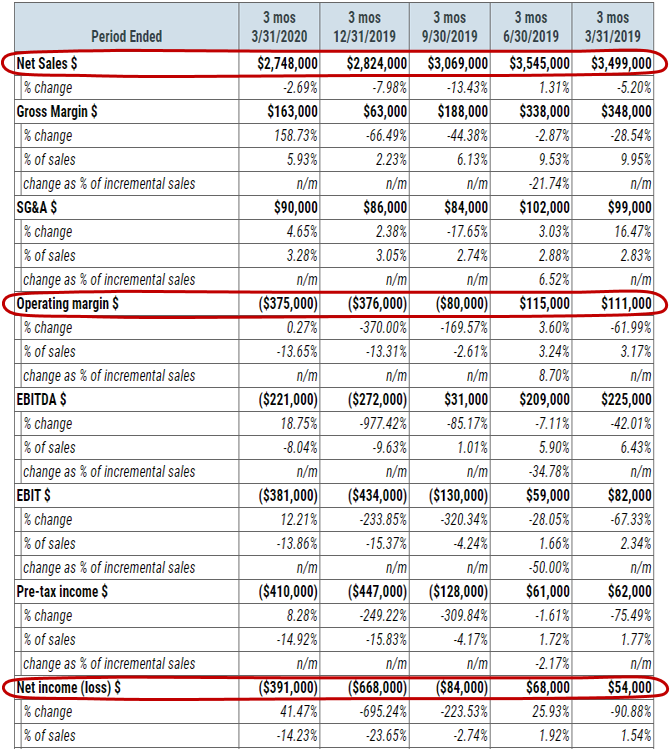

Century Aluminum Company is among the most vulnerable to the coronavirus demand shock. In March 2020, the company brought on an additional $90 million in debt through a loan and revolving credit facility, bringing its total debt burden to a record high of $382 million. Following that transaction, the FRISK® score was downgraded to a “1,” indicating a 10-to-50x higher probability of bankruptcy versus the average public company. In 2020, the company will likely see a 14% decline in revenue versus 2019 because of the fall in aluminum prices. Financial performance is already in a trouble spot, as it has realized falling sales and incurred operating and net losses over the past five quarters, as shown below:

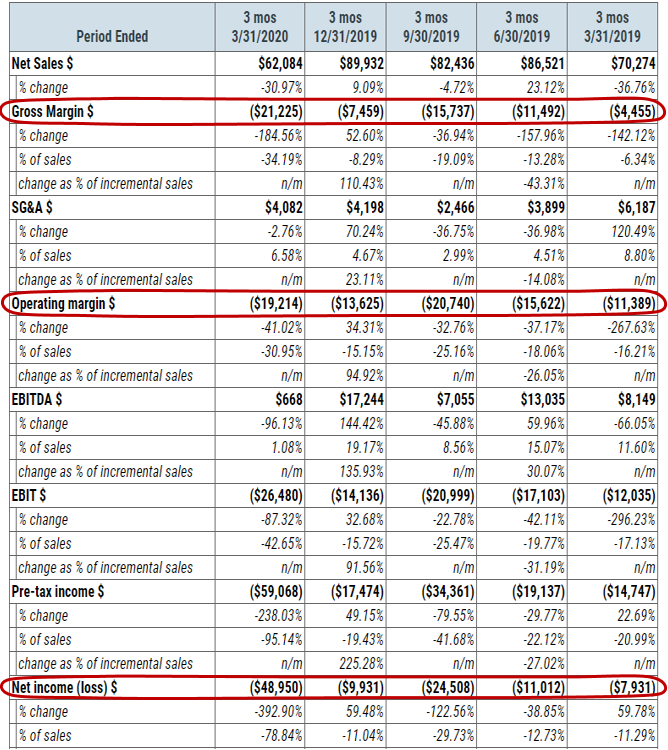

Taseko Mines Limited carries a FRISK® score of “1” and doesn’t have much room to maneuver. Total liquidity is strained with a net working capital base of $27 million against an annualized cash burn rate of $30 million. Q1 2020 copper sales realized a 30% year-over-year decline in average pricing, only modestly offset by its hedges. Similar to the previous situation, Taseko was already showing weak performance, including negative gross margins, prior to the rout in copper prices:

United States Steel Corporation’s operating performance is taking a toll on its credit profile, with its FRISK® score sinking down from a “2” over the last 12 months to the bottom-rung “1” presently. In the last two quarters, the company incurred restructuring and impairment charges, resulting in its largest net losses since 2016. Then in May, it was disclosed that seven out of its 10 blast furnaces are now idled, curtailing a substantial portion of its steel production. Below is a snapshot of its waning operating performance:

Bottom Line

The harsh downturn in several end markets has resulted in overcapacity in key industrial commodity markets, causing base metal prices to break materially lower. Since there is no discernable timeline for a global economic recovery, marginal producers, such as the operators mentioned above, may be unable to withstand the pressure. Aluminum Century Company, Taseko Mines Limited, and United States Steel Corporation are currently among the most exposed to failure. Contact us to see how a metal production bankruptcy could disrupt your supply chain and what actions you can take to prevent it from happening to your company.