South African retailer Steinhoff International Holdings NV is battling the fallout from a massive accounting fraud and facing legal claims amounting to more than $10 billion USD. Couple that with the overall industry decline due to coronavirus and bankruptcy could be very near.

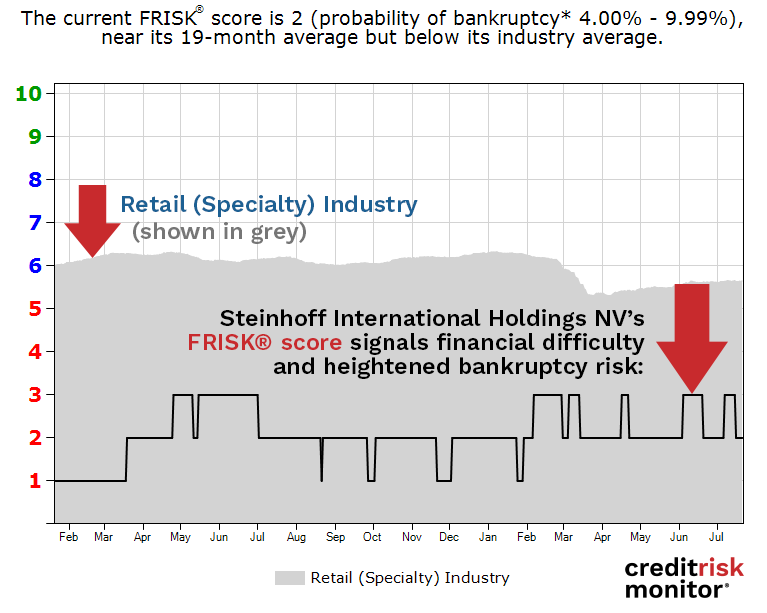

The company's FRISK® score has been in the high-risk "red zone" for bankruptcy risk since the beginning of 2019:

The global effort to slow the spread of COVID-19 continues to impact all economic regions and industries. Risk professionals must adapt quickly or risk being sideswiped by the rise in bankruptcies. Now is the time to improve your financial risk evaluation processes by adding tools like the 96%-accurate FRISK® score; as financials come but once a quarter, a metric that’s closer to real-time is essential in monitoring quick-changing corporate risk profiles. Such an addition will help identify companies that need your attention before they end up seeking court protection.

Download the free report to learn more.

Our FRISK® Score model incorporates four powerful risk inputs:

- “Merton”-type model of stock market capitalization and volatility

- Financial ratios, including those used in the Altman Z”-Score Model

- Agency ratings

- Website click pattern data from CreditRiskMonitor® subscribers, representing key credit decision-makers at nearly 40% of current Fortune 1000 companies plus thousands of other large companies worldwide

Since the start of 2017, the FRISK® Score’s rate of success in capturing public company bankruptcy is 96%. In any given year, you can count on one hand the times we miss – and in those outlier cases, the circumstances deal with unusual, unforeseen events such as natural disasters and CEO fraud.

Download the free report to learn more.

About High Risk Reports

Our High Risk Reports feature companies that are exhibiting a significantly high level of financial distress, as indicated by our proprietary FRISK® Score.

The reports highlight the factors that have pushed a company's score lower on the "1" (worst) to "10" (best) FRISK® Score, which is 96% accurate in predicting bankruptcy over a 12-month period. The High Risk Reports also includes analysis on financial indicators such as the company’s DBT index, stock performance, financial ratios and how it is performing relative to its industry peers.

The ultimate goal of the High Risk Report series is two-part: provide an early warning for those doing business with an increasingly distressed company and inform of the many signals that should be examined when assessing financial risks.