CreditRiskMonitor’s assessment of the U.S./Canadian E&P industry reveals that about two-thirds of operators are financially distressed and have higher-than-average risk of bankruptcy.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Residential construction operator Hovnanian Enterprises' bottom-rung FRISK® score displays the company's heightened financial risk in advance of its distressed debt exchange.

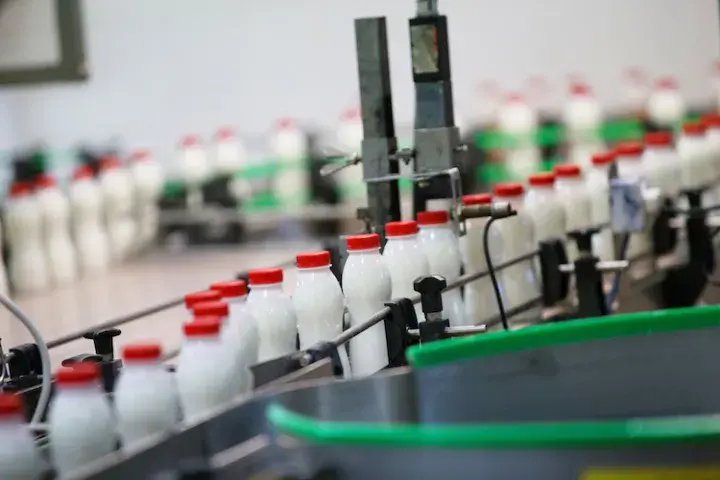

It’s rare to see a consumer staple food processing company falling into financial distress, but CreditRiskMonitor’s FRISK® score on the Dean Foods Company has been signaling elevated risk to our subscribers for more than a year.

A dormant debt powder keg ignited in 2023; as bankruptcies continue to explode in 2024, risk professionals must set into motion a multi-faceted approach to financial risk evaluation.

Argentina is using extraordinary measures to keep its economy afloat. As the peso declines, businesses that are heavily reliant on debt financing could be in trouble if problems persist.

CreditRiskMonitor’s FRISK® Stress Index is once again highlighting elevated financial risk for oil and gas drilling operators.

Trucking industry bellwethers, including UPS, FedEx, and Amazon, continue to enjoy steady delivery volumes and pricing power. Yet their collective lack of forward guidance reflects an industry with uncertainty, particularly for underperforming truckers.

The helicopter industry has seen three major bankruptcies in the last few years. Could we see a fourth? Unsecured creditors should take heed.

Crowdsourcing finds that hundreds of oil & gas companies continue to deal with financial distress in spite of the stabilization of energy commodity prices.