CreditRiskMonitor and Allianz Trade, the world’s leading trade credit insurer, are pleased to announce the approval of CreditRiskMonitor as a Discretionary Credit Limit (DCL) report provider in the U.S.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

The longer the coronavirus persists, the harder it will be for health services operators to avoid bankruptcy, quite similar to what recently transpired with Quorum Health Corporation.

The coronavirus has reignited challenges for Contura Energy, Inc. and for the coal industry in general, with the price of coal dropping towards multi-year lows.

Central banks worldwide are suppressing borrowing rates to accommodate credit markets, trying to alleviate financial pressures on corporations. This is creating a surge of "zombie companies," or firms that are staying alive in spite of their inability to service interest expenses.

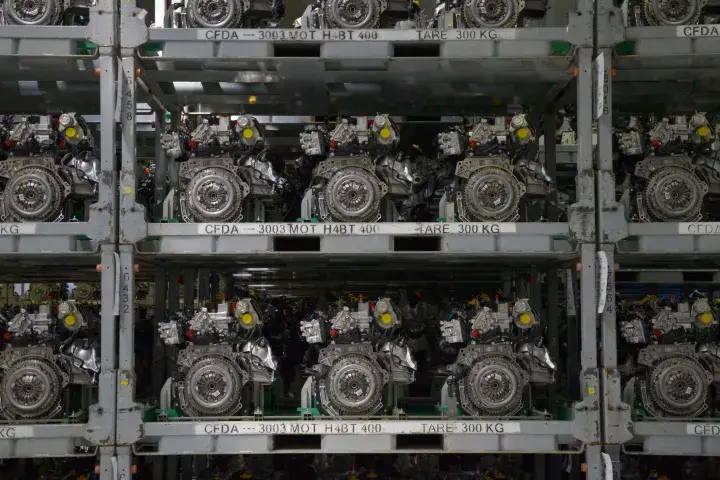

Many operators within the auto & truck parts industry continue to struggle from supply chain constraints and breakdowns brought on by the COVID-19 pandemic, adversely impacting profitability.

Establishing a culture of strong supply chain oversight is vital during a global pandemic, and CreditRiskMonitor can provide you all the tools necessary to be successful in this endeavor.

In 2019, nearly half of the 230 publicly traded Chinese construction companies we cover are financially distressed. If you have exposure to China’s real estate market, we urge you to monitor closely the financial risk potential of your commercial counterparties.

Don’t let a small hot streak on the stock market fool you – Kodak’s financial security remains very much in question and provides a picture-perfect example of bankruptcy risk.

Certain residential homebuilders are performing adequately, like PulteGroup, Inc., while others like Hovnanian Enterprises, Inc. remain severely exposed to credit risk.