Central banks worldwide are suppressing borrowing rates to accommodate credit markets, trying to alleviate financial pressures on corporations. This is creating a surge of "zombie companies," or firms that are staying alive in spite of their inability to service interest expenses.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

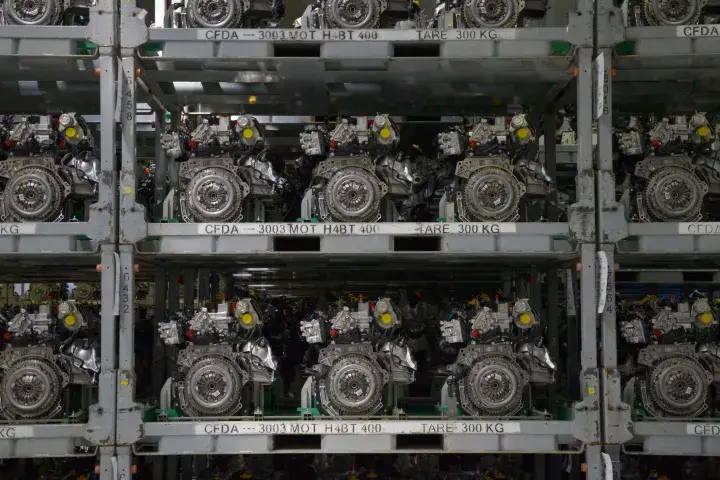

Many operators within the auto & truck parts industry continue to struggle from supply chain constraints and breakdowns brought on by the COVID-19 pandemic, adversely impacting profitability.

Public company financial risk is higher than it has ever been, and the weakest links in your supply chain may lead to costly, time-consuming problems.

The global effort to slow the spread of COVID-19 continues to impact all economic regions and industries. Risk professionals must adapt quickly or risk being sideswiped by the rise in bankruptcies.

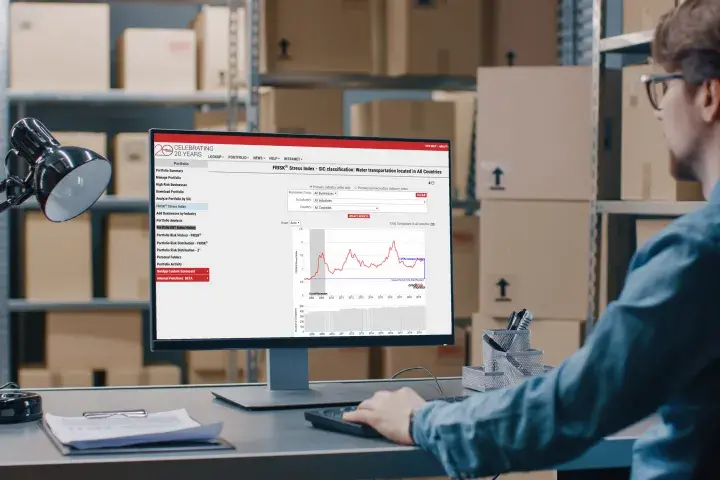

With concerns surrounding China’s economy and the sharp decline in the Baltic Dry Index, risk professionals should be vigilant in monitoring the changing conditions in the shipping industry.

With inflation running hot, the U.S. Federal Reserve has embarked on a rate hike agenda. Financially weak companies with material near-term maturities are struggling and, in some cases, bankruptcy could be imminent.

Public company bankruptcies soared in 2020, and filings continue to roll in as fallout from COVID-19. Here are five of the most notable Chapter 11 cases we've seen so far in 2021, and another five companies we feel are in big-time danger.

Armed with CreditRiskMonitor’s SupplyChainMonitor product, procurement teams worldwide are restructuring by onshoring, nearshoring, and avoiding increasingly risky countries.

Risk of financial failure in South America is higher than it was during the Great Recession a decade ago. We scouted more than 1,500 public companies to find the riskiest public companies on the continent.