A contraction in credit is not something that might occur: It will happen at some point. Risk professionals dealing with the retail sector are better off preparing now, while economic conditions are still strong.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

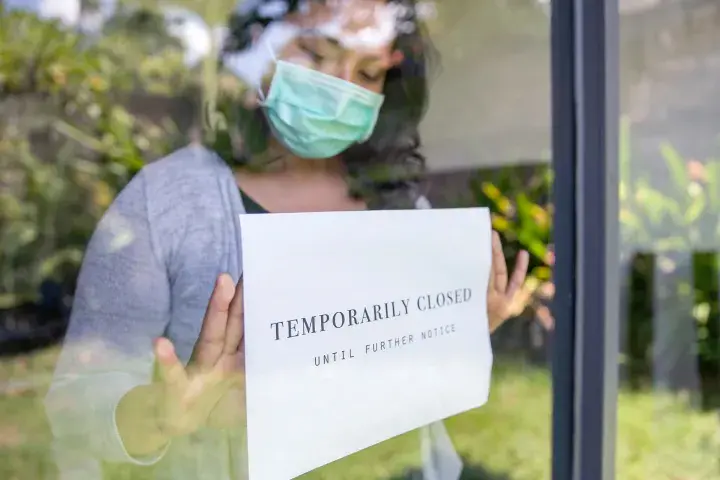

The challenged consumer environment will continue to pressure retailers and restaurants, which spells trouble for the collective group but especially for operators with red zone FRISK® scores.

The start of 2018 has various Bon-Ton Stores, Inc. stakeholders on edge, as all await a judge's ruling on the retailer's recent bankruptcy.

Retailers left and right exited stage left and into bankruptcy this summer. CreditRiskMonitor has the read on a few potential industry giants who might not survive to see 2021.

CreditRiskMonitor offers up five quick and important facts that you need to know about Diebold Nixdorf Inc. to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.

It’s rare to see a consumer staple food processing company falling into financial distress, but CreditRiskMonitor’s FRISK® score on the Dean Foods Company has been signaling elevated risk to our subscribers for more than a year.

As the fallout from one of the biggest bankruptcies of 2019 begins to settle, we see that credit and procurement professionals who evaluate risk in public companies as a habitual practice are proving to be the best at avoiding unnecessary exposure.

Sentiment data, farmed from leading credit managers who subscribe to our service, is pointing to extreme bankruptcy risk in a growing list of leading oil and gas giants.

The coronavirus has reduced air travel across key channels worldwide. Equity markets are souring on airliners, especially those that already carry excessive debt and are strapped for cash.