Frontier and Windstream have reported poor customer retention and experienced pricing weakness over the last few years, resulting in earnings decline. The most telling sign is the concern exhibited through our proprietary subscriber crowdsourcing data.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

CreditRiskMonitor recently published a Bankruptcy Case Study on apparel titan Sequential Brands Group, Inc. What were the glaring warning signs of failure? And how can you avoid a major bankruptcy write-down when the evidence of danger is cloaked? Our latest “Five Fast Facts” blog answers these questions and more.

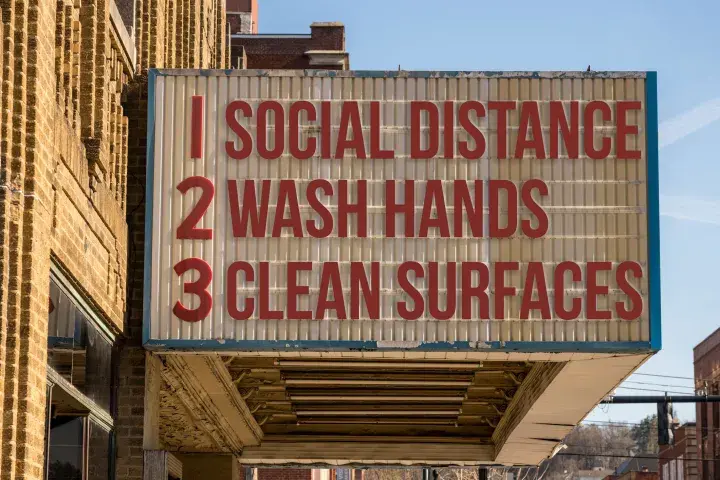

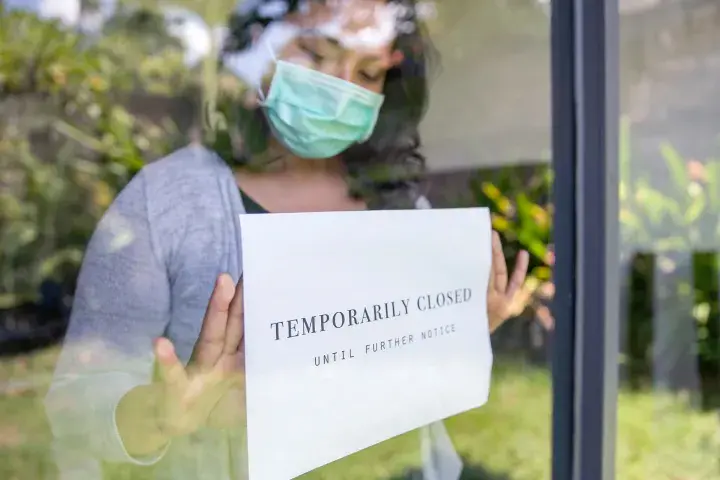

Heavily indebted public companies - including perhaps theaters near you - are reeling as countries around the world shut their economies to slow the progress of COVID-19.

Retailers left and right exited stage left and into bankruptcy this summer. CreditRiskMonitor has the read on a few potential industry giants who might not survive to see 2021.

The longer the coronavirus persists, the harder it will be for health services operators to avoid bankruptcy, quite similar to what recently transpired with Quorum Health Corporation.

If a premium grocery chain like Whole Foods can experience a multi-month SKU disaster, chances are that it can happen to your company too. Evaluate the financial health of your supply chain, see which vendors are most at risk of failure, and take the necessary steps to safeguard against them.

Two major U.S. pharmaceutical companies possess heightened bankruptcy risk largely due to lawsuits stemming from the opioid crisis. Our models are reflexive enough to give the most accurate forward-looking reads on financial risk when calamities strike.

Thomas Cook and Virgin Australia, two massive airliners, have filed bankruptcy. Could American Airlines be next?

The helicopter industry has seen three major bankruptcies in the last few years. Could we see a fourth? Unsecured creditors should take heed.