Apparel retailers have required significant adjustments to handle their financial leverage and operating lease commitments. Brooks Brothers and Tailored Brands, in particular, fell prey to slowing demand for professional business attire, a trend which was accelerated by the coronavirus pandemic.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Some big names filed for bankruptcy in 2017, and they all had a few key common indicators. Read our analysis and findings here.

Keep your brains about you: if it looks like a zombie, acts like a zombie, and reports like a zombie, it is probably a zombie.

Public company financial risk is higher than it has ever been, and the weakest links in your supply chain may lead to costly, time-consuming problems.

Popular prepared meal kit company Blue Apron faces a mighty challenge in 2018 to remain solvent as new competitors in Amazon and Wal-Mart enter their space.

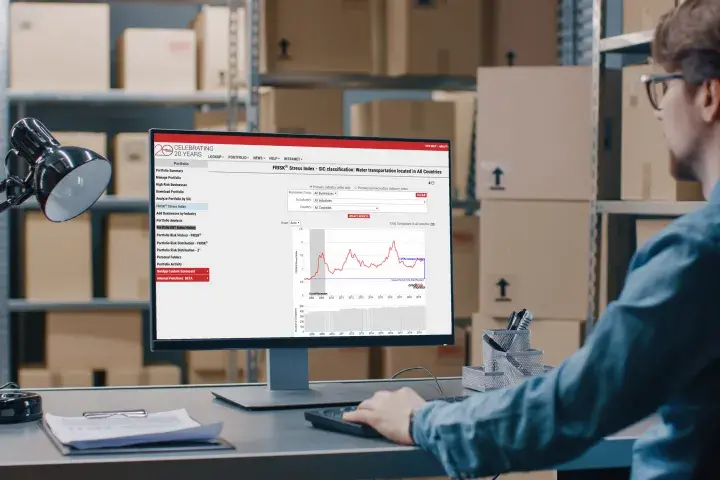

You may have heard: the global supply chain is broken. Shipping delays and congested seaports have tripled container freight rates worldwide. We take a look at retail trade businesses with the highest risk potential.

Looking to China in a COVID-19 age, creditors may soon start forcing several high-profile companies into legal proceedings commensurate with corporate failure.

A contraction in credit is not something that might occur: It will happen at some point. Risk professionals dealing with the healthcare sector are better off preparing now, while economic conditions are still strong.

A recent IMF report has highlighted a surge in instability within nonfinancial corporations. As the potential for mass economic failure mounts, CreditRiskMonitor is providing the daily markers that effectively signal on the counterparties in your portfolio that hold the most extreme bankruptcy risk potential.