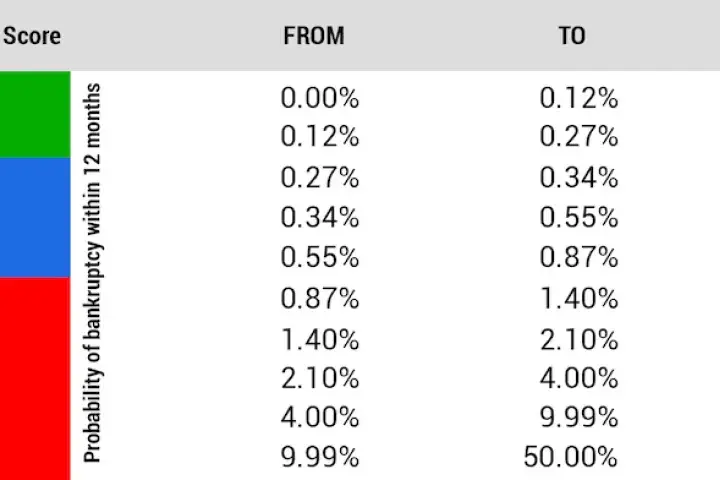

CreditRiskMonitor delivers a highly accurate gauge on U.S. public company bankruptcy risk. In 2020, out of 85 occurrences of bankruptcy, our proprietary FRISK® score only missed predicting two bankruptcies. That amounts to a 97% rate of success during that time.