CreditRiskMonitor® offers up five quick and important facts that you needed to know about now-bankrupt Rite Aid Corporation to have made a more solid business evaluation – or, more advisable, an alteration of credit extension or a pivot to a peer.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Sanctions have delivered significant financial stress to the Russian government and corporations alike. Overall, many Russian companies have dropped into – or have sunk further down into – the FRISK® score red zone, indicating heightened financial stress and corporate failure risk.

Heavily indebted public companies - including perhaps theaters near you - are reeling as countries around the world shut their economies to slow the progress of COVID-19.

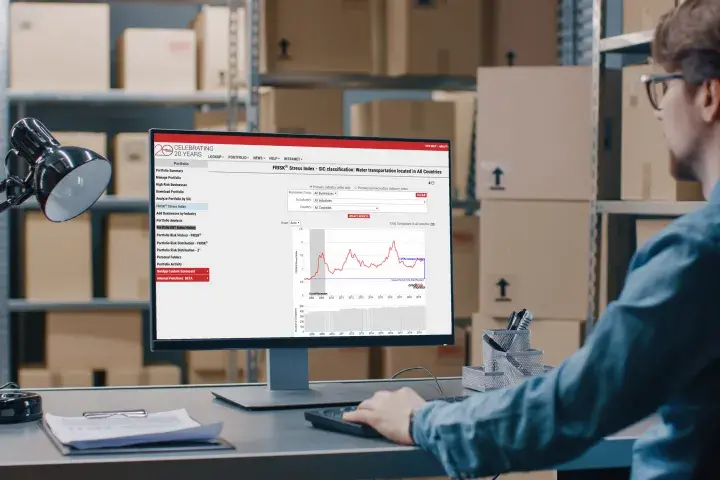

Public company financial risk is higher than it has ever been, and the weakest links in your supply chain may lead to costly, time-consuming problems.

The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. The first of a five-part look at these inputs, here’s how the stock market plays a role.

The global effort to slow the spread of COVID-19 continues to impact all economic regions and industries. Risk professionals must adapt quickly or risk being sideswiped by the rise in bankruptcies.

Apparel retailers have required significant adjustments to handle their financial leverage and operating lease commitments. Brooks Brothers and Tailored Brands, in particular, fell prey to slowing demand for professional business attire, a trend which was accelerated by the coronavirus pandemic.

One of the largest department store collapses of the last several years, the downfall of Debenhams Plc was foretold long ago by our FRISK® score.

Never get burned by public company bankruptcy risk -- we look at how the FRISK® score can help you prevent fires within your portfolio, using Ferrellgas Partners, L.P. as a cautionary example.