CreditRiskMonitor offers up five quick and important facts that you need to know about Bed Bath & Beyond Inc. to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

CreditRiskMonitor’s FRISK® Stress Index is once again highlighting elevated financial risk for oil and gas drilling operators.

Thomas Cook and Virgin Australia, two massive airliners, have filed bankruptcy. Could American Airlines be next?

The fall of car rental giant Hertz Global Holdings, Inc. proves the point that the health of an entire supply chain, from raw material harvesting to finished products, is critical to understand relative to assessing bankruptcy risk potential.

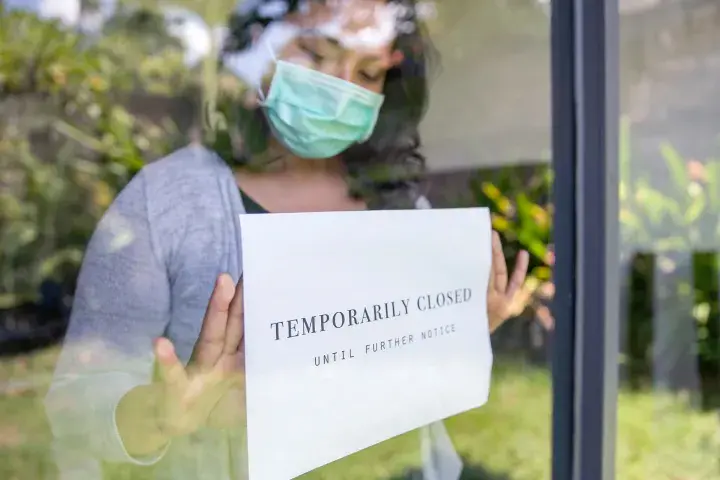

Retailers left and right exited stage left and into bankruptcy this summer. CreditRiskMonitor has the read on a few potential industry giants who might not survive to see 2021.

The median U.S. supplier has reduced capital expenditures into property, plant, and equipment and has increased their total debt-to-asset burden in the last two years. Such action creates pitfalls in supply chains, especially in the age of COVID-19.

Looking to China in a COVID-19 age, creditors may soon start forcing several high-profile companies into legal proceedings commensurate with corporate failure.

CreditRiskMonitor’s assessment of the U.S./Canadian E&P industry reveals that about two-thirds of operators are financially distressed and have higher-than-average risk of bankruptcy.

The Russia/Ukraine conflict has pushed oil prices above $100 USD per barrel, further impacting the profitability, or lack thereof, of the airline industry. We identify airlines most at risk of bankruptcy.