For J. C. Penney Company, Inc., CreditRiskMonitor's proprietary subscriber crowdsourcing is indicating negative sentiment and matches the high-risk assessment of the retail giant provided by the FRISK® score.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

The fall of car rental giant Hertz Global Holdings, Inc. proves the point that the health of an entire supply chain, from raw material harvesting to finished products, is critical to understand relative to assessing bankruptcy risk potential.

CreditRiskMonitor’s FRISK® Stress Index shows elevated financial risk within the global steel manufacturing industry, including big-time players in Schmolz + Bickenbach and ArcelorMittal.

With cracks already starting to show in the trucking industry and CFOs worrying that economic conditions are primed to decline, the time to prepare is now.

Stage Stores Inc. is nearly 10 times more likely to face bankruptcy by this time next summer than the typical public company.

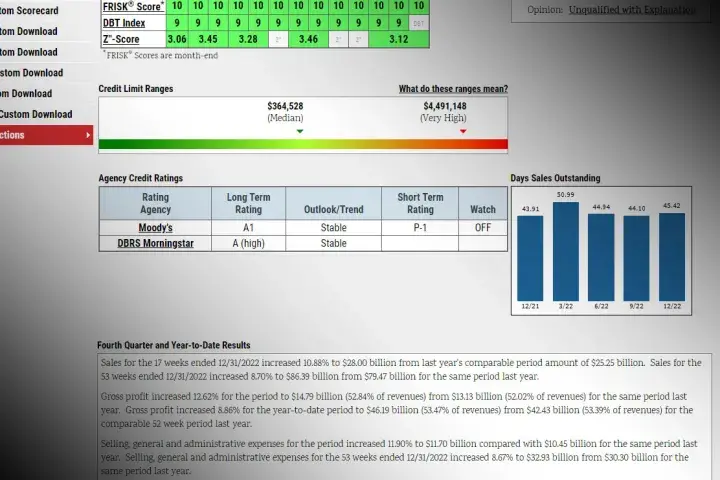

In preparation of future bankruptcies, credit professionals are using CreditRiskMonitor’s Credit Limit Ranges solution for automated monitoring on the size of credit lines.

Amazon’s push into the prescription delivery market along with COVID-19 have had varying impacts on retail pharmacies. For merchandise vendors selling to Rite Aid Corporation, now is the time to evaluate risk exposure.

As the world grapples with a new surge of COVID-19 infections, it is worth revisiting Hertz Global Holdings’ bankruptcy and what their tribulation should teach you about other distressed travel names in your portfolio.

You may have heard: the global supply chain is broken. Shipping delays and congested seaports have tripled container freight rates worldwide. We take a look at retail trade businesses with the highest risk potential.