As the fallout from one of the biggest bankruptcies of 2019 begins to settle, we see that credit and procurement professionals who evaluate risk in public companies as a habitual practice are proving to be the best at avoiding unnecessary exposure.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Just like tariffs, supplier financial risk has become an important category to monitor by company procurement departments. If this isn't on your radar today, it should be.

Establishing a culture of strong supply chain oversight is vital during a global pandemic, and CreditRiskMonitor can provide you all the tools necessary to be successful in this endeavor.

Rite Aid Corporation's elevated risk of financial failure might be imperceptible if a credit and procurement managers put too much stock into whether or not the pharma retail mainstay continues to pay bills on time.

The harsh downturn in several end markets has resulted in overcapacity in key industrial commodity markets, causing base metal prices to break materially lower. We note where bankruptcy is most probable.

CreditRiskMonitor recently published a High Risk Report on pharmacy retail chain Rite Aid Corporation. This detailed report will provide five quick and important facts that you need to know about this financially weak drug store operator.

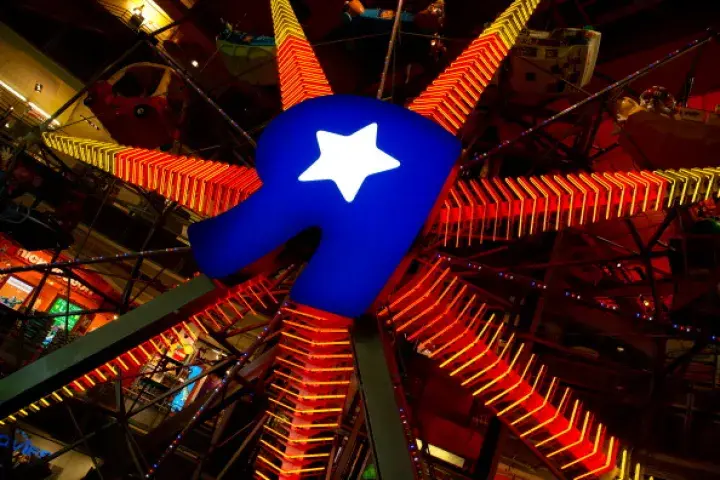

Toys “R” Us filed for bankruptcy right before the holiday season in 2017 as suppliers began to restrict access to trade credit, setting in motion a liquidity crunch.

As the likelihood of an economic downturn continues to intensify, public companies across cyclical industries like trucking should be monitored closely.

CreditRiskMonitor’s assessment of the U.S./Canadian E&P industry reveals that about two-thirds of operators are financially distressed and have higher-than-average risk of bankruptcy.