The Federal Reserve recently voiced concerns about excessive corporate financial leverage - and risk management departments need to take heed.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

Most trade payments only become past due after a bankruptcy filing. Thus, unsecured creditors are given a false sense of security and after months - or years - of legal proceedings, they recover pennies on the dollar.

The helicopter industry has seen three major bankruptcies in the last few years. Could we see a fourth? Unsecured creditors should take heed.

Frontier Communications’ deteriorating business fundamentals have been ongoing for years now, and CreditRiskMonitor’s subscriber crowdsourcing has provided an important high-risk signal in the last few quarters.

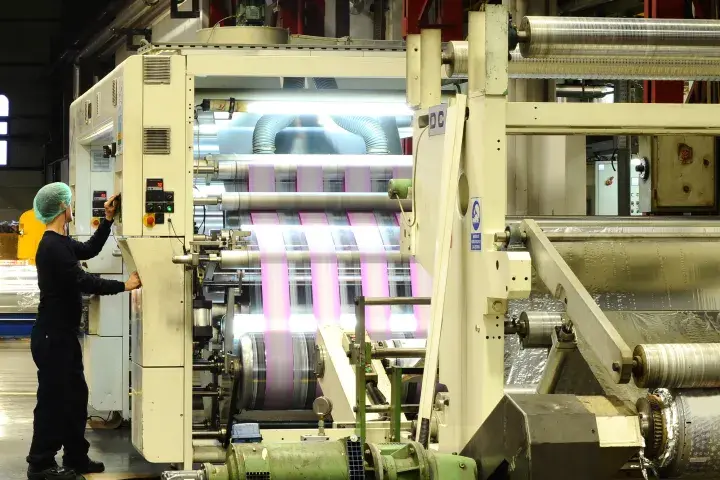

With escalating geopolitical tensions and heavy sanctions hitting Russia and China, corporations are sourcing alternative suppliers from other countries.

CreditRiskMonitor warned of the increased bankruptcy risk at newspaper owner McClatchy Company for more than a year before their Chapter 11 filing in February 2020. Yet McClatchy Company is not an isolated case and risk professionals should be monitoring other news provider outlets closely.

Leveraged to the max, it seems as though there’s not enough makeup in the world to mask Revlon, Inc.’s deep financial troubles.

Major drug manufacturers Mallinckrodt plc and Endo International plc are financially distressed due to elevated debt and product-related risks. If your company is doing business with these manufacturers, you should evaluate your risk exposure and perform further research.

D&B’s "Bankruptcy: Why the Surprise?" whitepaper shows that their popular PAYDEX® score misleads trade creditors on public company bankruptcy risk.