Avoid the crash: not having a daily risk download like what we provide subscribers with our proprietary FRISK® score, when world events like armed conflict are changing industry every day, is like flying a plane without instruments through a hurricane.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

From the start of the coronavirus pandemic, CreditRiskMonitor subscribers have experienced an increase in public company FRISK® scored corporate failures* throughout North America.

The coronavirus has reignited challenges for Contura Energy, Inc. and for the coal industry in general, with the price of coal dropping towards multi-year lows.

Unless there is a rapid economic recovery, more retailers are going to go the way of J. C. Penney, Pier 1 Imports, Neiman Marcus and J.Crew. That is: bankruptcy.

Part of CreditRiskMonitor's Mid-Year Review series, we focus on the volatile state of casual dining establishments and how the FRISK® score is helping credit and procurement managers stay ahead of bankruptcy risk.

The offshore oil and gas market remains widely depressed. Troubled outfit Hornbeck Offshore Services, Inc. has fallen to a FRISK® score of “1,” which indicates severe financial distress.

Although the story can be significantly different for every single public company that finds itself faced with bankruptcy, there's one familiar trend: payment data repeatedly misses the risk.

While many missed the warning signs for Aegean Marine Petroleum Network, Inc.'s bankruptcy in November 2018, the FRISK® score's daily calculation of the company's risk revealed sobering truths.

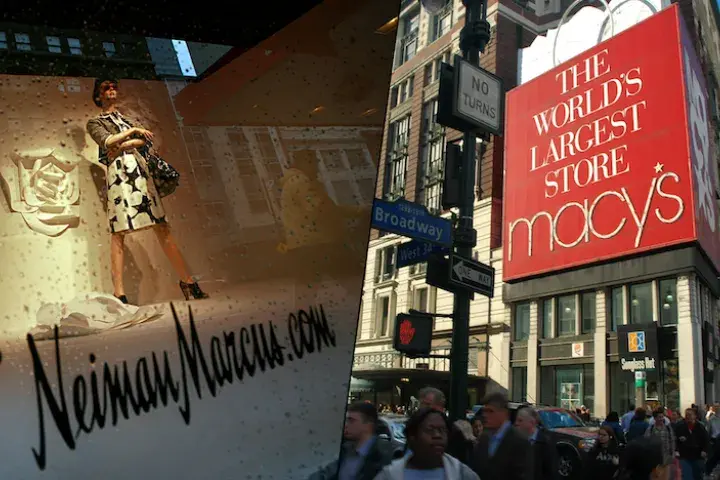

Big-name retailers Macy’s, Inc. and Neiman Marcus Group LTD LLC are on opposite ends of the bankruptcy risk spectrum - and for Neiman Marcus, time may be running out to turn their fiscal fortunes around.