Based on Neiman Marcus Group LTD LLC’s bottom-rung FRISK® score of “1,” trade creditors must perform deep financial analysis and take extra care when dealing with the company.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

The media and financial institutions, including the Federal Reserve, underreport the proliferation of zombie firms, a frightening reality you must not ignore. Learn how you can use the FRISK® score and other CreditRiskMonitor report features to protect your company from bankruptcy-prone zombies.

You may have heard: the global supply chain is broken. Shipping delays and congested seaports have tripled container freight rates worldwide. We take a look at retail trade businesses with the highest risk potential.

Most trade payments only become past due after a bankruptcy filing. Thus, unsecured creditors are given a false sense of security and after months - or years - of legal proceedings, they recover pennies on the dollar.

The senior housing industry reported a significant share of the coronavirus illness cases, causing a collapse in occupancy. A considerable population decline in assisted living facilities could deliver a slew of corporate bankruptcies in the coming year.

CreditRiskMonitor® offers up five quick and important facts that you needed to know about now-bankrupt Rite Aid Corporation to have made a more solid business evaluation – or, more advisable, an alteration of credit extension or a pivot to a peer.

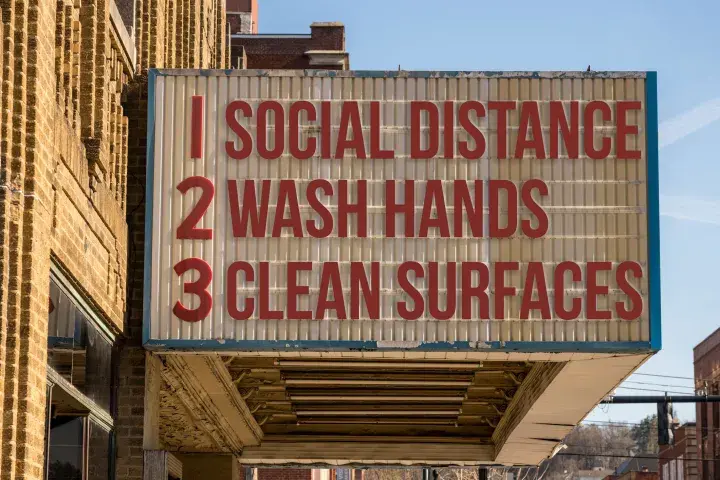

Heavily indebted public companies - including perhaps theaters near you - are reeling as countries around the world shut their economies to slow the progress of COVID-19.

CreditRiskMonitor warned of the increased bankruptcy risk at newspaper owner McClatchy Company for more than a year before their Chapter 11 filing in February 2020. Yet McClatchy Company is not an isolated case and risk professionals should be monitoring other news provider outlets closely.

The FRISK® score cuts through the “Cloaking Effect” by identifying financially stressed companies with a differentiated and proprietary method that doesn't rely on payment history.